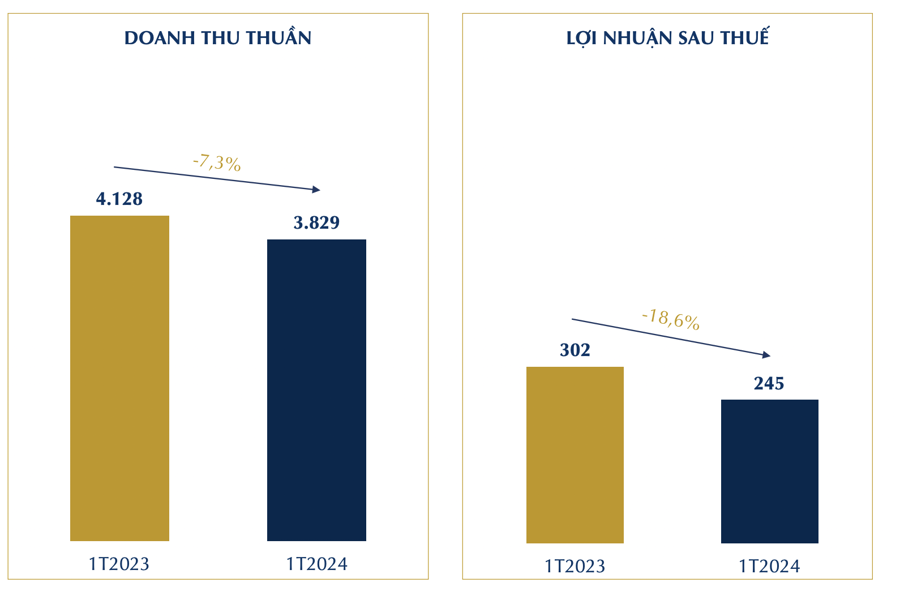

According to PNJ, shopping behavior in the Vietnamese consumer market in January and February depends on the lunar cycle, with major holidays such as Tet and the God of Wealth festival. In January 2024, in the context of not yet recovering purchasing power and Tet and God of Wealth falling in February this year, PNJ recorded net revenue of 3,829 billion VND, a 7.3% decrease compared to the same period, and after-tax profit of 245 billion VND, a 18.6% decrease compared to the same period.

Specifically, retail jewelry revenue in January 2024 decreased by 6.1% compared to the same period due to Tet coming late and purchasing power still declining. Wholesale jewelry revenue in January 2024 increased by 32.6% compared to the same period in the context of orders prepared for Tet.

Gold revenue in January 2024 decreased by 15.6% due to the impact of Tet and the God of Wealth festival.

The average gross profit margin in January 2024 was 17.2%, a decrease compared to the 18.2% level in the same period of 2023 due to changes in the structure of goods sold in the retail channel. Total operating expenses in January 2024 decreased by 3.7% compared to the same period. The operating expense/LNG ratio in January increased from 47.5% to 52.1%.

As of January 31, 2024, PNJ’s total number of stores reached 402, an increase of 2 stores compared to the end of 2023, including 393 PNJ Gold stores, 3 CAO Fine Jewellery stores, 5 Style by PNJ stores, and 1 Wholesale Business Center.

In the recent meeting with VnDirect, PNJ expects that purchasing power will begin to recover from Q3/24 when the industry recovers, helping to improve consumer income. Revenue in Q1/24 may be lower than the same period due to last year’s January coinciding with the lunar new year and the God of Wealth day. However, revenue will improve in Q2/24.

The growth momentum in 2024 comes from the company having accumulated new customers in 2023 and will continue to develop this customer base in the coming year, continuously increasing market share, and the middle class is still growing steadily. According to the leadership, the northern region is experiencing better growth than other regions across the country.

PNJ’s stock price decreased by 1.90% from 90,500 VND per share to 87,900 VND per share in today’s trading session on February 21.