Illustration

In December 2023, Vietnam’s textile and garment exports earned over $2.9 billion, up 5.5% compared to the previous month, according to preliminary statistics from the General Department of Customs. For the whole year of 2023, the country earned over $33.3 billion from textile and garment exports, a decrease of 11.4% compared to 2022.

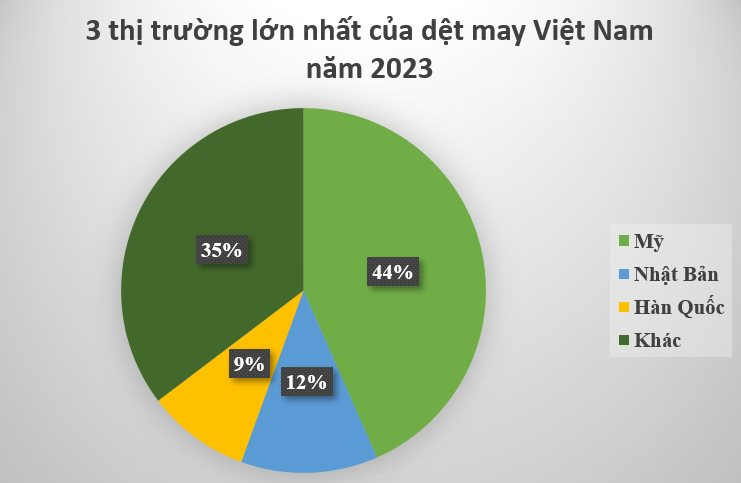

When it comes to markets, the US, Japan, and South Korea are the top three markets for Vietnam’s textile and garment industry. For the US, this country spent over $14.46 billion on importing textiles and garments from Vietnam, accounting for 44% and a decrease of 16% compared to 2022. Japan is the second-largest market for Vietnam with over $4 billion, a slight decrease of nearly 1% compared to the previous year. South Korea ranks third with $3.04 billion, a decrease of 7.8% compared to 2022.

Source: General Department of Customs

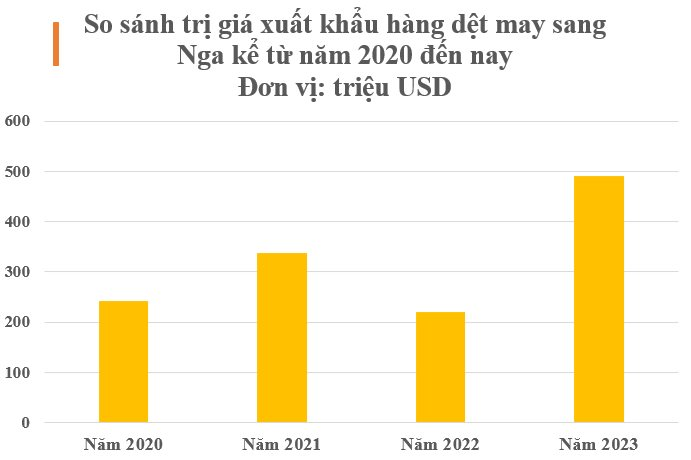

Notably, while major markets recorded a decline, textile and garment exports to Russia saw a sharp increase in 2023. Specifically, Russia spent over $490 million on importing textiles and garments from Vietnam, doubling – equivalent to a 121% increase compared to the previous year. Textiles and garments were also the largest export value to Russia in 2023 and the highest value in the past 5 years. This proves that Vietnam’s textile and garment products are increasingly favored in this country.

Source: General Department of Customs

In 2021, Vietnam’s textile and garment industry ranked third in global exports with a 5.7% market share. In 2022, Vietnam’s textile and garment exports reached $44.5 billion, an increase of 10.5-11% compared to 2021, still ranking third after China and Bangladesh. Vietnamese textile and garment products have been exported to over 100 countries and territories with 47-50 different items.

The usual advantages of Vietnam’s textile and garment industry to compete with major rivals such as Bangladesh, India, etc. are abundant labor, cheap labor. With these advantages, the textile and garment industry has become a key export industry of Vietnam, contributing over 10% to the annual export turnover.

However, since the end of 2022, global political instability and increasing inflation have led to a decline in global textile and garment demand; major export markets of Vietnam such as the US, EU… have seen sharp demand reduction as consumers tighten spending on non-essential items, including textiles and garments. Especially in 2023, global textile and garment demand decreased, production order prices decreased significantly, averaging a 30% decrease. Some large quantity items even decreased by up to 50%.

In 2024, Vietnam’s textile and garment industry is expected to continue facing multiple difficulties, being affected by the global and domestic economy, leading to a decrease in product demand. In addition, there are a series of increasing input costs such as electricity prices, transport fares, minimum wage, and new regulations from the export market. In that context, Vietnam’s textile and garment industry aims to export $44 billion in 2024, an increase of about $4 billion compared to 2023.