In the report submitted to the State Securities Commission and Ho Chi Minh City Stock Exchange on February 20, 2024, Eximbank stated that no shares were sold during the period from January 15 to February 7, 2024, as the market price did not meet the bank’s target selling price.

| Price movement of EIB shares from the beginning of the year to date |

During the period from January 15 to February 7, the price of EIB shares experienced fluctuation within the range of 18,700 – 20,200 dong/share. There was no session that closed higher than the bank’s target price of 20,199 dong/share.

Eximbank’s plan to handle 6.09 million treasury shares was approved at the Annual General Meeting in April 2023. The bank had two options for handling the treasury shares: selling them or using them as bonus shares. However, at that time, the Management Board stated that the bank had just completed a new issuance of shares to increase its charter capital and also had plans to increase the charter capital further, so selling the treasury shares was deemed appropriate.

In the disclosure of trading information, Eximbank stated that the purpose of selling the treasury shares was to supplement its business capital. According to the plan, on each trading day, Eximbank would set a minimum selling volume of 3% and a maximum of 10% of the registered trading volume with the State Securities Commission.

At the beginning of February 21, 2024, EIB shares were traded around 18,700 dong/share, up 2% compared to the beginning of the year. The average liquidity was over 12.6 million shares/day.

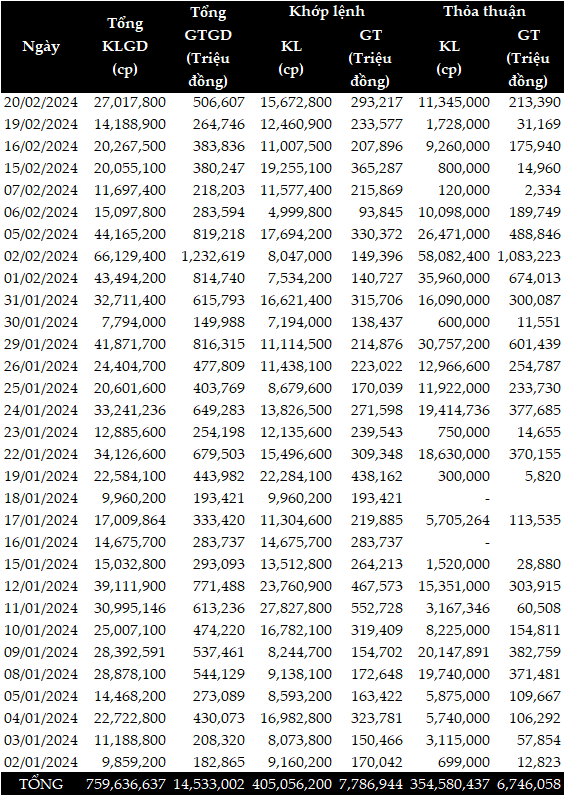

Since the beginning of 2024, EIB shares have recorded a large volume of negotiated transactions, with nearly 355 million shares traded, worth over 6.746 trillion dong, equivalent to 19,025 dong/share. The most recent session on February 20 had over 11.3 million negotiated shares traded, with a value of over 213 billion dong, equivalent to 18,809 dong/share. There was a session with a negotiated trading volume of 30.7 million shares (on January 29), even reaching over 58 million shares (on February 2).

|

Trading of EIB shares from the beginning of 2024 to date

Source: VietstockFinance

|

Previously, Eximbank set its plan for 2024 with a pre-tax profit target of 5,180 billion dong, an increase of 90% compared to the results of 2023.

The target by the end of 2024 is to increase total assets by 11% to 22,102 billion dong. Mobilized capital and credit outstanding are projected to increase by 10.5% and 14.6% respectively, reaching 16,670 billion dong and 20,476 billion dong.

This plan will be presented at the Annual General Meeting in 2024, scheduled to be held on April 26.