Amended Credit Institution Laws: Ensuring Efficiency and Development of Banking Operations

In the recently passed Amended Credit Institution Laws, there is an noteworthy provision aimed at reducing ownership ceiling in banks. The maximum ownership ratio for institutional shareholders, shareholders, and related individuals will be reduced, except for foreign investors.

Specifically, the ownership limit for individuals at a bank remains unchanged at 5%. However, an institution is not allowed to own more than 10% of the charter capital of a credit institution, including indirect ownership, instead of previously 15%. Shareholders and related individuals are also not allowed to own more than 15% of the capital, instead of previously 20%.

Major shareholders of a credit institution and related individuals of those shareholders are not allowed to own shares from 5% of the charter capital upwards of another credit institution.

When presenting, the Standing Committee of the National Assembly stated that it is necessary to reduce the ownership ratio of institutional shareholders in banks; this will help diversify shareholder structure, increase public participation, and limit banks’ control and acquisition.

In addition, the National Assembly’s permanent committee stated that reducing the ownership ratio from 15% to 10% for institutions is also in line with the direction of the credit institution restructuring plan, linked to bad debt resolution from 2021 to 2025.

Within 5 years from the date of license issuance, founding shareholders must hold at least 50% of the charter capital of a credit institution; founding shareholders as legal entities must hold at least 50% of the total shares held by founding shareholders.

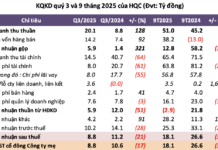

Which banks’ major shareholders will have to reduce the ownership ratio?

According to a report from the State Bank of Vietnam (SBV), as of December 31, 2022, if the share ownership ratio of an institutional shareholder is adjusted from 15% to 10% of the charter capital, there will be 17 institutional shareholders in 13 joint stock commercial banks and 1 finance company with a share ownership ratio exceeding 10%.

|

Major shareholders in banks list

Source: Compiled

|

According to the management report for the first 6 months of 2023, Geleximco Corporation, Hanoi General firm, currently owns 12.78% of the capital at ABBank with over 132 million shares of ABB. Meanwhile, Vice Chairman of the Board of Directors of ABBank Vu Van Tien owns nearly 3.8 million shares of ABB, equivalent to 0.37% of the capital.

At PGBank (PGB), after Petrolimex divested, 3 domestic major shareholders took its place: International Corporation Cường Phát owns 40.6 million shares (13.54%); Vũ Anh Đức Commercial Company holds 40 million shares of PGB (13.36%), and Gia Linh Import-Export and Commercial Development LLC currently owns 39.2 million shares of PGB (13.1%).

The Military Industry – Telecoms Group currently owns 14.14% of the capital at MB, equivalent to nearly 641 million shares of MBB.

However, the Amended Credit Institution Laws also stipulate the reduction of ownership ratio for shareholders and related individuals to not exceed 15%.

Related individuals are specifically listed, including family relationships (biological parents, stepfathers, stepmothers, siblings…) or parent companies, subsidiaries. Other legal entities and individuals with potential risks to the operations of credit institutions, foreign bank branches will be determined according to the internal regulations of the credit institution, foreign bank branches, or by written request from the SBV through inspection and supervision activities.

Under the new amended laws, currently, some banks have no shareholders exceeding the ownership ratio, but related individuals still own a “near-large” proportion of shares.

Masan Group Corporation currently owns 14.88% of the capital at Techcombank, equivalent to over 524 million shares of TCB. At the same time, Mr. Nguyen Dang Quang – Deputy Chairman of Techcombank’s Board of Directors and also Chairman of Masan’s Board of Directors – currently owns over 9.4 million shares of TCB (0.27%).

At ABBank, in addition to Geleximco exceeding the ownership ratio, Chairman of Geleximco‘s Board of Directors Mr. Vu Van Tien also owns 0.366% of the charter capital in the bank.

At SHB, although T&T Group only owns 9.99% of the bank’s capital, SHB’s Chairman Do Quang Hien holds 2.33% of the capital in SHB and the youngest son, Do Quang Vinh, owns 0.02%.

However, the Amended Laws also include a transitional provision. From the effective date of the Laws, shareholders and related individuals owning shares exceeding the ownership ratio as stipulated by the Amended Laws will continue to maintain their shares, but no additional shares can be acquired until complying with the regulations on ownership ratio, except for receiving dividends in shares.

Need for control tools

In a report by securities firm Shinhan Securities (SSV) released on January 23, 2024, the research team evaluated that tightening the ownership ratio will help limit cross-ownership and manipulation in banks. The publication of information to shareholders with ownership of 1% and above helps investors have a better understanding of the ownership structure of the bank.

However, supervision and enforcement by state agencies are important factors in ensuring the effectiveness of these regulations.

A report from securities firm SSI published on January 26, 2024 stated that although there are no specific instructions or timelines for cases that are currently violating the ownership ratio, the new laws allow these entities to continue to maintain their shares and not increase their current ownership ratio, except for receiving dividends in shares. This hardly creates significant changes in the current ownership structure of banks unless credit institutions carry out private placements for other shareholders.

Mr. Tran Truong Manh Hieu – Head of Strategic Analysis Department at Korea Investment & Securities Vietnam, said that in the short term, the Amended Credit Institution Laws’ provision of reducing bank ownership ratios will cause some shareholders to reduce their bank ownership on a large scale. If they only sell at a market-determined price, it will heavily influence bank stocks.

Dr. Nguyen Huu Huan – Financial and Banking Expert, agreed, stating that reducing the ownership ratio of bank shares by an individual, an organization, and a group of related organizations aims to divide the power of shareholders. This adjustment is appropriate and helps limit the ability of an individual or organization to team up with other shareholders to dominate and take control of banks.

However, the issue is not determining at what ownership ratio is, but how to implement these regulations. Even if the ownership ratio is reduced to 2%, if the entities deliberately bypass the law, recruit additional people to reach the required share ownership ratio, they can still control the bank. The issue is how the SBV has tools to control the actual ownership issue – a problem that has persisted for a long time and continues to exist.

Assoc. Prof. Dr. Nguyen Huu Huan – Lecturer at the University of Economics Ho Chi Minh City (UEH), shares the same view. He believes that reducing the ownership ratio of institutions from 20% to 15% aims to prevent cross-ownership, but this does not have much impact. If an institution divides its ownership among many individuals and organizations, the registered name also meets the requirement.

Assoc. Prof. Dr. Dinh Trong Thinh – Economic Expert, has a more optimistic view. He believes that in general, this Law is one of the documents that helps make the financial-banking system more transparent, ensuring fair competition and the system of financial-credit organizations as well as ensuring transparency in credit institutions that are more clear.