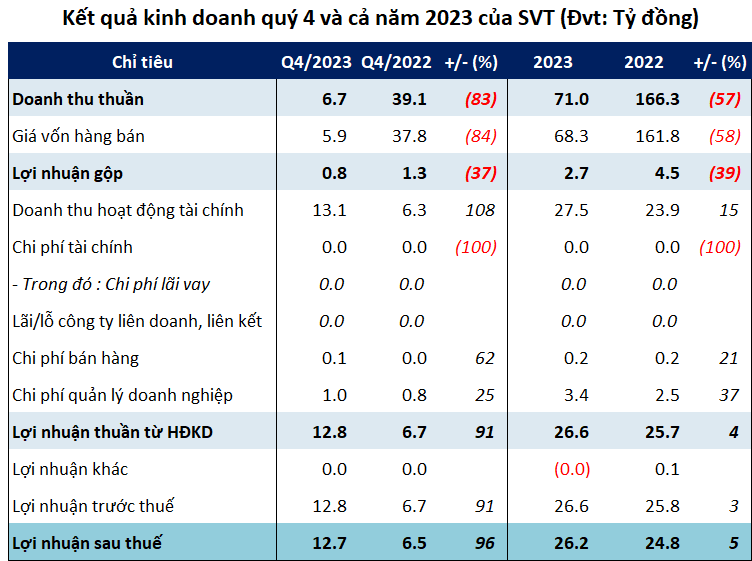

Previously, SVT also announced its Q4 2023 business results with net revenue of nearly VND 7 billion, down 83%; while net profit was nearly VND 13 billion, up 96% compared to the same period.

The exceptional business results of SVT were due to the financial operating revenue of over VND 13 billion, an increase of 108% compared to the same period, mainly from dividends and profits distributed during the period.

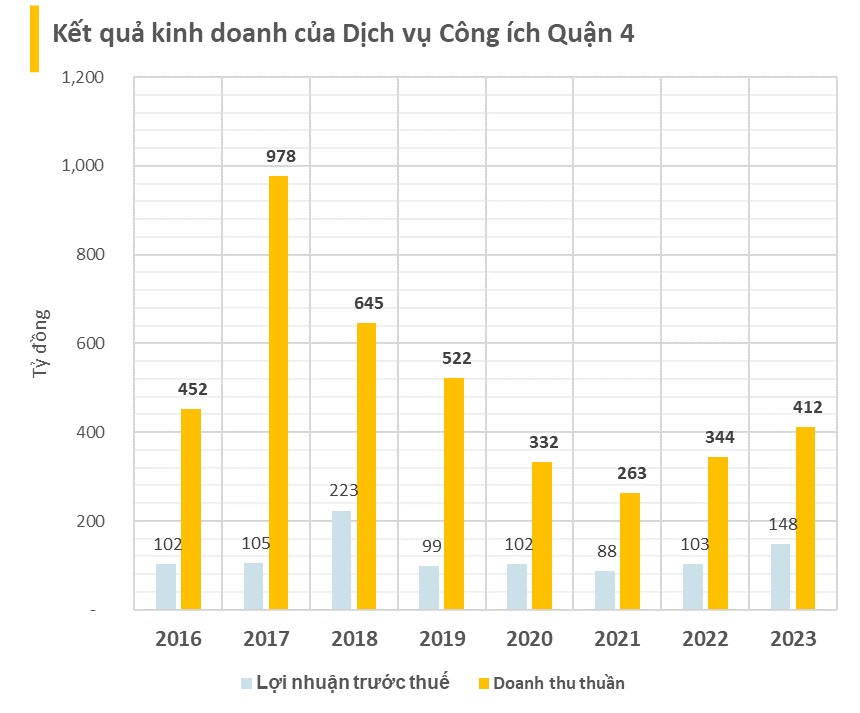

Source: VietstockFinance

|

SVT stated that its Q4 sales revenue was affected and tended to decrease due to the impact of import prices, foreign exchange rates, and interest rates leading to low efficiency. However, the profit in this quarter increased significantly compared to the same period, mainly from financial activities in both the paper trading and education sectors.

Ending the year 2023, SVT recorded net revenue of VND 71 billion, a decrease of 57%, while net profit was over VND 26 billion, an increase of 5%.

As of December 31, 2023, SVT’s total assets reached VND 236 billion, an increase of 12% compared to the beginning of the year. Of which, the majority is concentrated in long-term assets of over VND 200 billion, accounting for 85%.

The cash and cash equivalents decreased by 57% compared to the beginning of the year, with only over VND 2 billion, and the company did not recognize the value of inventory.

On the other side of the balance sheet, SVT only has over VND 1 billion in payable and no financial debts.

At the end of the trading session on February 21, the price of SVT’s shares stood at VND 11,050/ share, a decrease of over 3% compared to the beginning of 2024, with low liquidity of only 4,450 shares per day.