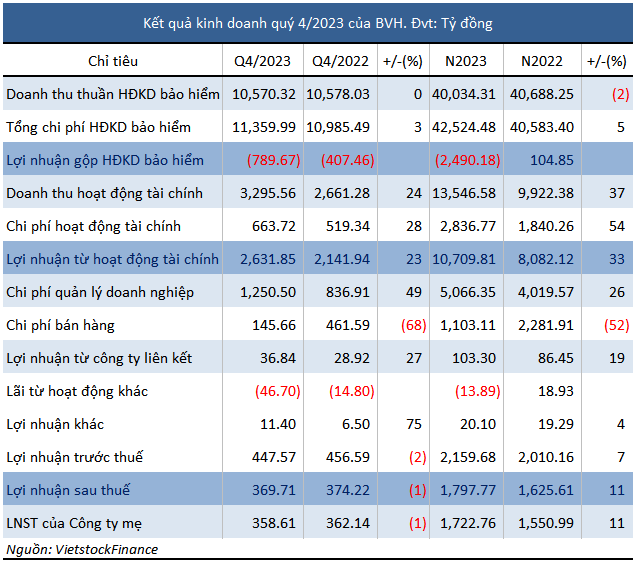

For the fourth quarter of 2023, BVH recorded a flat net profit compared to the same period last year, at approximately 359 billion VND.

This result was driven by a 23% increase in financial operating profit, reaching nearly 2,632 billion VND, offsetting the gross loss from insurance operations of around 790 billion VND due to increased total compensation expenses.

For the full year of 2023, BVH achieved a net profit of nearly 1,723 billion VND, an 11% increase compared to the previous year, thanks to the growth of the Group’s investment activities.

The financial operating profit increased by 33% to nearly 10,710 billion VND, mainly from interest income (8,642 billion VND, up 58%), investments in bonds and notes (3,941 billion VND, up 14%), dividend income (372 billion VND, up 32%), and exchange rate gain (nearly 173 billion VND, up 40%). The financial activities’ profit helped BVH offset the gross loss from insurance operations of more than 2,490 billion VND.

In 2023, BVH set a target of after-tax profit for the parent company at 1,100 billion VND, a 3% increase compared to the achievement in 2022. The Group has successfully achieved the set target.

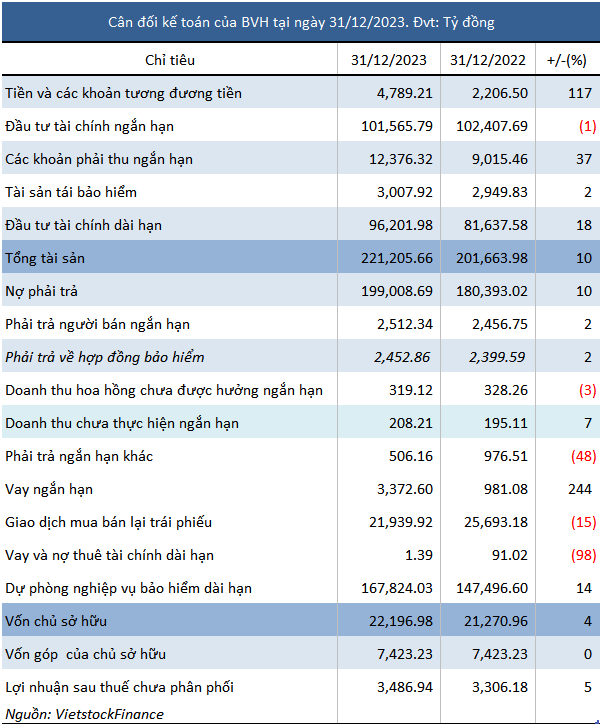

As of December 31, 2023, BVH’s total assets reached nearly 221,206 billion VND, a 10% increase compared to the beginning of the year.

Among these, cash and cash equivalents doubled to over 4,789 billion VND, mainly due to an increase of 2,419 billion VND in cash equivalents, reaching 3,726 billion VND. This includes deposit contracts with financial institutions, with a maturity of no more than 3 months and an interest rate ranging from 2.5-3.5% per year.

Short-term financial investments decreased slightly by 1% compared to the beginning of the year, to 101,566 billion VND, while long-term financial investments increased by 18% to nearly 96,202 billion VND.

The majority of the payable debt is long-term provisions, totaling over 167,824 billion VND, a 14% increase compared to the beginning of the year.

In addition, BVH had short-term borrowings of nearly 3,373 billion VND, which is 3.4 times higher than the beginning of the year, while long-term borrowings decreased by 98% to just over 1 billion VND.