According to the Social Security of Vietnam, as of December 2023, there are about 2.78 million civil servants and public employees (excluding the armed forces) participating in the social security system. Among them, about 80% receive salaries from the state budget, with an average salary of VND 6.93 million per month serving as the basis for social security contributions.

Along with the salary increase for civil servants and public employees, pension is expected to be adjusted from July 1, 2024

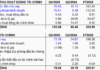

Starting from July 1, 2024, when implementing reforms, the average salary of civil servants and public employees will be about 30% higher than the average income of salaried workers. With this increase, the Social Security of Vietnam expects the average contribution basis for social security to also increase by about 54.8%.

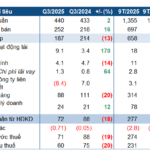

According to the calculations of this agency, the additional contributions to the social security sector for 1 year will reach about VND 31.7 trillion. The state budget alone will allocate an additional approximately VND 17.26 trillion for social security contributions, not counting the contributions for about 88,000 non-professional workers at the commune level who are participating in social security.

It is worth noting that with the high average monthly salary for social security contributions, people who contribute to social security (under the new policy) for a longer period of time will receive much higher pensions compared to those who retire before July 1, 2024. This leads to disparities in pension benefits among different groups and affects the sustainability of the pension fund and mortality rate.

Therefore, the Social Security of Vietnam proposes that for workers who have contributed to social security under the old salary regime, the social security contribution based on the salary from July 1, 2024 onwards will be calculated as the average for the entire contribution period. Meanwhile, this agency also proposes an annual increase of 8% in pension benefits.

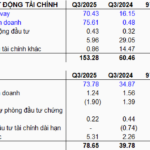

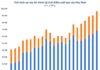

With this plan, the Social Security of Vietnam estimates that the total pension and mortality fund will increase from VND 83 trillion this year to VND 162 trillion in 2050. In contrast, the pension payout will increase from VND 94 trillion to VND 221 trillion in 2050 (under the current plan) or increase to VND 219 trillion (under the proposed plan).

Reasonable adjustment of pension increase

Mr. Pham Minh Huan, former Deputy Minister of the Ministry of Labor, Invalids, and Social Affairs, said that currently, the pension level for retired officials is still low, so everyone wants higher pensions to help ensure their livelihoods. The Social Security Law stipulates that each time the salary of civil servants and public employees increases, the minimum pension for retirees must also correspondingly increase or be higher.

“This issue has been mentioned for a long time, but so far, increasing pensions has not been implemented. The Ministry of Labor, Invalids, and Social Affairs, the Social Security of Vietnam, and relevant units need to discuss and agree on the most reasonable pension increase, as this is the expectation of a large number of retirees,” said Mr. Huan.

According to statistics, from 1995 to July 1, 2023, Vietnam has adjusted pensions 23 times. In these changes, the increase in proportions has been the same for those receiving pensions ranging from the lowest rate of VND 1.6 million per month to the highest rate of VND 124.7 million. Regarding pension increases, Minister of the Ministry of Labor, Invalids, and Social Affairs Dao Ngoc Dung said that when implementing the new salary policy, the minimum pension should increase by 15% compared to the increased salary of civil servants and public employees. Adjusting the pension policy in a balanced and harmonious manner is essential to ensure that retirees do not face difficulties and disadvantages after the reform.