There have been many fluctuations due to unpredictable macroeconomic conditions, but the stock market in 2023 ended on a positive note. The VN-Index increased by 12%, reaching 1,129.93 points – a modest achievement compared to the nearly 33% drop in 2022, but the VN-Index in 2023 showed much better performance.

The market has seen a positive upward trend, and self-trading departments of securities companies have had a remarkable year. The total profits of self-trading for the whole group is estimated to reach nearly 12 trillion VND, according to statistics from VietstockFinance. The self-trading profits in 2023 are more than 6 times the previous year.

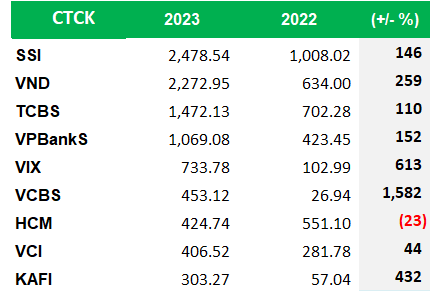

Major securities companies have all reported significant increases in their self-trading profits compared to the previous year. SSI Securities recorded a profit of nearly 2.5 trillion VND, which is 2.5 times higher than the previous year. VNDIRECT Securities (VND) recorded a profit that is more than 3.5 times higher, reaching nearly 2.3 trillion VND.

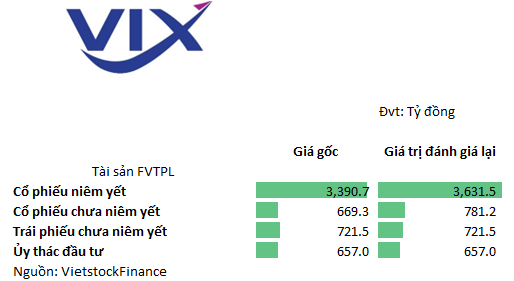

VIX Securities recorded a profit that is more than 7 times higher, amounting to 730 billion VND.

Vietcombank Securities (VCBS) achieved a self-trading profit of 453 billion VND, nearly 17 times higher than the previous year.

|

The top 10 securities companies with the highest self-trading profits in 2023

Unit: Billion VND

Source: VietstockFinance

|

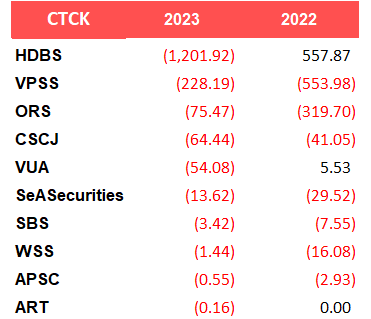

The overall picture is positive, but there are still some cases going against the trend. Notably, HD Securities incurred a self-trading loss of over 1.2 trillion VND due to high self-trading costs (up to 636 billion VND). VPS Securities incurred a loss of nearly 230 billion VND, a decrease compared to the nearly 560 billion VND loss in the previous year.

|

Securities companies with self-trading losses in 2023

Unit: Billion VND

Source: VietstockFinance

|

What does the self-trading department of each securities company hold?

After the victory in 2023, the self-trading department of the top 10 securities companies with the highest self-trading profits held which securities at the end of the year (December 31, 2023)?

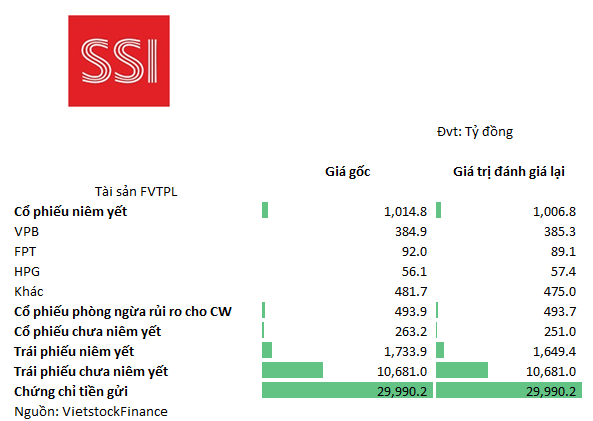

For SSI Securities, deposit certificates continue to account for a large proportion of the recorded gains/losses (FVTPL), with nearly 30 trillion VND. Non-listed bonds have the second largest proportion with a value of over 10.6 trillion VND.

