Breakthrough in profit in the last quarter

By December 13, 2023, new credit has only increased by 9.87% compared to the end of 2022 – much lower than the growth rate of the same period in 2022, as well as still quite far from the target of 14.5% set by the State Bank of Vietnam (SBV) for the whole year.

The reason for the weaker credit growth compared to the same period is due to the declining economy, which leads to reduced income and weakened ability to repay loans for customers. Furthermore, the real estate market – the sector attracting the largest credit capital – still remains sluggish. Although interest rates reached their peak in the second quarter, the overall level is still quite high, therefore unable to stimulate the demand for loan expansion.

According to the official announcement from the State Bank of Vietnam, total credit throughout the economy in 2023 increased by 13.71% compared to the end of 2022, reaching nearly 13.6 million trillion VND. If the reference date is December 13, then by December 29, within the last 15 days of 2023, credit growth has increased by 3.54%, equivalent to pumping 463,500 trillion VND into the economy.

It can be seen that capital demand improves in the last month of 2023 to meet the peak business season for the Lunar New Year 2024 as well as the resolute direction of the Government and the efforts of the banking sector, helping to accelerate the disbursement of credit towards the end of the year.

Thanks to “unleashed” credit, the main source of income for banks has also become abundant in the fourth quarter of 2023, boosting pre-tax profits of many banks.

Source: VietstockFinance

|

According to the data of VietstockFinance, the total pre-tax profit of 27 banks that have announced their fourth-quarter business results in 2023 reached 67,818 billion VND, an increase of over 26% compared to the same period thanks to the 7% increase in net interest income, reaching 121,005 billion VND.

Notably, banks recorded pre-tax profits that increased exponentially must mention SGB (increased 84 times), LPB (increased 3.9 times), NAB and VBB (increased 3.5 times)…

On the other hand, there were 3 banks that reported losses in the last quarter of the year including NVB (loss of 436 billion VND), ABB (loss of 124 billion VND), and PGB (loss of 3 billion VND). The common point causing these 3 banks to report losses is the sharp increase in credit risk provisions.

Shuffling of profit rankings

Source: VietstockFinance

|

The order of bank profits continuously changes throughout the quarters and has finally come to an end. Accordingly, with the solid position as the top 1 profit throughout 4 quarters, Vietcombank (VCB) naturally won the first place in profit for the year with an impressive profit of over 41 trillion VND, an increase of over 10% compared to the previous year.

Reaching the destination with a pre-tax profit of 27,650 billion VND, an increase of 20%, BIDV climbed from the top 3 position last year to win the runner-up this year. MBB also advanced one level in profit rankings compared to the previous year, maintaining the top 3 position with a profit of 26,306 billion VND, an increase of 16%.

Which bank had the strongest profit growth this year?

In summary for 2023, the total pre-tax profit of 27 banks reached 255,325 billion VND, an increase of 4% compared to 2021, thanks to a 4% increase in net interest income, reaching 447,450 billion VND.

Source: VietstockFinance

|

The shining star in profit growth is Sacombank (STB) with a pre-tax profit of 9,595 billion VND in 2023, a 51% increase compared to 2022. This result is achieved thanks to a 29% increase in net interest income to over 22,072 billion VND and a reduction of credit risk provisions by 58%, amounting to over 3,688 billion VND.

In second place for annual profit growth speed is Nam A Bank (NAB) with a 46% increase compared to the previous year, reaching a pre-tax profit of 2,268 billion VND thanks to increased main income and significant income from non-interest activities (services).

