Electronic component manufacturing at Doosung Tech Viet Nam Co., Ltd. (100% Korean capital), in Luong Son Industrial Park (Hoa Binh). Photo: Danh Lam/TTXVN

In 2024, Vietnam’s GDP growth is projected to reach 6-6.5%, making Vietnam one of the strongest growth environments in Southeast Asia. According to Mr. Khanh Vu, Deputy CEO of VinaCapital investment fund, this growth will be driven by the growth factors of the entire economic sectors – from exports, manufacturing, tourism, to domestic consumption and consumer sentiment. Wages in the public sector will increase from mid-year, which is one reason why domestic spending in 2024 will be stronger than in 2023.

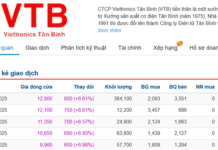

Economic growth is also supported by a favorable interest rate environment. According to Mr. Vu, the encouraging thing is that companies currently borrow to fund working capital and capital expenditure. A year ago, they borrowed at interest rates from 9-10%, but now they can borrow at interest rates of 5-7%. The deposit interest rate is decreasing faster than the lending interest rate, so the lending interest rate will probably decrease even more.

Citi economist Helmi Arman, in Manhattan-based multinational financial services company Citi, said that after being frozen in early 2023, real estate activities in Vietnam recovered in the second half of the year. The government is pushing for structural reforms to lay the foundation for a more sustainable recovery in the real estate sector. However, this will not happen immediately. By 2025, the recently passed Land Law amendments will take effect.

For international investors, Vietnam’s manufacturing sector remains the most attractive, especially the supply chains for smartphones and consumer electronics. For domestic investors, the export of textiles, footwear, and furniture is the most concerned.

The trend of many companies shifting production activities to Vietnam has brought benefits. In the direction of semiconductor production, the Vietnamese Government has a strategy to expand the scale of the entire supply chain by increasing testing and packaging capacities for semiconductor chips. The strength of the manufacturing industry is having a positive impact on export flows. Economic experts Khanh Vu and Senior Portfolio Manager at Manulife Investment Management Kenglin Tan are optimistic about some signs of stability in Vietnam’s exports.

There have been concerns that Vietnam’s decision to implement a “global minimum tax” will impact foreign investment flows, but that has not happened. According to Ms. Kenglin Tan, from the perspective of foreign investors, whether investing in Vietnam or other agreement countries such as Mexico or Thailand, they are all affected by similar policies. Foreign direct investment (FDI) flows in December 2023 demonstrated that investors were not hindered.

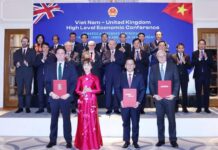

Interest in FDI is also growing. South Korea has set a goal of exceeding $100 billion in total investment by 2025. So far, the country has invested $84 billion in Vietnam, focusing on manufacturing, with $62 billion invested in over 4,600 projects, including major manufacturers such as Samsung, LG, and SK.

One major project benefiting from FDI is Long Thanh International Airport. FDI for this project comes from the US, Japan, France, Turkey, and the Netherlands.

In the tourism sector, the number of tourists coming to Vietnam has recovered to about 70% compared to pre-COVID-19 levels. Notably, domestic tourism is booming. The prospects for tourism are optimistic. According to a report from Vietnam Ratings Joint Stock Company, 66% of people surveyed in the tourism and hotel sectors expressed confidence in 2024. Among those surveyed, 93% said that new visa regulations will leverage the country’s tourism development roadmap.