Meanwhile, SSI Securities holds more than 1 trillion VND of stocks, with VPBank (VPB) being the most prominent with a value of nearly 385 billion VND.

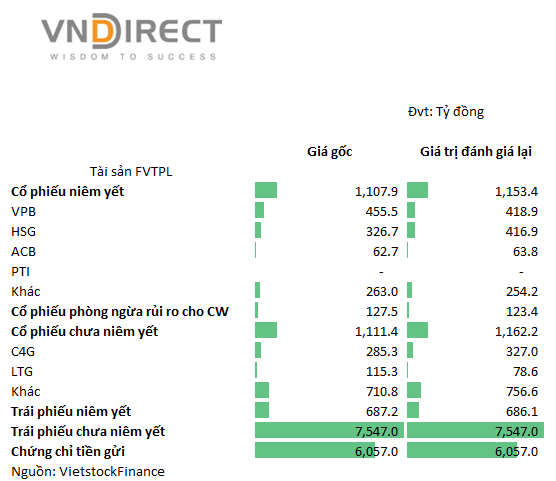

For VNDIRECT Securities (VND), non-listed bonds account for the largest proportion in the portfolio, with over 7.5 trillion VND. However, deposit certificates also have a significant value of over 6 trillion VND.

VNDIRECT Securities holds more than 1.1 trillion VND of stocks at this time. VPBank (VPB) and HSG Securities (HSG) are two prominent stocks in the portfolio. It’s worth noting that the company no longer includes PTI in the self-trading portfolio as it has been converted into a long-term investment.

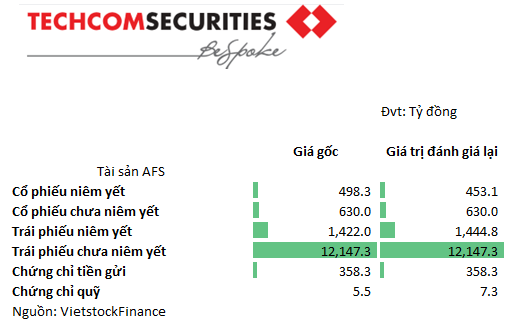

VCBS Securities records financial assets in the available-for-sale (AFS) portfolio. Among them, non-listed bonds account for over 12.1 trillion VND, accounting for 80% of the portfolio.

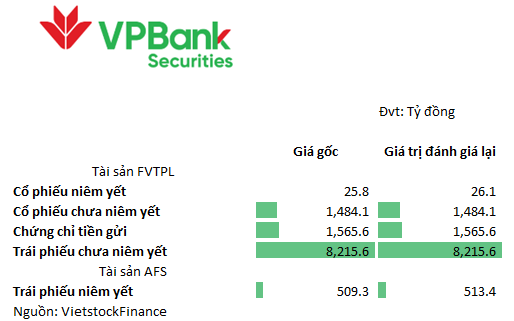

VPBank also has a significant proportion of non-listed bonds in its asset portfolio.

Contrary to the trend, VIX Securities mainly holds listed stocks. The portfolio value of the company is nearly 3.4 trillion VND, accounting for more than 62% of the FVTPL asset portfolio. The portfolio is currently profitable by more than 7%.

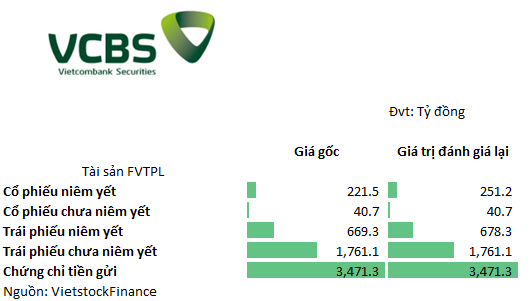

With VCBS Securities, which achieved profits that are several times higher than the previous year, the portfolio also follows the trend of holding deposit certificates and non-listed bonds.

