Race to set a record at the bottom

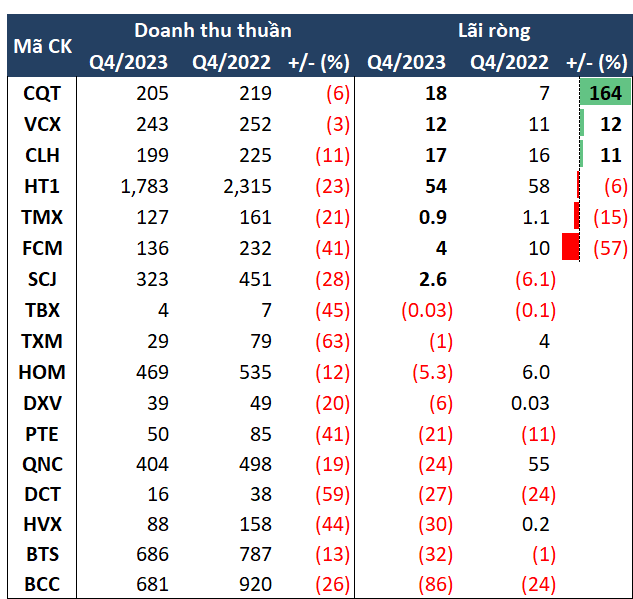

According to VietstockFinance, out of the 17 cement companies listed on the stock exchange that have announced their fourth quarter 2023 financial statements, only 3 companies reported an increase in profits and 1 company reported a loss transferred into profit. The remaining 13 companies (accounting for 76%) had unfavorable business results, including 3 companies with decreased profits, 5 companies with profit transferred into loss, and 5 companies that continued to make losses.

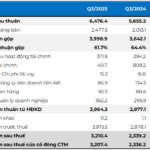

The total revenue of the industry in the fourth quarter decreased by 22% compared to the same period, reaching 5,484 billion VND. All 17 companies reported a decrease in revenue. The net profit result was negative 124 billion VND, compared to a profit of 100 billion VND in the same period.

Source: VietstockFinance

|

2023 may be the saddest year for Bim Son Cement (HNX: BCC) as it recorded a record loss of nearly 194 billion VND, compared to a profit of 69 billion VND in the same period. Specifically, in the fourth quarter, BCC recorded a loss of nearly 86 billion VND (accounting for 44% of the total loss in 2023).

Net profit of BCC from 2006 – 2023

VICEM But Son Cement (HNX: BTS) continues to face difficulties as it reported a loss of over 32 billion VND in the fourth quarter of 2023. This is the 5th consecutive quarter of losses for the company, starting from the fourth quarter of 2022.

BTS stated that its sales volume in the fourth quarter of 2023 decreased by nearly 69 thousand tons compared to the same period, resulting in a decrease in the company’s profit.

With no profit in all 4 quarters, accumulated losses for the year 2023, BTS reported a loss of over 96 billion VND, compared to a profit of nearly 54 billion VND in the same period. This is also the company’s worst business result since 2014.

| Net profit of BTS from 2014 – 2023 |

Following 2 consecutive quarters of losses, VICEM Hai Van Cement (HOSE: HVX) continued to report a loss of nearly 30 billion VND in the fourth quarter of 2023, compared to a profit of nearly 250 million VND in the same period. This is the worst quarterly result for HVX since its listing on HOSE in 2010.

VICEM Hai Van Cement stated that due to low demand for cement in the central and central highlands regions in the fourth quarter of 2023, total revenue only reached 56% of the same period.

For the entire year 2023, VICEM Hai Van Cement generated revenue of 512 billion VND, a decrease of 32%, and a loss of over 64 billion VND, compared to a profit of nearly 2 billion VND in the same period. With these results, 2023 became the year with the heaviest losses for HVX since 2010.

| Net profit of HVX from 2010 – 2023 |

Similarly, VICEM Hoang Mai Cement (HNX: HOM) also reported a loss of over 5 billion VND in the fourth quarter of 2023, compared to a profit of over 6 billion VND in the same period. This is the 2nd consecutive quarter of losses for HOM (over 26 billion VND loss in the third quarter of 2023).

HOM stated that the selling price of domestic and export cement in the period decreased by 72 thousand VND/ton and 113 thousand VND/ton, respectively, compared to the same period. In addition, the selling price of clinker also decreased by 135 thousand VND/ton. Along with that, electricity prices increased twice in 2023 (3% increase on May 4 and 4.5% increase on November 9), further narrowing the profit margin for HOM.

For the entire year 2023, HOM recorded revenue of over 1,738 billion VND, a decrease of 16%, and a loss of over 31 billion VND (compared to a profit of over 21 billion VND in the same period). These results make 2023 the worst year for HOM since its listing on HNX in 2009.

| Net profit of HOM from 2009 – 2023 |

Bright spot in a field of red flowers

Although the net revenue of the fourth quarter of 2023 reached nearly 205 billion VND, a decrease of 6% compared to the same period, VVMI Quan Trieu Cement (UPCoM: CQT) achieved a profit of nearly 18 billion VND, an increase of 2.6 times compared to the same period. With this result, CQT is the company with the highest profit growth in the industry in the fourth quarter.

