After a back-and-forth struggle in the morning session, the stock market continued its upward trend thanks to the support of the blue-chip group, especially the “family” Vingroup. VN-Index closed the session on February 20 with a gain of 5.09 points (0.42%) to 1,230 points, marking the 7th consecutive session with gains. Although liquidity decreased sharply compared to the previous session, the trading value on HOSE remained at 19,000 billion VND. In terms of foreign trading, they made a sudden net purchase of 170 billion VND in the entire market.

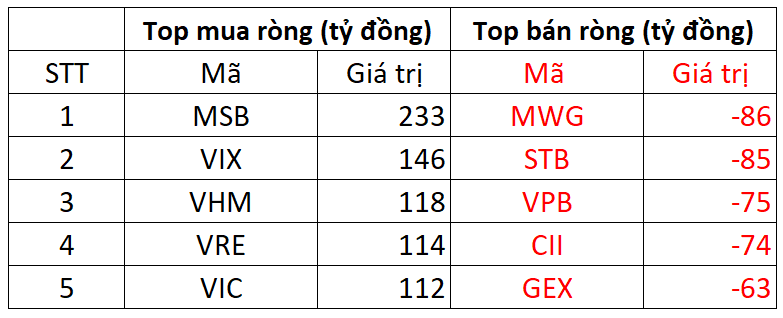

On HOSE, foreigners made a net purchase with an approximate value of 135 billion VND.

In the buying session, the net buying focus was on MSB bank with a value of 233 billion VND. Following that, VIX was net bought with a value of 146 billion VND. In addition, the three Vingroup stocks, VHM, VRE, VIC, also ranked in the net buying list on HOSE with 118, 114, and 112 billion VND.

On the other hand, MWG suffered the most selling pressure from foreigners with a value of 86 billion VND, STB, VPB were the next two stocks sold with 85 and 75 billion VND each.

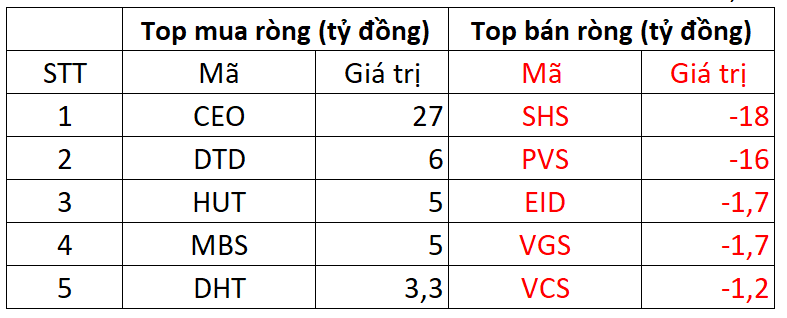

On HNX, foreigners made a net purchase of 6 billion VND

In the buying session, CEO was the strongest net buying stock with a value of 27 billion VND. Besides, DTD was next on the list of strong net buying on HNX with 6 billion VND. In addition, foreign investors also net bought HUT, MBS, DHT with not too big values.

On the contrary, SHS was the stock that suffered the most selling pressure from foreigners with a value of 18 billion VND; followed by PVS which was sold for about 16 billion VND.

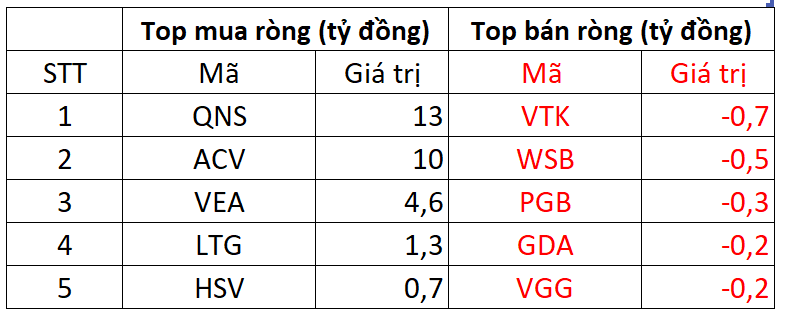

On UPCOM, foreigners made a net purchase of 29 billion VND

In the buying session, QNS insurance stock was bought by foreign investors for 13 billion VND. Following that, ACV and VEA were also net bought with each stock having a value of 10 and 4.6 billion VND.

On the other hand, VTK was sold by foreign investors for about 0.7 billion VND today; in addition, they also sold stocks in WSB, PGB, GDA,…