The morning decline did not add pressure to the afternoon session; on the contrary, liquidity decreased significantly and stock prices recovered, confirming weak selling pressure. Although there were no outstanding stocks, the breadth of market decline brought the VN-Index close to the reference level, with a negligible decrease of 0.02 points.

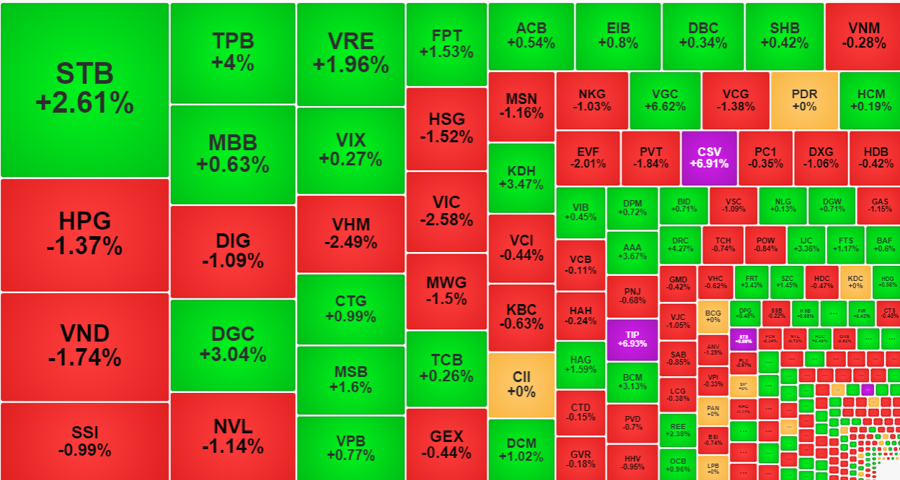

Among the top 10 largest stocks in the market, 4 increased and 6 decreased. None of the increases exceeded 1%, with the strongest being CTG up 0.99%, VPB up 0.77%, BID up 0.71% and TCB up 0.26%.

The VN-Index relied mainly on the average market capitalization stocks of the VN30 basket, with BCM increasing by 3.13%, ranking 17th in terms of market capitalization in the index. FPT increased by 1.53%, ranking 11th in terms of market capitalization. TPB increased by 4% with a ranking of 29th in terms of market capitalization… In addition, there were some other small stocks such as VGC up 6.62%, DGC up 3.04%…

The VN30 group did not lead the way, with a slight increase of 0.03% with 13 gaining stocks and 17 declining stocks. The price movement of this group was more positive in the afternoon session, with 18 improving stocks and only 6 declining stocks. However, the most important stocks did not show the necessary strength: VIC weakened, decreasing overall by 2.58%; VHM down 2.49%; HPG down 1.37%; GAS down 1.15%. These stocks were all in the declining group compared to the morning session, adding pressure to the VN-Index. In fact, the pair VIC and VHM alone caused the index to lose 2.5 points, more than the total points of the 5 strongest increasing stocks, which are BCM, FPT, BID, CTG, and TPB (+2.4 points).

However, the market this afternoon was not bad but showed good signals. Firstly, liquidity decreased: the total trading value on HoSE in the afternoon session was lower than in the morning session by nearly 16%, and the two exchanges overall decreased by 15.5%. Looking at the price decline in the second half of the morning session, the risk of a deeper adjustment this afternoon is quite possible, especially when the strong stocks have turned around. This afternoon was also a session with a large amount of stock selling on the first trading day of the week, with a trading volume of 1.06 billion shares on the two exchanges, with a trading value of over 24.4 trillion VND. Low selling pressure and decreased liquidity are positive signs.

Secondly, the market breadth changed positively. In the first 3 minutes after the lunch break, the VN-Index broke through the morning session’s low and recorded 129 gaining stocks/348 declining stocks (at the end of the morning session, there were 149 gaining stocks/312 declining stocks). From this low point, stocks gradually recovered and closed quite balanced with 239 gaining stocks/262 declining stocks, meaning that over a hundred stocks have recovered beyond the reference level.

Of course, the recovery ability and the magnitude of the increase are not the same for all stocks. On the HoSE exchange, there were only 72 stocks that increased more than 1% with a liquidity accounting for 27.6% of the total market volume. On the other hand, there were 65 stocks that decreased more than 1%, accounting for 28.5% of the liquidity. That means a large portion of stocks have a small price fluctuation range, although this group accounts for only about 44% of the market’s liquidity.

It’s not surprising that large-cap stocks such as VIC, VHM, MSN, GAS, VNM… adjusted today as the price fluctuation range for T+ trading is quite large, stimulating the realization of profits. The important thing is that this development did not cause significant turmoil in the market, nor did it increase liquidity drastically. There are still many stocks attracting positive cash flow, such as DGC, KDH, DCM, VGC, CSV, AAA, BCM… with strong price increases. If the leading stocks mentioned above overcome the first profit-taking phase, there is still a chance to push the VN-Index higher.