According to FiinGroup’s statistics, 4Q2023 net profit after tax (NPAT) of the entire market witnessed a remarkable growth from the previous year’s bottom, but the strong recovery in 4Q did not compensate for the overall annual result. In 2023, the overall market NPAT dropped by -6.7%, even larger than the decline observed in 2020 (when the Covid-19 pandemic broke out). This result fell short of the companies’ plan set at the beginning of the year during the Annual General Meeting of Shareholders (AGM) (expected to only decline -3%).

Many sectors recorded a decrease in their annual NPAT in 2023, but some showed signs of recovery or continued growth in 4Q, including Banking, Information Technology, Basic Resources (primarily Steel), Consumer Goods, Food, Construction, and Materials. In contrast, Retail and Utilities sectors have not escaped the downward trend.

From the data, it can be seen that the recovery story has been reflected in stock prices across many industries, including those with significantly lower growth than expected or even where profits are still “bottoming out.” The outlook for profit recovery will continue to be a driving force for stock prices in 2024, but it may not occur extensively and will only be concentrated in industries with genuine stories.

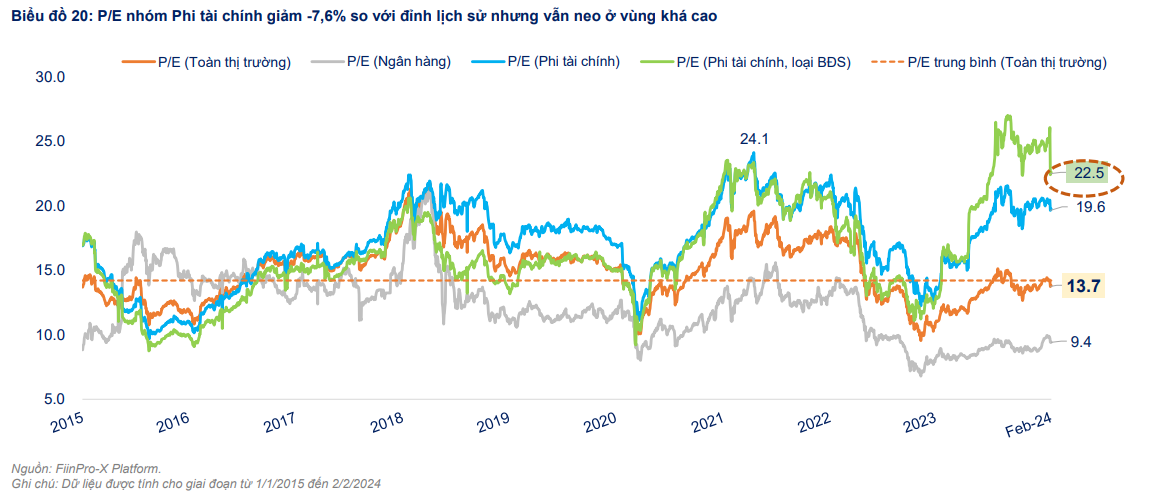

According to FiinGroup, the current stock price reflects expectations. The market’s P/E is currently at 13.7x, lower than the average level from 2015 to the present (14.2x), primarily due to the low valuation of the Banking sector. The Financial Sector excluding Real Estate has seen a decrease of -7.6% in P/E, and when excluding all Real Estate, the P/E has declined by -16% compared to its historical peak due to strong profit growth in 4Q2023. However, this is still considered a high valuation for this group.

