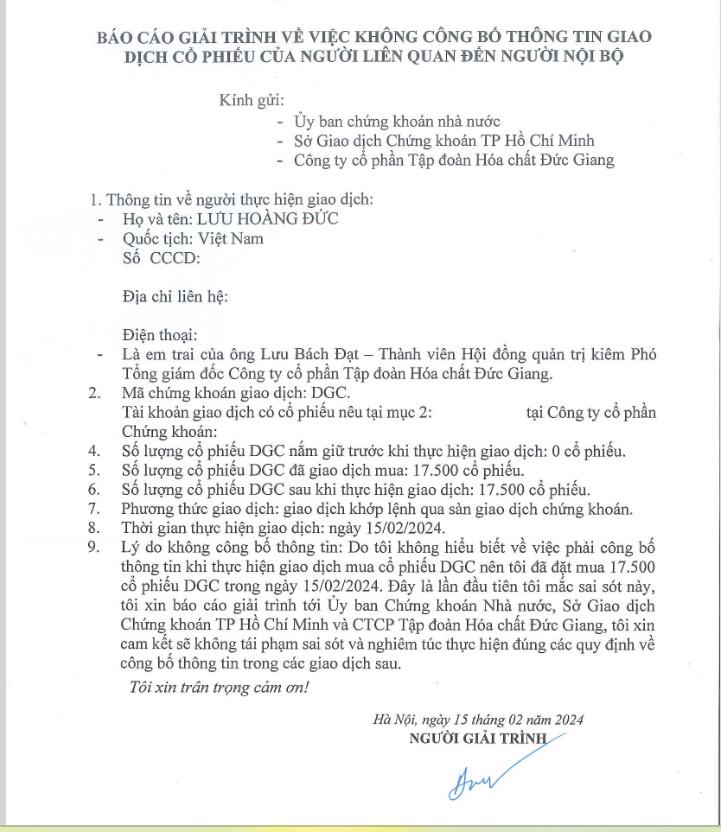

Luu Hoang Duc reports the stock trading results of related persons to insiders of Duc Giang Chemical Group (DGC-HOSE code).

Specifically, on February 15, 2024, Mr. Luu Hoang Duc, the younger brother of Mr. Luu Bach Dat, a member of the Board of Directors and Deputy General Director of DGC, announced that he had bought 17,500 shares of DGC to increase his ownership from 0 shares to 17,500 shares, accounting for 0.0046% of the charter capital.

Notably, before the transaction, Mr. Luu Hoang Duc did not register to buy in.

Explaining why he did not register to buy in, Mr. Luu Hoang Duc said, “Because I did not understand the need to disclose information when carrying out the transaction to buy DGC shares, I placed an order to buy 17,500 shares on February 15. This is the first time I made this mistake, so I would like to report and explain to the State Securities Commission, Ho Chi Minh City Stock Exchange and Duc Giang Chemical Group.”

By the end of the fourth quarter of 2023, Duc Giang Chemical Group recorded a revenue of VND 2,387.7 billion, a decrease of 23.3% compared to the same period (VND 3,111.5 billion); after-tax profit reached VND 745.7 billion, a decrease of 33.6% compared to the same period (VND 1,234.6 billion).

Accumulated in 2023, DGC recorded a revenue of VND 9,747.9 billion, a decrease of 32.5% compared to the same period (VND 14,444.1 billion) and after-tax profit reached VND 3,250.4 billion, a decrease of 46.2% compared to the same period (VND 6,037 billion).

On the stock market, at the end of the trading session on February 20, DGC’s stock price increased by 2.2% to VND 98,700/share.

Earlier on February 2, VCSC maintained its “buy” recommendation for DGC’s stock despite lowering the target price by 4% to VND 104,000/share.

VCSC reduced its core EBITDA forecast for 2024/25/26 by an additional 13%/8%/3% mainly due to lower assumptions on sales volumes. However, this was offset by our increase in the target EV/EBITDA from 6.5 times to 7.0 times.

In addition, the SEMI industry association forecast that global semiconductor sales will increase by 12% YoY in 2024. Furthermore, stable inventory levels of chip manufacturers reinforce chip production activities and thus increase the demand for industrial phosphoric acid in the future.

VCSC said that the average sales figures for three months of Taiwan Semiconductor Manufacturing Company continued to recover in December, reaching nearly the highest record of 2022.

DGC expects the demand for industrial phosphoric acid (IPC) in India to improve in the first quarter of 2024 after a weak fourth quarter of 2023. The demand from India affected DGC’s Q4 2023 business results, while the demand in East Asia remained stable.

The price of agricultural phosphoric acid increased as China banned the export of fertilizers from September 2023 until at least April 2024. The price of purified phosphoric acid rose from USD 900/ton to reach USD 985/ton in Q4 2023.

VCSC said that based on equivalent comparisons, DGC can save about VND 200 billion in apatite ore costs in 2024 compared to 2023 thanks to the full-year contribution from the second mining site.

In addition, VCSC increased our target EV/EBITDA and new target price corresponding to DGC’s 2024 P/E ratio of 10.3 times, which is now higher than DGC’s 5-year average trailing P/E ratio of 9.0 times because we believe DGC deserves to be priced higher than the average during the upcoming profit recovery period.

According to VCSC, the risks to VCSC’s positive outlook are narrower-than-expected market price differentials, delays in the soda-ash project, and unfavorable changes in phosphate export policies.