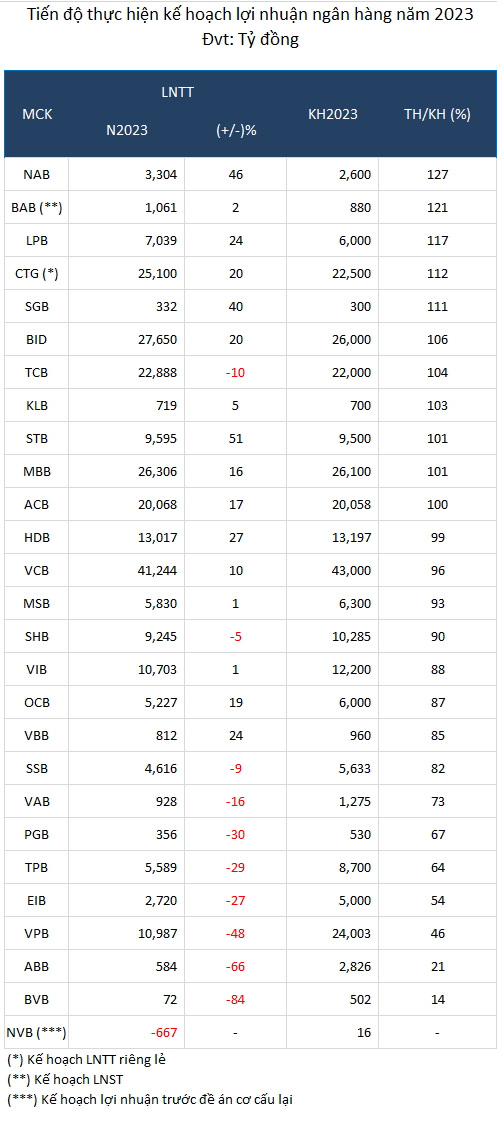

Many banks have achieved and exceeded their annual profit targets

The acceleration of profit growth in the last quarter of the year thanks to the strong credit disbursement has helped many banks achieve their profit targets for the whole year, although the execution rate at the 9-month milestone was not high. Specifically, 5 banks have exceeded their set profit targets.

Source: VietstockFinance

|

In 2023, Nam A Bank set a pre-tax profit target of 2,600 billion VND, a 15% increase compared to 2022. With a pre-tax profit of 3,306 billion VND, an increase of 46%, Nam A Bank has exceeded the profit target by 27%.

Bac A Bank, LPBank (LPB), VietinBank (CTG) and Saigonbank (SGB) are also banks that have exceeded their annual profit targets.

Will bank profits continue to improve in 2024?

In the base scenario of SSI Research, if GDP can recover at a rate of about 6-6.5%, the average interest rate throughout the year remains at the lowest level in recent decades, and SBV flexibly responds in the mechanism of recognition and provisioning for bad debts, the research team estimates that the pre-tax profit growth of banks in 2024 within the research scope is expected to reach 15.4% compared to 2023. This is a higher growth rate than the 4.6% in 2023.

With a predicted improvement in the macroeconomic context in 2024, SSI Research expects credit growth to recover to around 14%. This will be partly supported by lower lending interest rates. The growth potential may come from the corporate sector such as infrastructure construction, manufacturing enterprises, FDI, and prioritized sectors (agriculture, exports, high technology, SME and supporting industries). Moreover, the research team also notes that real estate investors have a need to refinance the capital for bonds maturing in 2024 with a total value of about 200 trillion VND (equivalent to 20% of credit for real estate investors in 2023). This could also be a significant motivation for credit growth in 2024, unless the regulatory authorities continue to inspect and strictly control cross-credit for related parties and satellite companies.

According to Agriseco Research, net interest income will resume growth on a low basis compared to the same period in 2024. In this, the optimistic factor that directly affects net interest income is the remaining potential for lending in key industries this year. In addition, income from outside of interest is expected to have stable growth in the coming period with the support of income from commercial activities, international payments, and card services of enterprises as well as the expectation that the corporate bond market will recover, thereby increasing income from securities trading and investment activities.

In general, Agribank Securities Research expects banks to maintain profit growth in 2024 thanks to strong credit growth and NIM recovery in a low-interest rate environment. However, the banking sector still has many risks from bad debts, especially from real estate loans.