Illustrative image

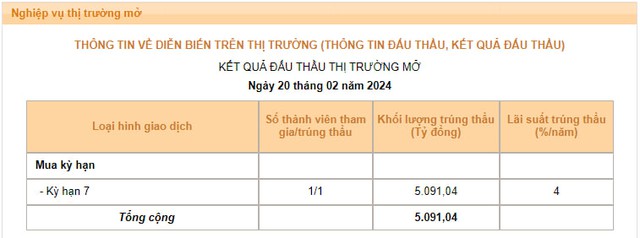

The trading session on February 20 witnessed significant developments in the open market as the State Bank of Vietnam (SBV) successfully bid for over 5,091 trillion VND on the collateralized loan channel with price-paper collateral (OMO). Accordingly, one market member “took a hot loan” from SBV with an amount exceeding the above-mentioned term of 7 days and an interest rate of 4% per year.

This is the first time since the beginning of 2024 that the banking system needs “trillion” support from the regulator. Previously, the winning bid for the OMO channel was only 1-2 billion VND in January.

This surprising turn of events occurred against the backdrop of the year-end peak payment period nearing the Lunar New Year.

Source: SBV

In another aspect, interbank interest rates have rebounded after two days of sharp decline. The latest figures released by SBV show that the average VND interbank interest rate at the overnight term (the main term, accounting for about 90% of the value of transactions) in the session of February 19 increased to 1.41% from the 1.04% level recorded at the end of the previous week. Along with the overnight term, interest rates on the other key terms also increased significantly: the 1-week term increased from 1.27% to 1.6%; the 2-week term increased from 1.39% to 1.6%.

The increase in interbank interest rates corresponds to the high trading volume, indicating a large borrowing and lending demand among banks despite the end of the peak payment period for the Lunar New Year.

Previously, interbank interest rates had been continuously increasing in the days leading up to the Lunar New Year, with the overnight term soaring from 0.12% per year in the session on January 29 to 2.38% in the sessions on February 6 and 7, i.e., nearly 20 times higher in just 1 week.

According to observers, the sharp increase in short-term interbank interest rates is mainly due to seasonal factors when payment and expenditure needs increase during the Lunar New Year holiday.

To support banks with liquidity needs, SBV continues to maintain the OMO channel, while adjusting the bidding term to 14 days during the Lunar New Year period. However, during the period leading up to the Lunar New Year, no market member needed the support of the regulator.