At the industry-wide online conference on strengthening bank credit in 2024 held on the morning of February 20, the leaders of the State Bank of Vietnam (SBV) announced that in early 2024, SBV will maintain the current interest rate levels to facilitate credit institutions’ access to low-cost capital from SBV, contributing to supporting the economy.

As of January 31, 2024, the interest rates for deposits and loans continued to decline; the average interest rates for new transactions of commercial banks decreased by around 0.15% per year and 0.25% per year compared to the end of 2023.

SBV has also issued dispatch No. 117 dated February 7, 2024, requesting banks to continue implementing the directions of the Prime Minister, SBV regarding interest rates and reporting the average lending rates, the difference between the average deposit and lending rates.

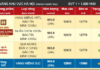

Mr. Tran Long, Deputy General Director of BIDV, said that in January 2024, the average interest rate for VND loans of BIDV decreased by 0.25% compared to the end of 2023. The current average lending rate is 7.3%, with the short-term interest rate at only 6.7%, and the medium and long-term lending rate is 8%. It has decreased relatively deeply compared to the middle and end of 2023. BIDV has proactively informed about the lending interest rate and preferential service products on the BIDV website.

However, according to Mr. Dao Minh Tu, Deputy Governor of SBV, many banks have not publicly disclosed the average lending rates.

Leaders of many banks have raised difficulties and suggested that the average lending rates should be publicly disclosed to individual customers, but not to business customers. It is not really suitable, and they propose that SBV provide clearer guidance…

Mr. Pham Quang Thang, Deputy General Director of Techcombank, said that the lending interest rates also depend on each customer segment and the level of risk. Therefore, it is difficult to publicly disclose the average lending rates to business customers. According to Mr. Thang, it is only possible to publish the lending rates for individual customers.

Mr. Pham Chi Quang, Head of the Monetary Policy Department, stated that SBV has issued a request for banks to continue announcing the average lending rates on the bank’s website. Banks are requested to report on their implementation by February 23 and clarify any difficulties or issues for management agencies to consider and resolve accordingly.

In the meeting on December 18, 2023, the Prime Minister concluded and requested SBV to direct credit institutions to study the public disclosure of the average interest rates of the credit institution system, the average lending rates of each credit institution, and the difference between the average deposit and lending rates. Thereby creating conditions for businesses and individuals to choose banks with low interest rates for loans.

Deputy Governor of SBV, Dao Minh Tu, emphasized that although there are no penalties for publicly disclosing the average lending rates, banks need to report as required. Photo: Duc Khanh

Mr. Quang stated that in the future, when SBV consolidates opinions from credit institutions, SBV plans to create a website where credit institutions can send links to the announcement of the average lending rates linked to the SBV website. From there, it ensures fairness, transparency, and public access to information about credit institutions.

SBV does not limit credit institutions from disclosing detailed information about customer groups, customer segments, and credit programs. The authority and responsibility for publicly disclosing average lending rates belong entirely to SBV.

Deputy Governor Dao Minh Tu emphasized that there has never been such a low interest rate mechanism before, so the lending interest rate is no longer a barrier or a major issue for borrowers. However, some businesses have not been able to access bank loans due to not meeting the credit conditions for borrowing.

Difficulties in legal procedures need to be resolved

In the 120 trillion VND housing loan program, social housing loans, renovation and construction projects, commercial banks have disbursed loans for 6 projects with a total amount of 531 trillion VND and disbursed loans for homebuyers with an amount of 4.5 trillion VND.

Mr. Nguyen Thanh Tung, General Director of Vietcombank, said that the bank is also actively promoting credit growth to meet the demand for social housing, low-income home loans in the 120 trillion VND credit package. So far, Vietcombank has approached 20 projects with a credit scale of about 10,000 trillion VND. However, the current difficulty is to resolve the legal procedures of the authorities.

It is known that the Ministry of Construction and the State Bank of Vietnam will organize a conference to resolve difficulties in the 120 trillion VND credit package on February 21.