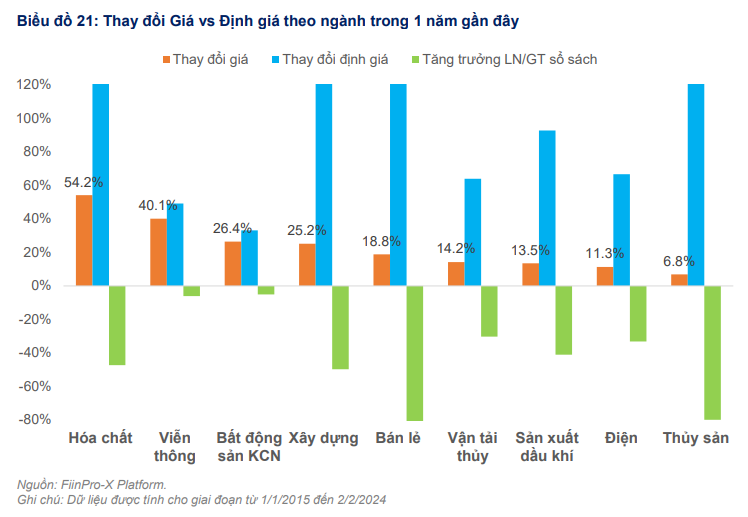

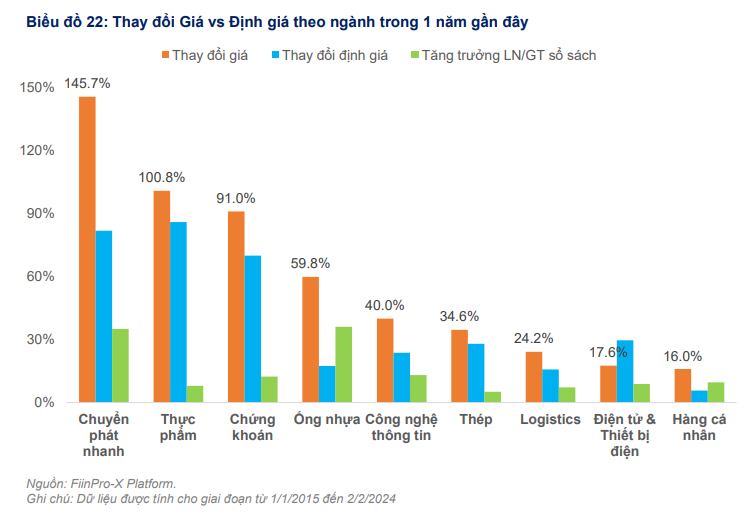

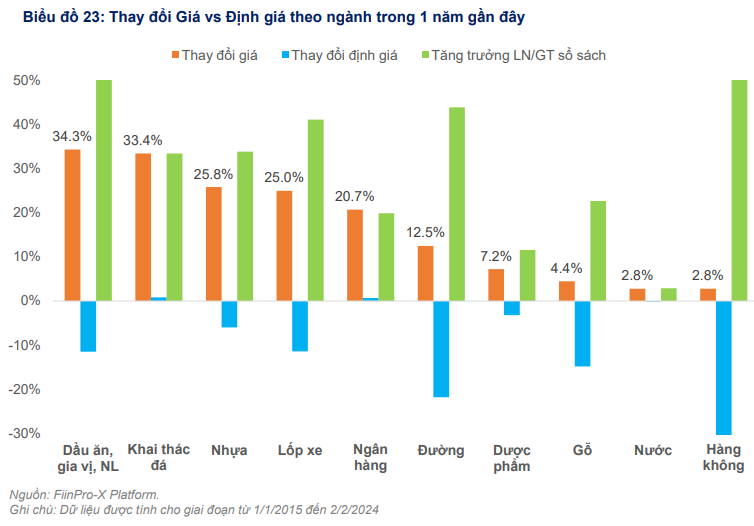

The analysis team examines the relationship between price changes, profit, and valuation to identify some sectors that have seen price increases recently due to profit recovery or expanding valuation levels based on investor expectations. From there, they identified several common industries.

The first category is sectors with price increases due to expectations of recovery, including Chemicals, Construction, Retail, Aquaculture, Electricity, Industrial Real Estate, Shipping… which are sectors that have shown strong price increases in recent periods but a decline in profits. The price increase primarily stemmed from expectations of early profit recovery and growth after a business disruption period caused by Covid-19 pandemic. These expectations have attracted inflows of investment capital, pushing up valuations.

In reality, the expectations of strong recovery in these industries have not yet materialized in 2023. These are also industries that require outstanding profit growth in 2024 to compensate for the expectations that have been priced in during the previous period. However, looking towards 2024, in the context of relatively low consumer demand, the profit outlook for most of these industries is unlikely to experience a strong recovery.

For Industrial Real Estate, the continued support for prices is information related to FDI capital disbursement activities (for Industrial Real Estate). For Aquaculture, the recovery in export activities is facing difficulties due to weak consumer demand in major export markets (United States, China) and increasing transportation costs.

The second category includes sectors with price increases due to both increased profit and valuation. Securities, Information Technology, Plastic Pipes, Express Delivery, and Steel are sectors with superior price performance compared to the overall market in 2023 thanks to strong recovery from profit lows as well as sharp valuation increases.

The analysis group believes that the profits of most of these industries have passed the recovery phase and are entering a growth phase, making it difficult to generate broad price momentum, especially in a market with unstable liquidity as it is now.

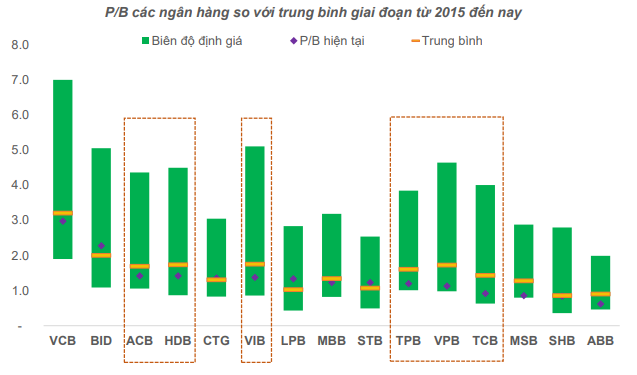

The third category includes sectors with price increases due to profit growth, with unchanged or relatively low valuation levels. Notably, the Banking sector is expected to witness a strong profit recovery on a low base in 2023.

FiinGroup believes that maintaining low valuation for over a year will be a price driver for the banking sector. Moreover, the expected profit in 2024 is positive thanks to low interest rates and abundant liquidity supporting banks to reduce capital costs for credit activities and create room for improvement in NIM. However, it is still necessary to consider the risks of economic growth not meeting expectations, weak credit demand, and the prolonged stagnation of the real estate market (including legal difficulties), which could result in a rise in bad debts and increased provisioning expenses.