Illustration

On February 21, foreign investors continued to make active transactions in Maritime Bank (MSB) shares of Vietnam Maritime Commercial Joint Stock Bank. Specifically, foreign investors bought over 31.2 million MSB shares while only selling 667,000 units, equivalent to a net purchase of nearly 30.5 million shares with a value of VND 477 billion.

From the Lunar New Year to now (February 15-21), foreign investors have net bought over 55.3 million MSB shares, with a value of over VND 856 billion.

The strong buying activity of foreign investors began on February 15, after the “foreign room” of MSB unexpectedly opened up tens of millions of shares since the previous week.

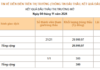

Specifically, according to data from Vietnam Securities Depository and Clearing Corporation, at the beginning of the session on February 7, 2024, the number of securities held by foreign investors in MSB (foreign room) was 599.8 million shares, corresponding to a ownership ratio of 29.99%, nearly reaching the foreign room limit according to the regulations of the State Bank of Vietnam (30% – equivalent to 600 million shares). However, after the Lunar New Year holiday (February 8-14), by the beginning of the session on February 15, the foreign room of the bank decreased to 27.09% corresponding to the number of shares held by foreign investors being 541.8 million shares. Thus, the number of shares held by foreign investors further increased by 58.2 million shares.

The ownership ratio of foreign investors in MSB unexpectedly decreased by nearly 3% after the Lunar New Year holiday, although previously, the trading data from Ho Chi Minh City Stock Exchange did not record any strong selling activity from this group. During the first 5 trading sessions of February (February 1-7), the foreign trading value was also very low, with not more than VND 4 billion per session.

This development also caused surprise because for many years, the ownership ratio of foreign investors in MSB has always been recorded below 30%, continuously “closing” the foreign room until there was a big change from February 15 as mentioned above.

After continuously buying more than 55.3 million shares from February 15 until now, foreign investors currently own over 597.1 million MSB shares, equivalent to a ratio of 29.86%. Thus, the number of MSB shares that foreign investors are allowed to hold is less than 3 million shares.

Accompanying this development, the share price of MSB has also continuously increased since the beginning of February. From February 2 until now, MSB has not recorded any trading session closing in the red. At the end of February 21, MSB’s share price was at VND 15,850 per share, up 16.5% compared to the end of January.

MSB’s liquidity has also significantly increased recently. Especially in the session on February 15 when the foreign room was unexpectedly opened, MSB witnessed a record trading value of VND 524 billion.

Currently, MSB is a mid-sized bank with a charter capital of VND 20,000 billion, listed on the Ho Chi Minh City Stock Exchange (HoSE). The bank’s market capitalization reaches over VND 31,000 billion. The bank has a major shareholder owning over 5% which is Vietnam Posts and Telecommunications Group, owning nearly 121 million shares, equivalent to a ratio of 6.05%.