Hoang Anh Gia Lai International Agricultural Joint Stock Company (HAGL Agrico – Code: HAG) recently announced that the company’s shareholders have approved a large-scale investment project in fruit cultivation combined with cattle farming in Attapeu province and Sekong province, Lao PDR.

The project is invested by HNG and the project is implemented by Nam Lao Agriculture Investment and Production Business Company Limited – a subsidiary 100% owned by HAGL Agrico. It is worth noting that Nam Lao Agriculture Investment and Production Business Company Limited was just approved for establishment at the end of December 2023, following the plan to merge Attapeu Agricultural Development Limited Company and Quang Minh Industrial and Agricultural Company Limited. Nam Lao Agriculture Investment and Production Business Company Limited has a charter capital of 8,300 billion kip (equivalent to 400 million USD).

The project aims to cultivate fruit trees (banana, mango, pomelo, durian), combined with cattle farming (grazing and fattening beef cattle), fruit processing, fiber production, production of organic microorganism fertilizer, and biological plant protection.

The project’s total area is 27,384 ha with a total investment of 18,090 billion VND. Of which, HAGL Agrico’s own capital is 9,650 billion VND, and the remaining capital of 8,440 billion VND will be borrowed.

HNG will contribute all 9,650 billion VND of equity capital to implement the project through contributing capital to Nam Lao Agriculture Investment and Production Business Company Limited. The remaining borrowed capital of 8,440 billion VND will be raised from domestic and foreign banks and credit institutions according to legal regulations.

According to the financial report of the fourth quarter of 2023, as of December 31, 2023, HNG had nearly 76 million in cash and deposits in banks.

The investment project will be completed from 2024 to 2028.

After completing the investment phase, the project is expected to have an economic effectiveness with an estimated annual export volume of fresh fruits of 624,000 tons (Banana: 500,000 tons/year; Pineapple: 80,000 tons/year; Mango: 18,500 tons/year; Pomelo: 16,000 tons/year; Durian: 9,500 tons/year). The processed fruit export volume is 25,000 tons/year.

The number of seed cattle provided to the local area is 12,000 heads/year. The export volume of beef is 17,000 tons/year.

The expected revenue is 13,500 billion VND/year (equivalent to 550 million USD/year) and the expected profit is 2,450 billion VND/year (equivalent to 100 million USD/year). The expected profit margin is 18%.

The project’s operating period is 50 years.

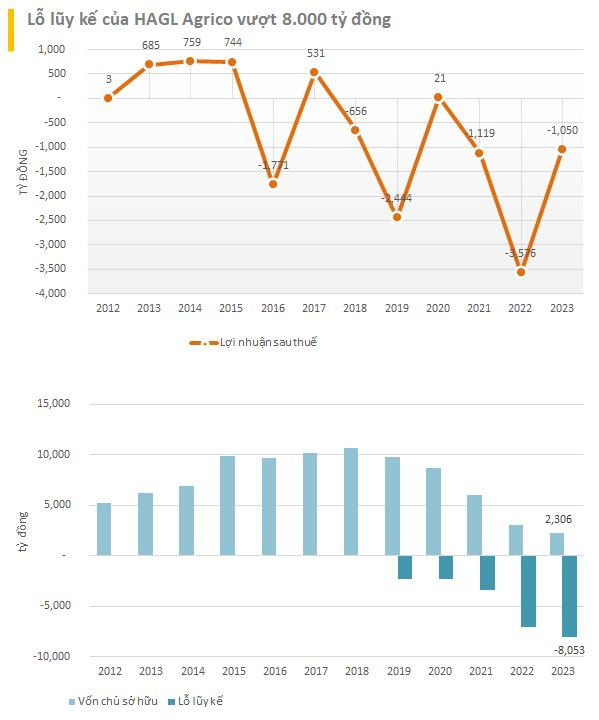

In 2023, HNG recorded a revenue of 605.5 billion, a decrease of 18%. Deducting costs, HNG had a net loss of over 1,050 billion VND.

Therefore, HNG has been incurring losses continuously for 3 years. In 2021 and 2022, the company’s losses were 1,119 billion and 3,576.5 billion respectively. The accumulated loss of HAGL Agrico has exceeded 8,000 billion VND and the company’s equity at the end of 2023 continued to decrease to 2,300 billion VND.

According to current regulations, enterprises are required to delist when they have been incurring losses for 03 consecutive years or the total losses exceed the contributed charter capital or the equity is negative in the most recent audited financial statements. HNG is in the first case.