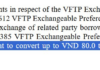

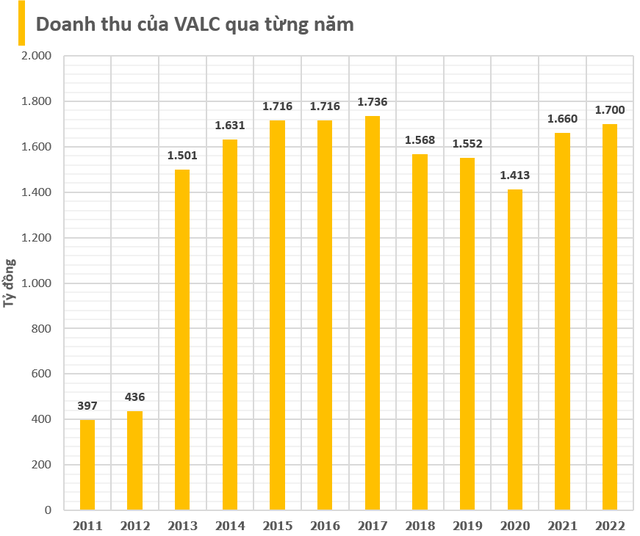

According to Vietnam Airlines’ (stock code: HVN) 2022 annual report, Vietnam Aircraft Leasing Company (VALC) recorded a revenue of 72 million USD (approximately 1,700 billion VND) and a pre-tax profit of 21.8 million USD (approximately 512 billion VND), both showing growth compared to 2021. The ROE rate is at 28%.

Based on our data, amidst the significant challenges faced by the aviation industry due to the Covid-19 pandemic, this company still managed to stay profitable while other Vietnamese airlines suffered losses. Prior to the outbreak, VALC had been consistently growing its revenue and profit year by year. However, the company faced difficulties in 2020 and 2021 before regaining its momentum in 2022.

VALC is the only Vietnamese company operating in the aircraft leasing industry in Vietnam. Besides leasing, the company also provides maintenance and spare parts for aircraft. The company follows the practice of purchasing aircraft and then leases them to national airlines for operation, and VALC itself does not carry out flights.

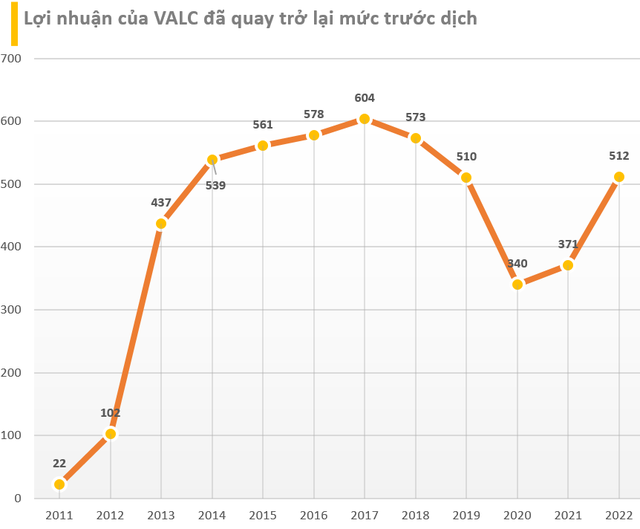

In 2007, Vietnam Investment and Development Bank (BIDV) and Vietnam Airlines – Vietnam Airlines Corporation decided to establish an aircraft leasing company in Vietnam named VALC.

At the time of its establishment, the representative of the founding shareholders, Mr. Tran Bac Ha – former CEO of BIDV, stated that the idea of establishing an aircraft leasing company had been reported to the Government by BIDV in April 2007 and quickly designated by the Prime Minister as one of the key projects to focus on. BIDV and Vietnam Airlines, along with other shareholders, took nearly 6 months to complete the preparation work. By September 2007, with a charter capital of 640 billion VND, the company was approved by the Government for establishment.

By 2017, the company had the participation of private shareholders. The current charter capital of the company is 1,520 billion VND. The state-owned shareholders still hold the majority, with Vietnam Airlines, BIDV, and PVComBank collectively owning 63.38% of the capital. Eurowindows, through its subsidiary Mê Linh Supermarket Joint Stock Company, also invested in VALC.

At the beginning of 2023, VALC attracted attention when auctioning an ATR 72-500 aircraft with production number 925 (MSN 925) for a starting price of 136.6 billion VND. It is worth noting that this is the 9th time VALC has auctioned the ATR 72-500 MSN 925 aircraft. In 2016, the company announced the auction of 5 ATR 72-500 aircraft, of which the ATR 72-500 MSN 925 was auctioned with a starting price of 215 billion VND (equivalent to 9.62 million USD at the exchange rate of 22,340 VND/USD).