In a recent announcement, South Korean organization Ecorbit Co., Ltd. disclosed the completion of its sale of 12,000,000 BWE shares of Biwase – Binh Duong Water – Environment Joint Stock Company, exiting its position as a BWE shareholder. This sale accounted for 6.22% of the company’s capital and took place during the trading session on May 2nd.

On the same day, the market witnessed a block trade in BWE shares equivalent to the quantity sold by Ecorbit, valued at nearly VND 470 billion, corresponding to an average price of VND 39,150 per share – lower than the closing price of VND 43,000 per share on the same trading day.

Ecorbit Co., Ltd. (formerly known as TSK Corp) is a South Korean company specializing in environmental technology, offering smart environmental services such as water treatment and waste management, with a focus on natural resource recycling. This domain aligns closely with Biwase’s expertise in providing clean water, waste and wastewater treatment, and harnessing waste for clean energy production. Biwase is also one of the few Vietnamese companies on the stock exchange that fully meets ESG (Environmental, Social, and Governance) criteria.

Ecorbit Co., Ltd. entered Biwase in early November 2020, acquiring 12 million BWE shares and becoming a major shareholder. Based on the closing price of VND 25,150 per share on the same day, the estimated investment for this transaction was approximately VND 302 billion. Thus, after more than three years, the South Korean organization has exited its position, realizing an estimated profit of VND 168 billion (excluding taxes and fees), representing a 55% return on their initial investment without any active trading during their holding period. Additionally, Ecorbit would have consistently received annual dividends amounting to tens of billions of VND.

The departure of the major foreign shareholder from BWE coincides with the company’s upcoming issuance of over 27 million shares as a 14% stock dividend for 2023. In previous years, BWE consistently paid cash dividends ranging from 7% to 13%. This is the first time the water industry enterprise has opted to distribute stock dividends.

In contrast to the foreign shareholder’s exit, BWE’s leadership team has recently registered to purchase a significant number of shares by way of block trades. Specifically, CFO Tran Tan Duc registered to buy 450,000 shares, Deputy General Director Ngo Van Lui registered to buy 100,000 shares, BOD Chairman Duong Anh Thu registered to buy 50,000 shares, and Deputy General Director Mai Song Hao registered to buy 20,000 shares. These transactions are expected to take place between May 10th and June 7th, 2024.

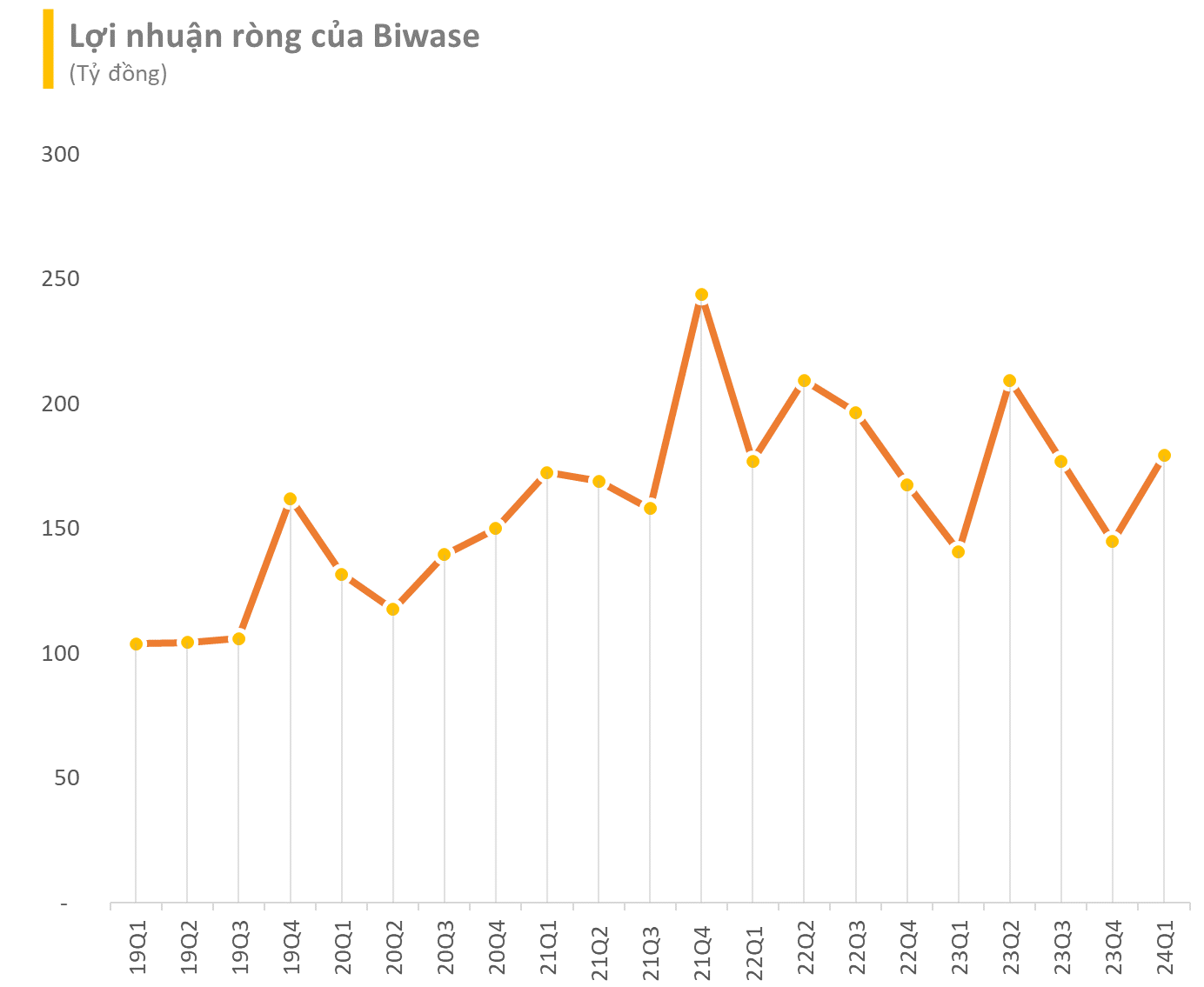

Regarding financial performance, in Q1/2024, BWE recorded net revenue of nearly VND 792 billion, a 16% increase compared to the same period last year. This growth was attributed to increased revenue from water production activities and waste treatment services, driven by an expansion in the number of customers connected to the clean water supply, as well as higher volumes of clean water, domestic waste, and industrial waste. Additionally, enhanced measures to prevent water loss resulted in a reduced water loss ratio compared to the previous period, leading to cost savings in production.

Consequently, the company reported a 25% increase in pre-tax profit, amounting to VND 198 billion. Biwase’s after-tax profit attributable to the parent company’s shareholders rose by 27% compared to the same period in 2023, reaching over VND 179 billion.