The personal customer segment at some banks is still growing but at a slower pace than last year. Photo: LÊ VŨ |

In Q4 2023, Vietnam’s banking system witnessed a record growth in the amount of deposits, with deposit growth in Q4 equal to the sum of all previous quarters combined. Deposit growth is usually attributed to increased income of the people and effective business operations of organizations, however, given the difficult economic conditions in recent times, this explanation seems unconvincing.

So where did these deposits come from and who deposited such large amounts into the banking system in Q4 2023? By examining the financial reports recently released by banks before Tet, we can find the answer to this question.

When examining the relationship between deposits and loans, an interesting observation is that the growth of both of these figures usually occurs in sync with each other, meaning that deposit growth and loan growth often go hand in hand to maintain the balance sheet of the entire banking system. When the Government requires commercial banks to accelerate the disbursement of credit to support economic growth in the past year, the influx of deposits into the system also surged.

Loans can also generate deposits

When there are more deposits in the banking system, it also means an increase in the money supply in the economy. Money is simply a tool that can be used to facilitate transactions. The commercial banking system has effectively become a massive “money-printing machine” through deposit-taking and lending activities for the entire economy. In the context of Vietnam’s economy, which is almost entirely dependent on capital from the banking system, this becomes particularly true.

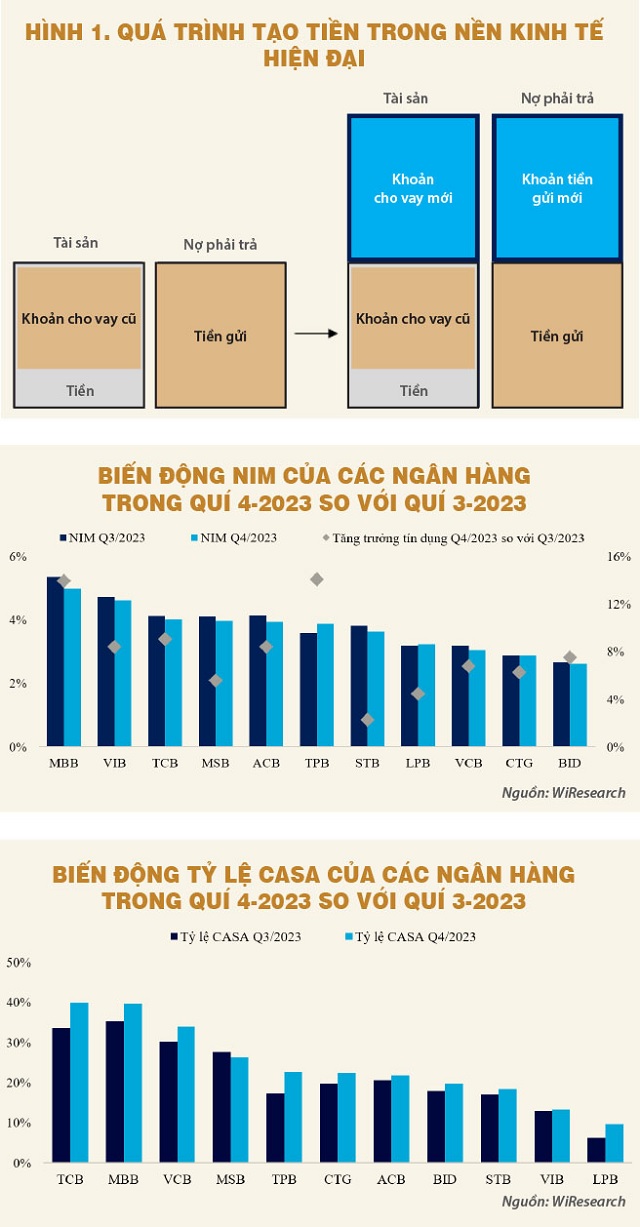

Figure 1 illustrates how new loans from commercial banks can also generate new deposits. When a new loan is disbursed, it will be used to pay a supplier of the borrower, who also has a bank account. The money is still within the banking system and causes the overall size of the balance sheet of the entire banking system to increase accordingly. Therefore, loans can still generate deposits, and the increase in credit disbursement by banks can create a corresponding amount of deposits.

In normal economic conditions, this is nothing to talk about. However, in the context of the past quarter, we must understand the pressure on credit disbursement by commercial banks is significant because it could affect the credit growth target for the following year. Meanwhile, finding financially capable borrowers to repay their debts in difficult economic conditions is also a challenge.

Credit outstanding has also increased sharply in just the last 1-2 months, and to assess whether the credit lending activity of the banks is truly effective or not, we can look at the following two perspectives from the financial reports of the banks.

NIM decreased sharply and CASA increased significantly in most banks

Most banks saw a sharp decrease in NIM in the fourth quarter. The push for credit has put great pressure on the profitability of the banks’ loans. The disbursement of credit in a series, but still having to manage the risks, can lead to some banks using “tricks” to create loans that are actually circulating within the banking system rather than being pumped into real economic activities. The higher the credit growth rate in the fourth quarter, the more significant the decrease in NIM. Loans disbursed in the past can provide very low profitability for the banks.

Alongside the decrease in NIM is the significant increase in the CASA ratio of commercial banks. CASA refers to non-term deposits that individuals and organizations deposit in commercial banks, usually for payment services. Data from listed commercial banks shows that the CASA ratio of the commercial banking system is estimated to have increased from 19.31% in Q3 to 21.87% in Q4 2023. This is a remarkable growth rate in a short period of time. The CASA ratio has grown the strongest in banks with a high corporate loan-to-deposit ratio, especially in ecosystem-based businesses.

In the context of the still difficult economy, alongside the significant increase in CASA, we can consider this as a phenomenon. This can be explained by when a commercial bank disburses a loan to a business customer and the business pays suppliers who also have accounts within the same banking system, then the money is again in the banking system, creating new non-term deposits for the initial lending bank.

Another point to note is that the bad debts of the entire banking system also decreased significantly in Q4 2023, despite the challenging economic conditions. Based on the financial reports of listed banks, the bad debts from the banking system decreased sharply from 2.24% at the end of Q3 to 1.93% at the end of Q4 2023. The growth of credit may have contributed to the refinancing of some businesses or related ecosystems, allowing previously bad debts to be paid off, thereby reducing the overall bad debt ratio of the entire system.

Loans create deposits, as we have seen recently, also partly indicates that the economy is facing difficulties, as evidenced by the flow of funds within the banking system.

In 2024, banks in Vietnam face the challenge not only of achieving the target for disbursing new credit but also of effectively managing the outstanding credit accumulated from the previous year, which is currently generating excess liquidity in the system. This may be the reason why we have recently seen information related to the low credit growth in January 2024 and the State Bank of Vietnam continues to urge commercial banks to increase lending to support capital sources for the economy.

Lê Hoài Ân (CFA)