However, for the entire year 2023, CQT only achieved revenue of 618 billion VND and net profit of nearly 28 billion VND, a decrease of 14% and 42% respectively.

Following closely is Yen Binh Cement (UPCoM: VCX) with a profit of over 12 billion VND, an increase of 12% compared to the same period, thanks to nearly 16 billion VND generated from other income (penalties for contract violations).

In the fourth quarter, although revenue decreased by 11%, the net profit of La Hien VVMI Cement (HNX: CLH) still increased by 11%, reaching over 17 billion VND, thanks to a decrease in cost of goods sold. For the entire year, CLH generated revenue of over 659 billion VND and net profit of over 47 billion VND, a decrease of 19% and 16% respectively compared to the previous year.

|

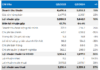

Fourth quarter 2023 financial results of cement companies

Unit: Billion VND

Source: VietstockFinance

|

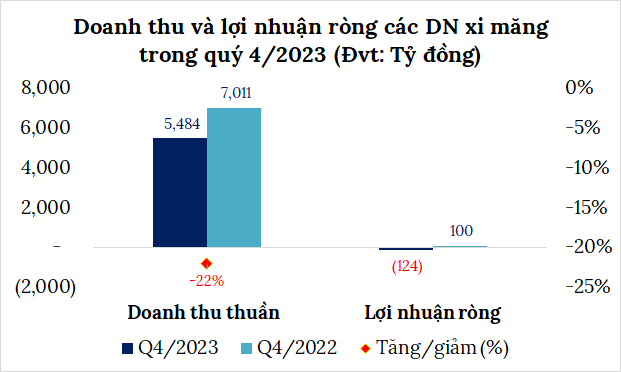

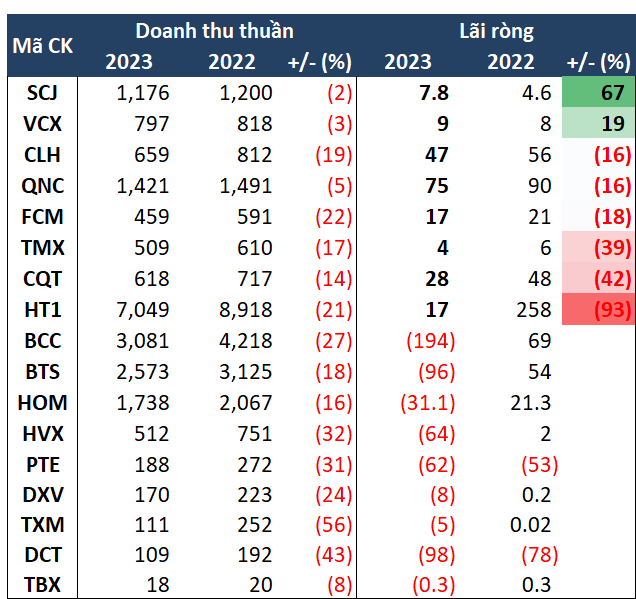

Cement companies with trillion VND revenue in 2023

According to VietstockFinance, the total revenue of the 17 cement companies in 2023 reached 21,190 billion VND, a decrease of 19% compared to the same period in 2022. The final result was disappointing with a loss of 353 billion VND, while the previous year recorded a profit of 506 billion VND.

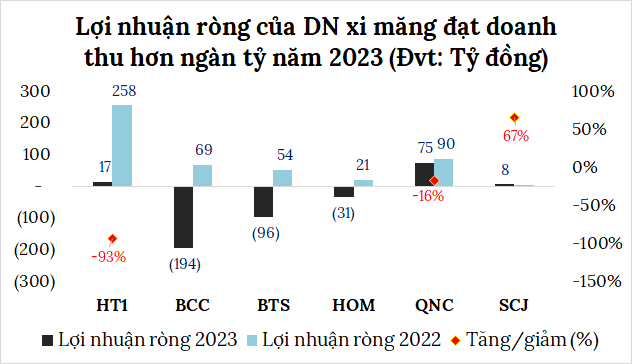

Only 6 out of the 17 cement companies achieved revenue of over 1 trillion VND in 2023, including Vicem Ha Tien Cement (HOSE: HT1), BCC, BTS, HOM, Quang Ninh Cement and Construction (UPCoM: QNC), and Sai Son Cement (UPCoM: SCJ), with a total revenue of 17,040 billion VND, accounting for 80%.

Source: VietstockFinance

|

Despite achieving trillion VND revenue, these 6 companies incurred losses of up to 221 billion VND (accounting for 63% of the total losses in the industry). Notably, BCC suffered the heaviest losses with nearly 194 billion VND, accounting for over half of the industry’s total losses.

