Some leading indicators closed short-term gains today and declined, creating some volatility in the session. This is not surprising as the rapid intensity of the recent rallies is not sustainable. The ability to overcome these short-term fluctuations will determine the opportunity to test the 2023 peaks of the indices.

The good news is that the intraday fluctuations did not harm prices too much. Many stocks had good demand and gradually recovered towards the end of the session. Of course, there are still many stocks sold off heavily and experienced deep declines, but overall the opportunities are still abundant as long as you have flexible positions and choose the right stocks.

Observing the trading in the session plays the most important role at this time, in order to perceive the selling pressure and bottom-fishing demands from each side. The risk level in individual stocks varies, especially for the ones that have not increased much or are in the accumulation phase. Profit-taking usually comes in two forms: active selling at different price ranges during the uptrend, and passive selling when prices weaken. The support level at which selling pressure weakens and the price decreased provides valuable information, as there will certainly be fast trading phenomena in sessions like this.

Since many people still observe the index for trading, the closer the index approaches the technical resistance zone, the more likely it is to experience fluctuations. When looking at the long rally, minor corrections in the index and approaching the old peak, overbought technical indicators will sound an alarm, and the psychological tendency to test the peak will arise. Therefore, during market fluctuations, weak selling pressure at low prices for specific stocks or having more bottom-fishing demands means that investors are paying more attention to those stocks rather than the index, or at least their expectations are still high.

In the next few sessions, leading stocks are likely to have buying demand at lower prices. Money flow is still relatively stable and withdrawing also takes time. The trading volume on HSX and HNX today was about 21.7 trillion, maintaining a level above 20 trillion for the third consecutive session. At the two peaks last August and September, the average trading volume was around 26-27 trillion per session, with many sessions at over 30 trillion. The trading volume in the past three days of about 22.3 trillion per session is not considered abnormal.

Currently, stocks still have room for further increase compared to fundamental extreme levels and have good money flow, so holding is still advisable, and if agile, one can take advantage of trading opportunities. However, overall stock exposure should be kept at an average level. It is better for the index to maintain small daily fluctuations than to increase sharply, which depends on the balance between the leading stocks. If large-cap stocks like VIC, VHM, GAS, VNM, etc. remain strong, there is no need to worry, but if the coordination adjustment causes a significant reduction in scores, it is certain that there will be shaken psychology.

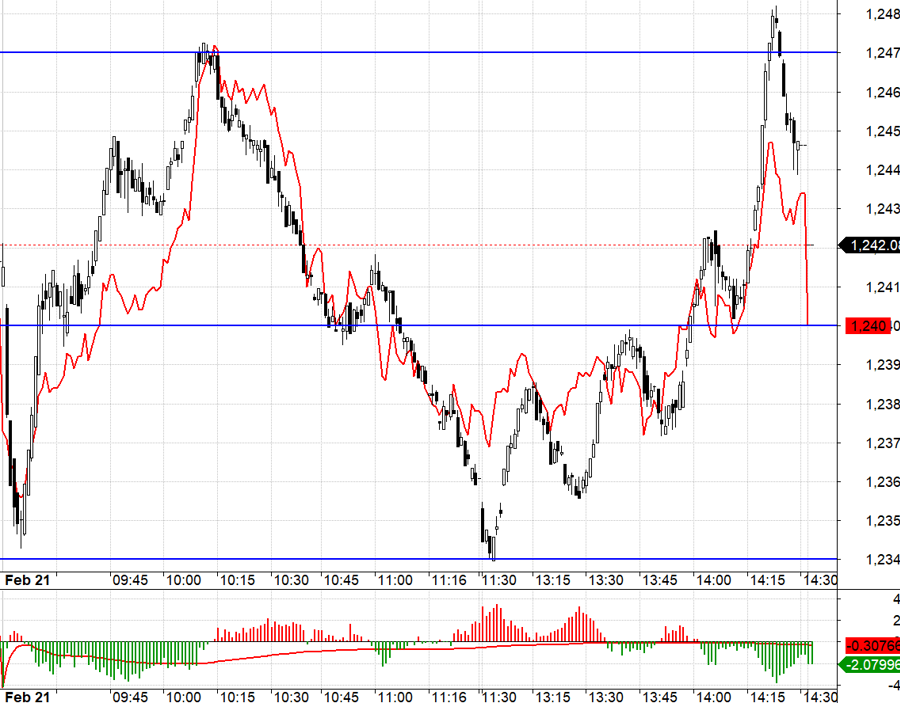

The derivatives market is also aligning with caution over the risk in the VN30 leading group. Today, the VN30 increased intraday F1 and even discounted. The trading volume increased by about 46% compared to yesterday, the Open Interest (OI) increased, and the negative basis indicates the phenomenon of constructing a short position. This is also reasonable if holding a long position because the differentiation in stocks in the VN30 is not enough to increase the index’s fluctuation range. However, if trading, one should be flexible in Long/Short, as the leading stocks can still strengthen in the short term or at certain times of the session.

VN30 closed at 1242.08 today. The nearest resistance levels tomorrow are 1249, 1256, 1261, 1266, 1272, 1278. Supports are at 1240, 1233, 1228, 1222, 1219, 1210.

“Stock Blog” is for personal purposes and does not represent the views of VnEconomy. The opinions and evaluations are those of the investor and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any arising issues related to the reviews and investment opinions posted.