The focus of the stock market recently has been on the “Vingroup” group of stocks. In particular, Vincom Retail (VRE) has increased nearly 16% in just 3 sessions and is now at its highest level in almost 4 months. This strong increase in stock price brings joy to shareholders, but not everyone has the patience to fully enjoy it as VRE had a challenging period before.

Pyn Elite Fund is one of the “less fortunate” when it sold a large amount of VRE shares just before the unexpected bull run. According to the newly released January report, as of January 31, 2024, VRE is no longer among the top 10 largest investments of the fund. It is estimated that the EUR 750 million (~ VND 20,000 billion) overseas fund still holds less than 26.4 million VRE shares.

In fact, VRE used to be a very popular stock among foreign funds from Finland. At one point in April last year, Pyn Elite Fund allocated nearly 10% of its assets to this stock. However, the percentage of VRE in the fund’s portfolio has continuously decreased and by the end of 2023, it was only 4.7%. At that time, it was estimated that Pyn Elite Fund held about 37.9 million units.

Therefore, in just January 2024, it is estimated that Pyn Elite Fund has net sold at least 11.5 million VRE shares.

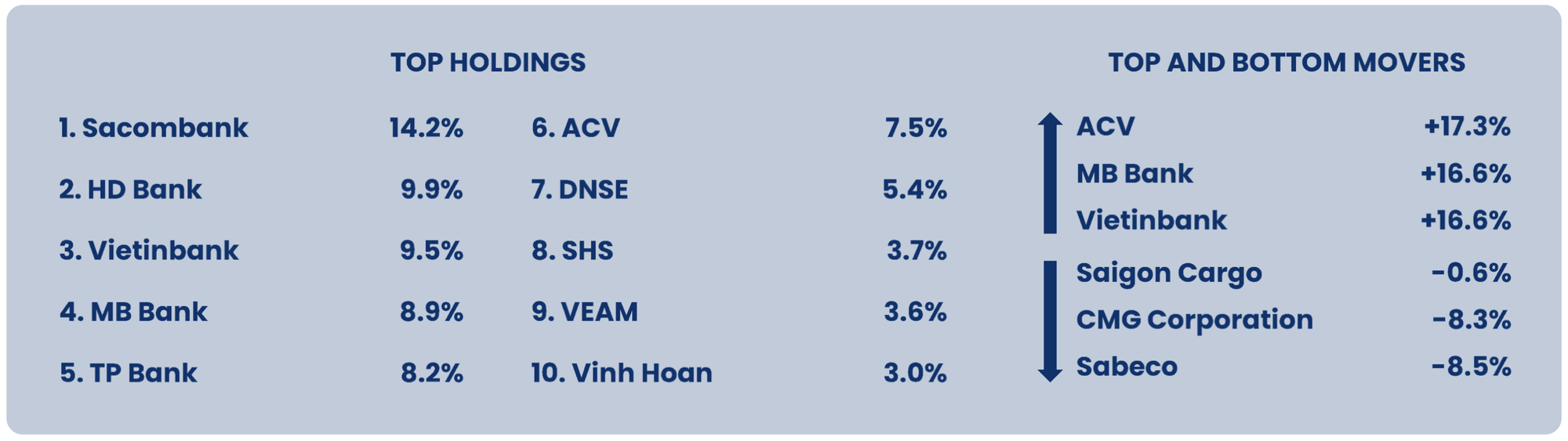

The top 10 largest investments of Pyn Elite Fund at the end of January 2024

With a market capitalization of about VND 58,000 billion (~ USD 2.5 billion) and high liquidity, VRE is one of the top choices for major institutions. In addition to Pyn Elite Fund, foreign funds such as Dragon Capital, Fubon ETF, VNM ETF, FTSE ETF, all hold this stock. Furthermore, the portfolios of the two largest domestic ETFs, namely DCVFM VNDiamond ETF and DCVFM VN30 ETF, also include VRE.

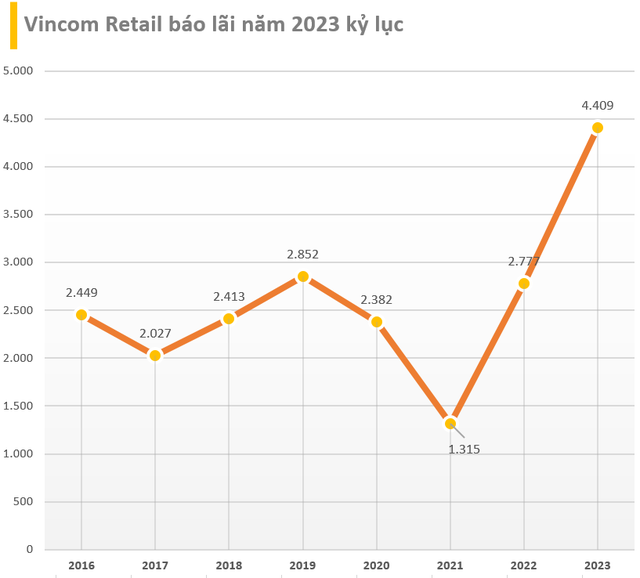

As for Vincom Retail, the company had a strong year in 2023 with net revenue reaching VND 9,791 billion and after-tax profit reaching VND 4,409 billion, an increase of 33% and 58.8% respectively compared to the same period. This is a record profit level achieved by the company operating 83 commercial centers nationwide, since its inception.

In the year, Vincom Retail continued to improve the efficiency of existing assets, including 83 commercial centers located in central locations in 44 provinces and cities of Vietnam, pioneering the introduction of 11 major international brands appearing for the first time in Vietnam such as Lush, ADLV, Wulao… And 10 flagship stores with unique and distinctive models at Vincom commercial centers such as Nike Live, Pizza 4P’s Premium, Aldo, Swarovski.

With the achieved results in the past year, Vincom Retail will continue to optimize its operational model, search for and introduce new consumer trends at Vincom commercial centers. In 2024, Vincom Retail plans to open 6 more commercial centers with a total retail floor area of about 160,000 square meters, maintaining its position as the leading retail real estate developer in Vietnam and the region.

According to Mirae Asset, the total new retail floor area in 2024 is expected to come from VMM Grand Park, VMM Ocean Park 2 projects, and Vincom Plaza projects in Ha Giang, Dien Bien, Dong Ha, Bac Giang. Other projects being implemented include Vincom Megamall Phu Yen, Vincom Megamall Co Loa. According to Vincom Retail, the company currently has reserved land to develop 2 – 3 commercial centers in Ho Chi Minh City and 1 commercial center in Long An.