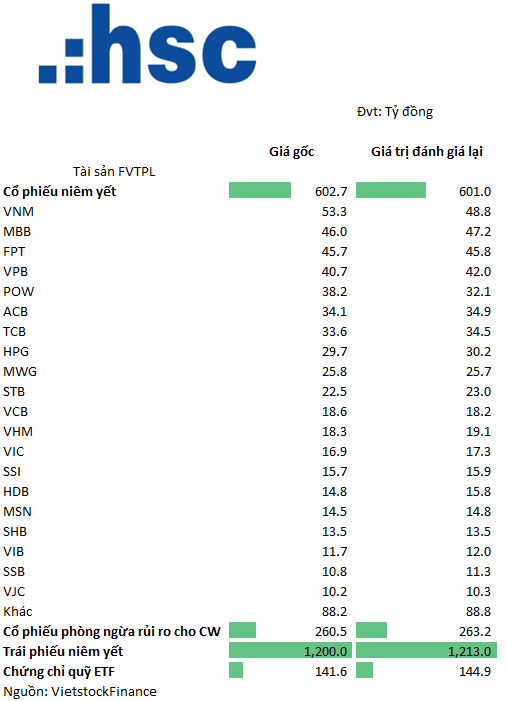

For Ho Chi Minh City Securities (HCM), the company holds 1.2 trillion VND of listed bonds and 600 billion VND of listed stocks. For stock portfolios, these are all stocks in the VN30 portfolio. The company stated that self-trading is mostly about market making for ETFs and warrant products with collateral.

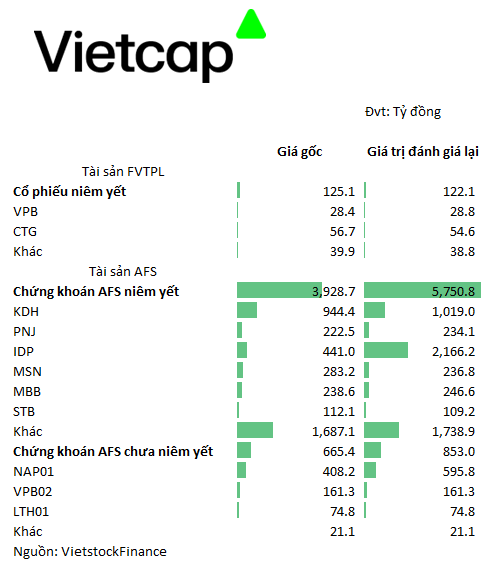

Vietcap Securities (VCI) mainly holds AFS assets. Notable investment items include KDH, PNJ, IDP, MSN, MBB… In addition, the company holds many non-listed stocks such as NAP01, VPB02, LTH01.

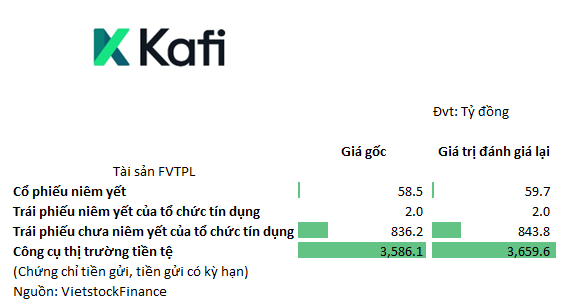

A new name in the top self-trading profits group is KAFI Securities. The company mainly holds money market instruments (deposit certificates, time deposits).

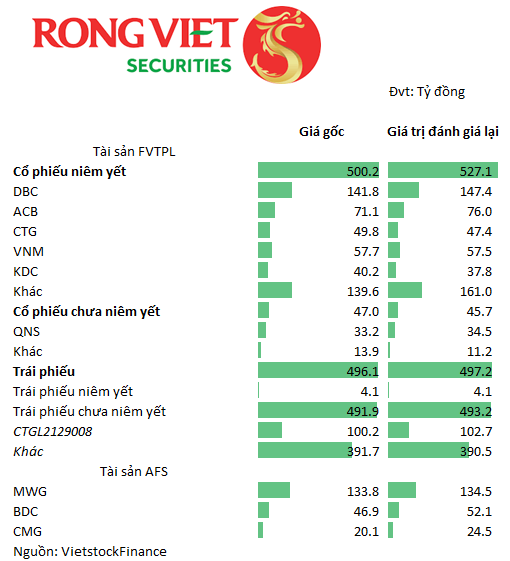

Rong Viet Securities (VDS) focuses on self-trading stocks. The listed stock portfolio of the company is profitable by 5%. BDC, ACB, CTG, VNM, KDC are the main stocks.