Source: VietstockFinance

|

Major player HT1 also faced a difficult fourth quarter as its revenue for the whole year of 2023 reached 7,049 billion VND, a decrease of 21%, and net profit of only 17 billion VND, a sharp decline of 93%.

Compared to the set targets, HT1 only achieved 78% of its revenue target and 6% of its net profit target. 2023 is also the company’s worst year since 2014.

|

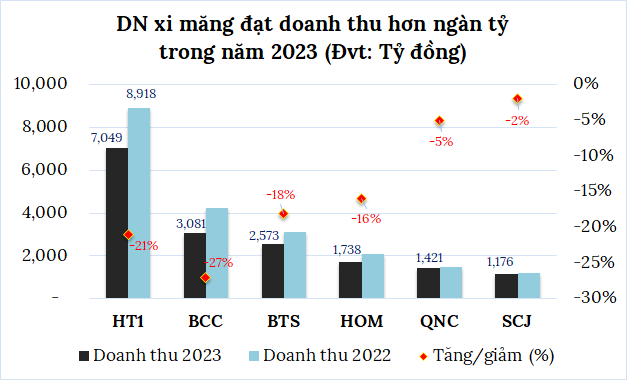

Financial results for 2023 of cement companies

Unit: Billion VND

Source: VietstockFinance

|

Which path for the cement industry in 2024?

Le Nam Khanh – General Director of VICEM – stated that 2023 was an extremely challenging year, affected by the global situation and the real estate market that has not shown signs of recovery, with cement supply exceeding demand; the price of raw materials and fuel for cement production remained high.

Along with that, domestic and export cement consumption declined, inventories increased, and some factories had to reduce production or shut down to limit clinker dumping, thus reducing the efficiency of production and business. The shift in demand from bagged cement to bulk cement also reduced the effectiveness of VICEM’s production and business activities due to the brand value associated with bagged cement.

According to data from the General Department of Customs, in 2023, the cement industry exported more than 31.3 million tons of clinker and cement, equivalent to over 1.32 billion USD, a decrease of more than 1% in volume and over 4% in value compared to 2022.

In the cement industry’s outlook report for 2024, SSI Research forecasts that cement consumption in the domestic market will be low (hitting bottom) in the first quarter of 2024, due to both the Lunar New Year holiday and weak demand. However, from the second quarter of 2024, cement sales are expected to improve compared to the same period, thanks to the recovery of construction activities.

In addition, large-scale infrastructure investment projects such as Long Thanh Airport and expressway projects in the central and southern regions may compensate for the weak demand in 2024.

Growth in the export market is somewhat limited as China reduces its cement imports from Vietnam. In 2023, cement and clinker exports remained relatively steady (down 1% compared to the same period) due to China reducing imports by 90% due to weak demand in the real estate market.

On the other hand, Bangladesh is a growing market as cement and clinker exports to this country increased by 40% thanks to increased investment in infrastructure.

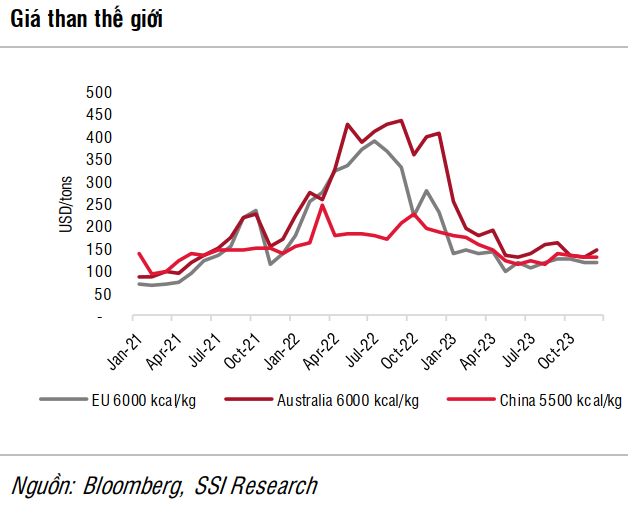

According to SSI Research, in the fourth quarter of 2023, the average coal price in Europe decreased by more than half compared to the same period, reaching 120 USD/ton; the coal price in Australia decreased by 65%, reaching 136 USD/ton; the coal price in China decreased by 35% to 123 USD/ton.

In the first half of 2024, SSI Research believes that coal prices will remain stable as it approaches winter in the northern hemisphere (and sanctions against Russia remain in effect), helping to balance the pressure from the decline in oil and gas prices. Therefore, the average input cost of coal for cement production companies is expected to decrease in 2024, as the high base price was established in the first half of 2023. As a result, the gross profit margin of cement production companies is expected to reach its lowest point in the first quarter of 2024 and then improve in the following quarters.

Thanh Tu

Thanh Tu