The retail market may need to reduce rental prices?

In the fourth quarter of 2023, the Hanoi retail market recorded a supply of 1.78 million square meters, stable compared to the previous quarter but up 3% compared to the same period last year, thanks to the entry of Lotte Mall West Lake. Supply growth reached an average of 2% in the past five years.

The demand from new brands will be met by high-quality commercial centers that will be operational in the period from 2024 to 2026. Retail spaces in office buildings and commercial shophouses may have to reduce rental prices, according to Savills.

The rental price for ground floors increased by 15% compared to the same period last year, reaching over 1.1 million VND/m2/month. The rental price for ground floors in the city center reached 3.2 million VND/m2/month, 79% higher than the outlying areas where the rental price only reached 1.1 million VND/m2/month. Projects implementing revenue-sharing mechanisms and high visitor traffic, such as Lotte Center Hanoi, may see rental price increases of up to 14%.

|

Retail market activity from 2019 – 2023

Source: Savills

|

From 2024 to 2026, 4 shopping centers and 11 retail podiums will provide an additional 250,000 square meters. Shopping centers will account for 67% of future supply market share, while retail podiums will account for 33%.

FDI capital creates significant demand for serviced apartments and office segments.

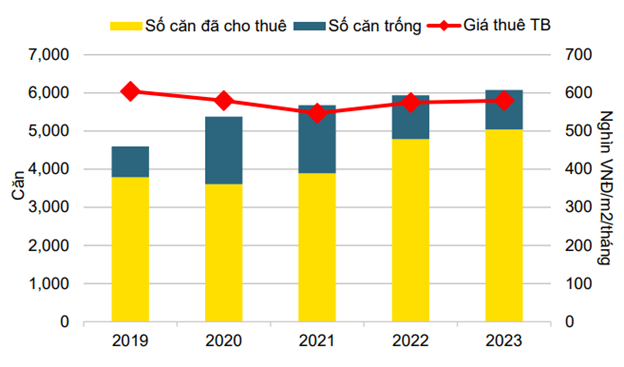

In the fourth quarter of 2023, the supply of serviced apartments reached 6,078 units from 63 projects, a 1% decrease compared to the previous quarter due to the cessation of the Dolphin Plaza (Grade B) serviced apartment project. However, the supply increased by 2% compared to the same period last year, thanks to the entry of two Grade A projects, Lancaster Luminaire and L7 West Lake, in the second half of 2023.

The occupancy rate reached 83%, a 2-point increase compared to the same period last year. The rental price reached 580,000 VND/m2/month, a 1% increase compared to the previous year.

|

Serviced apartment market activity from 2019 – 2023

Source: Savills

|

In 2024, FDI registered in Hanoi reached the highest level in the past three years, reaching $2.9 billion, a 70% increase compared to 2022. Hanoi is among the top 5 leading FDI attraction points in the country. Capital contributions and share purchases had the largest increase, reaching 248% compared to the same period last year and accounting for the largest proportion with $2.1 billion, equivalent to 75% of the total registered FDI in Hanoi.

The largest project is the merger deal of Sumitomo (Japan) worth $1.5 billion. Japan accounts for 60% of the total investment registered in industrial parks in Hanoi, making Japan a potential tenant group.

New registered capital increased by 89% annually to $441 million, and the number of new projects increased by 12% to 408 projects. Hanoi aims to develop industrial parks and clusters such as the Hoa Lac High-Tech Park, while focusing on developing infrastructure for electricity, telecommunications, and information to attract foreign investors.

As a result, Hanoi will have a future supply of about 3,821 serviced apartments. In 2024, there are two projects, including Parkroyal Serviced Suites Hanoi (Grade A) with 261 units and Fusion Suites (Grade B) with 193 units. In 2025, there are 1,905 units in Tay Ho View Complex.

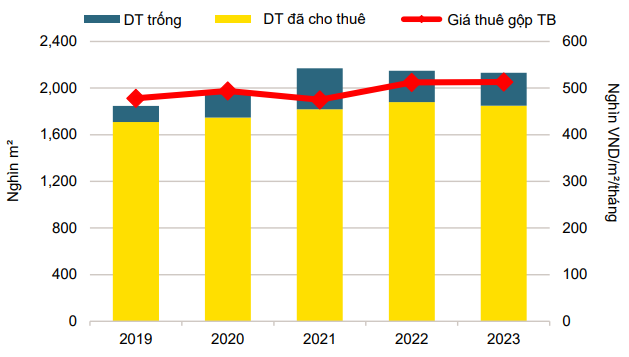

Regarding the office segment, due to a project in Hai Ba Trung District converting office space into commercial and service podiums, the office supply in this market in the fourth quarter of 2023 reached 2.13 million square meters, a 1% decrease compared to the same period last year.

In terms of demand, Savills forecasts growth from tenants in the energy and electricity, manufacturing, and consulting industries. European, Japanese, and Singaporean businesses are actively seeking environmentally friendly office projects. This will be a good signal for projects that achieve green certification in the near future.

In 2023, leasing activities in the manufacturing sector increased significantly thanks to FDI inflows. Tenants in the manufacturing sector had the largest total leased area, followed by tenants in the information technology, finance, insurance, real estate, and education sectors. Projects with green certification such as Capital Place, Lancaster Luminaire, and Lotte Mall are particularly popular with tenants and had the most transactions in 2023.

The average gross rental price reached 513,000 VND/m2/month, stable compared to the previous quarter and the same period last year. Grade A rental prices maintained at 829,000 VND/m2/month like the previous quarter, and Grade C rental prices also remained unchanged at 308,000 VND/m2/month. Grade B decreased by 1% compared to the previous quarter, reaching 442,000 VND/m2/month.

|

Office market activity from 2019 – 2023

Source: Savills

|

According to Savills, from now until 2026, 15 new projects will provide over 389,770 square meters of office space. Grade A offices are expected to account for 86% of future supply. Typical projects include Grand Terra, Taisei Square Hanoi, Tien Bo Plaza, 27-29 Ly Thai To, and projects in Starlake area.

The hotel market is gradually recovering.

Hanoi’s tourism sector is showing good signs of recovery, although it no longer depends on the Chinese market. Many projects that will be operational in the medium term will make the hotel market more vibrant, according to Savills.

Supply in this market reached 11,226 rooms from 70 projects, a 2% increase compared to the previous quarter, after L7 West Lake officially received a 5-star rating, and a 10% increase compared to the same period last year due to four 5-star-rated projects and two 4-star-rated projects in 2023.

The average hotel rental price reached 2.9 million VND/room/night, an 8% increase compared to the previous quarter and a 16% increase compared to the same period last year.

In 2023, the occupancy rate increased by 21 percentage points compared to the same period last year, reaching 60%, and the average rental price was 2.7 million VND/room/night, a 28% increase.

|

Hotel market activity from 2019 – 2023

Source: Savills

|

In 2023, Hanoi welcomed 24 million tourists, a 28% increase compared to the previous year. The number of international tourists reached 4 million, a 167% increase. The number of domestic tourists reached 20 million, a 16% increase.

From 2024 to 2026, 13 projects with 2,746 rooms are expected to be operational. In 2024, there will be three projects entering the market, including Dusit Hanoi – Tu Hoa Palace with 207 rooms, Fusion Suites with 238 rooms, and My Dinh Pearl Phase 2 with 500 rooms.