![]()

Michael Kokalari – Director of Macroeconomic Analysis and Market Research at VinaCapital provided an analysis of Vietnam’s export performance and its impact on the economy and stock market.

In 2023, Vietnam’s exports recorded negative growth for the first time since the global financial crisis, which had a significant impact on GDP growth in 2023 as exports accounted for an average of 90% of GDP in the 2019-2022 period. However, exports continued to grow in the fourth quarter of 2023, and increased sharply by 42% compared to the same period in January 2024, driven by a 33% increase in high-tech electronic product exports (accounting for one-third of Vietnam’s total exports).

The high growth rate in January 2024 was due to a low comparison base, as Vietnam’s exports declined in early 2023 (a 12% decrease in exports in the first quarter of 2023), which coincided with the Lunar New Year holiday in 2023. However, the growth rate in January 2024 was impressive, even though it coincided with the Tet holiday and/or a decline in exports in the previous year (a 6.7% increase in exports compared to the previous month in January 2024).

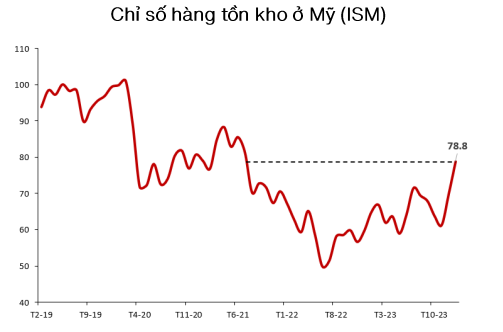

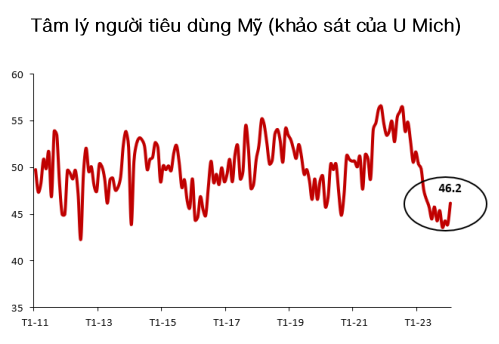

More importantly, VinaCapital expects Vietnam’s export orders to continue to increase in the coming months due to the recovery of the US economy, reflected in the highest consumer confidence since the post-COVID-19 reopening.

Export growth driven by electronic products and Tet

VinaCapital views the strong growth of Vietnam’s exports in January 2024 as a result of nearly 60% growth compared to the same period in the exports of computers and electronic products. Global PC (personal computer) revenue decreased by 30% compared to the same period in early 2023 but rebounded at the end of last year, partly due to users upgrading to higher configured machines to handle artificial intelligence (AI). Global smartphone revenue also rebounded for the first time in 2 years at the end of 2023, although the recovery was not as pronounced in the computer segment as new products lacked attractive features to drive user upgrades. Vietnam’s smartphone exports increased by 16% compared to the same period in January 2024, thanks to the launch of the new Samsung S24 smartphone in the month.

Finally, another reason that contributed to the strong export growth in January 2024 was that this month had more than 25% more working days compared to January 2023 – due to the Lunar New Year holiday taking place from January 21-27, 2023. This simple calculation shows that exports should actually increase by 25% in January 2024 based on the calculation method based on the number of working days, so the 42% growth in exports in January is impressive even when taking into account the Tet holiday.

The economy will be driven by production and consumption activities

The manufacturing sector grew by 19.3% compared to the same period in January 2024, so export growth exceeded production growth. This means that the inventories of manufacturers decreased in the previous month (Vietnam’s PMI index in January 2024 also confirmed the decline in finished goods inventories). The combination of declining inventories and increasing new orders means that production activities in factories in Vietnam need to be intensified to meet the high demand for “Made in Vietnam” products.

Manufacturing accounts for nearly 25% of Vietnam’s GDP, so boosting production activities will drive GDP growth. In addition, nearly 10% of Vietnam’s workforce is employed by FDI companies with relatively high wages. According to the General Statistics Office, FDI companies reduced labor in early 2023, also a reason why Vietnam’s GDP only grew by 3.3% in the first quarter of 2023, but labor in the manufacturing sector recovered after last year’s slowdown. Factory labor wages also recovered by 5-7% after hitting bottom last year.

Therefore, the economy will be driven by increased production activities and higher domestic consumption this year, supported by increased employment in the manufacturing sector. Consumer confidence and domestic consumption demand, weaknesses in 2023 due to labor cuts and issues in the real estate sector, will rebound. While not expecting strong growth in consumer spending in the first quarter, VinaCapital’s Director of Analysis still expects stronger consumer spending and domestic consumption demand in the later stages of this year.

Stock market is the most attractive channel for investment in the near future

VinaCapital expects domestic investors to pour more money into the Vietnamese stock market in the first quarter and throughout this year due to three factors:

First, deposit interest rates at Vietnamese banks are near their lowest level.

Second, the broad-based economic recovery discussed above will boost corporate earnings – especially in the banking and consumer sectors.

Third, market valuations are at very attractive levels (VN-Index is trading at 10x FY24 P/E, nearly 2 times below the 5-year average P/E standard deviation and lower than the valuation of other emerging markets in the region by 25%).

In addition, the recovery of the real estate sector in Vietnam will take more time as measures to address market issues are still being implemented. Therefore, Vinacapital experts believe that the stock market is currently the most attractive channel for people to invest in the coming period.