In its newly released strategy report, SSI Securities expects a clearer economic recovery in the second half of 2024, with increased exports due to global interest rate cuts and returning consumer confidence. As 2023 benefited from measures that “delayed time” for the real estate and financial markets to return to normal, the recovery this year will help the financial system avoid major challenges.

Domestically, the main focus will still be on the recovery of the real estate sector in the context of companies needing to quickly address the legal issues of their projects and the current high mortgage lending rates. In 2024, if the legal issues of existing projects are not resolved soon, SSI Research forecasts a strong increase in M&A activities, focusing on projects with full legal status. As a result, the estimated supply source can be positively improved from the low level in 2023. Market liquidity continues to improve for the mid-market segment in major cities, while the resort real estate sector may continue to face many challenges.

Fundraising from selling projects with full legal status can provide real estate companies with additional time to resolve legal issues with their pending projects. However, the recovery will be differentiated among different segments and will require more time to fully recover. Only real estate companies with strong financial health can overcome the challenges in 2024.

Meanwhile, the non-performing loan ratio of banks may reach its peak in the third quarter of 2024 and then decrease.

Therefore, the prospects for the real estate and banking sectors may not be favorable in 2024. The expected recovery process will occur gradually, not to mention certain factors that need close monitoring, including the draft land tax currently being developed by the Ministry of Finance, which will have a significant impact on real estate demand. Other factors that need close monitoring are the geopolitical situation in the world and domestic economic recovery support policies.

The 1,300 threshold can be completely conquered

In terms of money flow, SSI Research believes that both individual and foreign investor capital flows are favorable for the stock market this year. Record-low interest rates will be the main growth driver, especially for individual investors. Deposits in banks continue to increase as other investment channels are quite limited (the price of gold has increased significantly, while the real estate and corporate bond sectors require more time to recover). Therefore, this capital flow can return to the stock market in various periods of 2024. As individual investors accounted for 92.2% of the average daily trading volume of the entire market in 2023, VN-Index is predicted to have significant jumps in 2024 thanks to this individual investor flow.

The net selling trend of foreign investors may also reverse in 2024 following the Fed’s interest rate reduction action and the opportunity for the Vietnamese stock market to be upgraded by FTSE Russell in 2024-2025. The upgrade to Emerging Market status is an event that investors have long awaited, opening up expectations that the selling pressure from foreign investors will not be as strong as in previous years.

“2024 is expected to be a year with strong fluctuations, with a strong recovery that may follow after a deep adjustment. Investors are advised to buy when the market undergoes significant corrections,” emphasized the SSI report.

SSI Research believes that the fair value for VN-Index at the end of 2024 is 1,300 points, although there may be times during the year when the market surpasses this threshold.

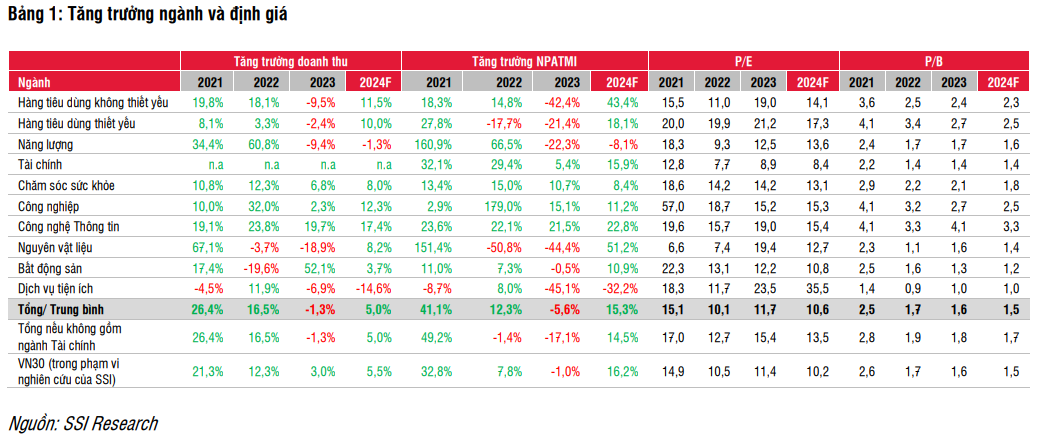

Some industries are expected to experience significant recovery (with net profit growth of more than 30% compared to the same period), including prominent sectors such as Steel, Retail, and Securities. In addition, SSI also has a positive view of the IT and IEZ Real Estate industries based on their long-term growth potential.