SSI Research has just released an updated report on the prospects of the steel industry, with a focus on the potential recovery in demand by 2024, especially in the domestic market.

It is expected that the total steel consumption will recover by more than 6% compared to the same period in 2024, with domestic consumption seeing a growth of nearly 7%. The domestic market has shown initial signs of recovery by the end of 2023, with a 13% increase in consumption from September to November compared to the same period after a 20% decline in 8T2023. Steel consumption in 2024 will be supported by macroeconomic conditions and a booming real estate market. In the previous cycle, construction steel consumption in 2013 increased by about 3% compared to the bottom in 2012.

Export volume can maintain growth thanks to positive global demand prospects: According to the World Steel Association, global steel demand is expected to increase by 1.9% in 2024 compared to 1.8% in 2023. Demand from developed economies is expected to increase by 2.8% in 2024 after a 1.8% decline in 2023, with the demand from the US and Europe increasing by 5.8% and 1.6% respectively after a 5.1% and 1.1% decline in 2022.

On the other hand, demand from ASEAN countries (excluding Vietnam) is expected to increase by 5.2% in 2024, higher than the 3.8% in 2023.

Expectations are that export production will improve in the first quarter, due to the increasing price gap between steel in North America and Europe compared to steel in Vietnam. In addition, Europe’s stricter control over the import of finished steel products produced by Russia in 2024 will also support Vietnam’s steel exports to Europe (Europe imported more than 1.9 million tons of finished steel products from Russia in 7T2023).

In 2023, Vietnam’s steel exports showed very good competitiveness in the context of strong steel exports from China. China exported 83.5 million tons of steel in the first 11 months of 2023, an increase of 34.5%, the highest level in many years.

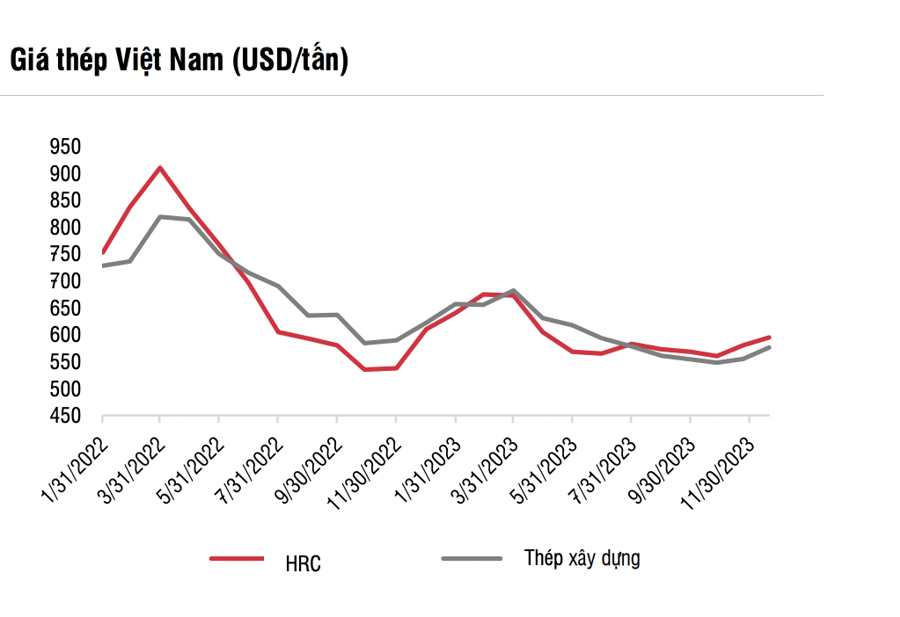

Steel prices may have bottomed out and improved in 2024 due to a more balanced supply and demand: China’s steel production in 11T2023 increased by 1.5% to 952 million tons. However, in terms of monthly basis, China’s steel production has almost continuously decreased from the peak of 95.7 million tons in March to 76.1 million tons in November due to weak demand and high raw material costs, while the profit margins of steel companies have fallen to a low level.

China’s production decline has also led to a global production decrease from 165 million tons in March to 145.5 million tons in November. Steel inventories in China have significantly decreased in recent months, helping to reduce the global excess supply pressure in the near future.

Therefore, steel prices may have bottomed out and will recover in the coming time. However, SSI Research does not expect steel prices to increase significantly as overall demand will still be affected by weak demand in China due to the sluggish real estate market. On the other hand, the increase in steel prices compared to input costs could stimulate production activities in China to rebound.

The profits of steel companies will achieve high growth rates in 2024 from the low base in 2023 thanks to improved consumption, especially HPG and HSG, and gross profit margins will increase from the low level in recent years. The profit growth may be higher in the first half of 2024 due to the low base profit in the first half of 2023. The recovery trend may be maintained after 2024, although consumption demand and profit margins are still subject to fluctuations, so steel stocks are suitable for investors with a higher risk tolerance.

The current stock prices have been priced at a high level, partly reflecting the 1-year profit prospects of the industry, with a projected P/E ratio ranging from 15x-17x, exceeding the historical average of about 10x. Steel stocks are often priced high at the bottom of profitability. In addition, steel stocks have also been favored in recent years as they are considered stocks with a high beta coefficient.