The Lang Son Provincial Customs Department has reported to the General Department of Customs a list of businesses that are under forced execution for unpaid taxes, late payment, administrative fines, and late payment fines as of January 31, 2024, as requested in the Official Letter No. 1862/TCHQ-TXNK dated April 1, 2019, from the General Department of Customs.

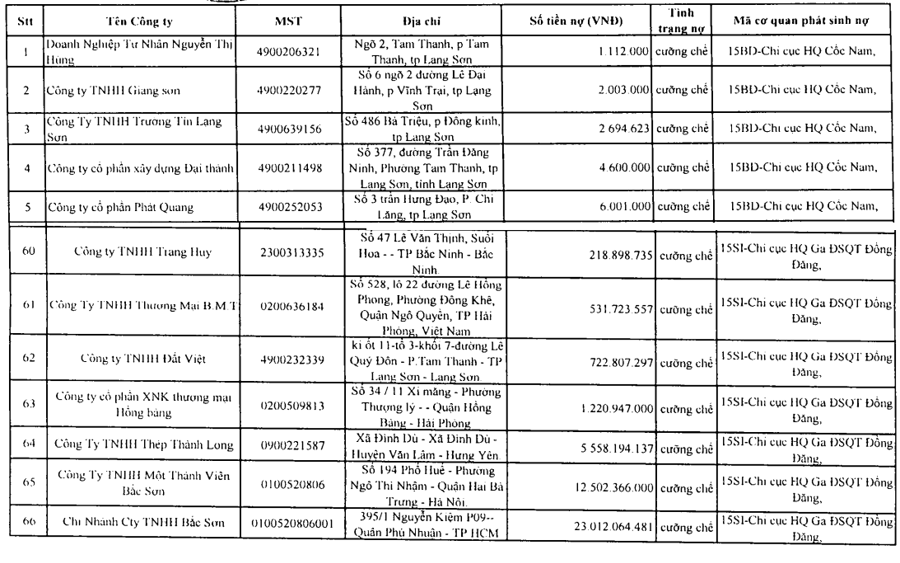

In the list released by the Lang Son Provincial Customs Department, there are 417 businesses with tax debts totaling nearly 175 billion VND. Among them, there are some large businesses with tax debts such as the Branch of Bac Son Co., Ltd. (395/1 Nguyen Kiem, Ward 09, Phu Nhuan District, Ho Chi Minh City with tax code 0100520806-001), owing 23 billion VND; Bac Son Member Limited Company (194 Hue Street, Ngo Thi Nham Ward, Hai Ba Trung District, Hanoi), owing about 12.5 billion VND.

Bac Son Co., Ltd. has had overdue tax debts for many years. The police have initiated a criminal case, investigating the intentional violation of state regulations on economic management and taxes at this company, including the branch in Ho Chi Minh City, for fabricating the domestication ratio and embezzling tax money.

In addition, on this list, Duc Tra Co., Ltd. (161 Dang Van Nyu, Hanoi) owes nearly 8.5 billion VND in taxes; Viet Hoa Paper Joint Stock Company (No. 1 in Group 37, Cluster 5, Alley 124/55, Au Co Street, Tu Lien Ward, Tay Ho District, Hanoi) owes more than 12 billion VND in taxes; Trang Huy Co., Ltd. (47 Le Van Thinh, Suoi Hoa, Bac Ninh City) owes 5.6 billion VND, etc.

The amount of tax recovery and handling in the first 11 months of 2023 by the Lang Son Provincial Customs Department is 15 billion VND.

Recently, the Huu Nghi Border Gate Customs Division – Lang Son Provincial Customs Department has issued many decisions to enforce the implementation of administrative decisions on tax management by deducting money from accounts, requesting the freezing of accounts of the enforced subjects at the State Treasury, and credit institutions for many businesses such as Son Lam Pharmaceutical Joint Stock Company, Dai Thanh Trading and Transport Co., Ltd… due to long-standing tax debts.

Currently, cases of outstanding export and import tax arrears in the management area of the Lang Son Provincial Customs Department have mostly ceased operations, declared bankruptcy, or the legal representative of the tax debtor is no longer at the previously registered business address, or the company’s leaders are involved in legal proceedings. In addition, some businesses are still operating under the pretext of difficulties in business activities to evade tax debt repayment.

In recent times, the Lang Son Provincial Customs Department has implemented many measures to enforce tax debt collection to reduce the tax debt to the lowest level. In addition to the regulations, the unit actively proposes the coordination of functional agencies to enforce tax enforcement against tax debtors.

One of the stronger measures being implemented by the customs sector and the Lang Son Provincial Customs Department against tax debtors is the temporary ban on exit for the legal representative of the business. This tax enforcement measure has yielded certain results. However, the recovery results have not met expectations, and the customs sub-departments at the border gates in the province are currently facing difficulties in recovering overdue export and import tax debts.

In 2024, the Lang Son Provincial Customs Department is assigned the task of collecting the state budget from import and export activities amounting to 5,000 billion VND. To fulfill this task, the unit has issued a plan to implement key solutions for state budget revenue in 2024 from the beginning of the year, synchronously implementing solutions for state budget revenue by strengthening administrative procedure reforms, modernizing customs operations, and reducing customs clearance time.

At the same time, the Lang Son Customs Department also aims to effectively implement measures to prevent revenue loss, focusing on reviewing, inspecting, and detecting violations in the field of goods classification, determining value, origin of goods, thereby implementing tax collection measures and determining taxes to contribute to revenue increase. In addition, it will fight against smuggling and trade fraud, proactively review, classify, recover, and handle tax arrears arising before January 1, 2024, and prevent the occurrence of new arrears through inspection and examination work.