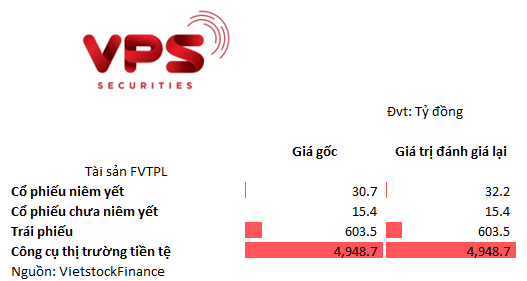

In terms of self-trading losses, VPS Securities mainly holds money market instruments and non-listed bonds.

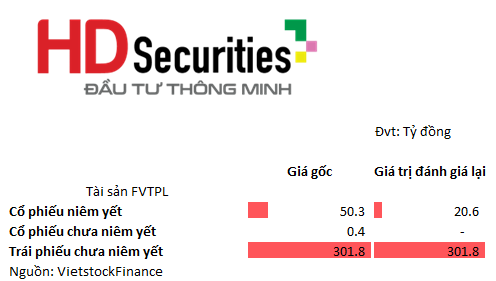

HD Securities mainly holds non-listed bonds (nearly 302 billion VND). The remaining part is mostly listed stocks. With an original price of over 50 billion VND, HD Securities incurred a loss of nearly 60%.

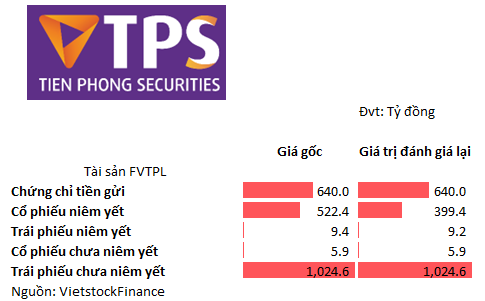

TPS Securities has the largest proportion of non-listed bonds in its portfolio, with a value of over 1 trillion VND. The stock portfolio ranks third, after deposit certificates, with a value of over 520 billion VND, recording a loss of 23%.

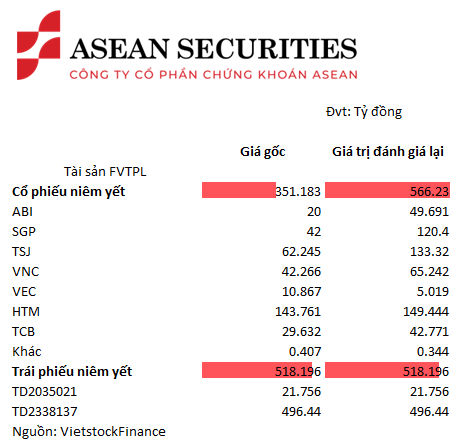

Aseansc Securities incurred self-trading losses in 2023 due to significant losses in FVTPL assets. However, the stock portfolio is currently profitable by 60% at the end of the year. The company holds several prominent stocks such as TSJ, HTM, VNC, SGP, TCB…

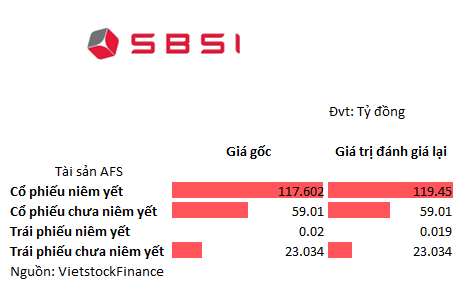

Stanley Brother Securities (SBSI) mainly holds stocks. The stock portfolio (listed and non-listed) is slightly profitable by 1% at the end of the year.

Chí Kiên