The market liquidity increased sharply compared to the previous trading session, with the trading volume of VN-Index reaching nearly 1.246 million shares, equivalent to a value of over VND 28 trillion; HNX-Index reached over 121 million shares, equivalent to a value of over VND 2.1 trillion.

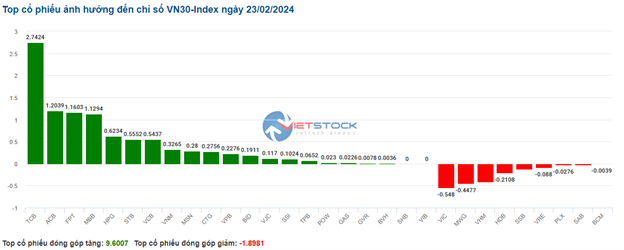

VN-Index opened the afternoon session with a very optimistic atmosphere, continuing the upward momentum of the morning session, then unexpected selling pressure appeared, causing the index to decline and close at the lowest level of the day. In terms of impact, VIC, VHM, GAS, and VCB were the most negative stocks, deducting more than 5.4 points from the index. On the other hand, BID was the most positive stock, contributing to a 3.3-point increase to VN-Index.

| Top 10 stocks with the most impact on VN-Index (measured in points) |

HNX-Index also had a similar trend, with the index being negatively impacted by stocks such as DXP (-6.04%), DTD (-4.17%), NRC (-3.77%), DDG (-3.64%),…

|

Source: Vietstock Finance

|

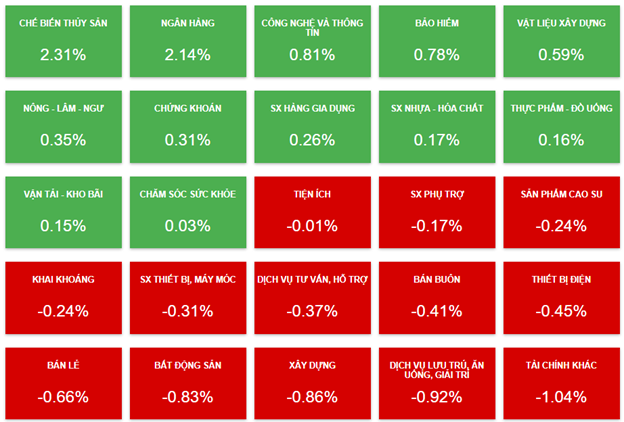

The agriculture-forestry-fishery sector had the sharpest decline in the market with -3.61%, mainly due to stocks such as HAG (-3.17%), VIF (-9.38%), and HNG (-1.85%). Following that were the other financial sector and real estate sector with declines of 3.43% and 3.25% respectively. On the other hand, the seafood processing industry showed the strongest recovery with 0.62%, mainly driven by stocks such as VHC (+0.62%), FMC (+1.09%), and IDI (+1.28%).

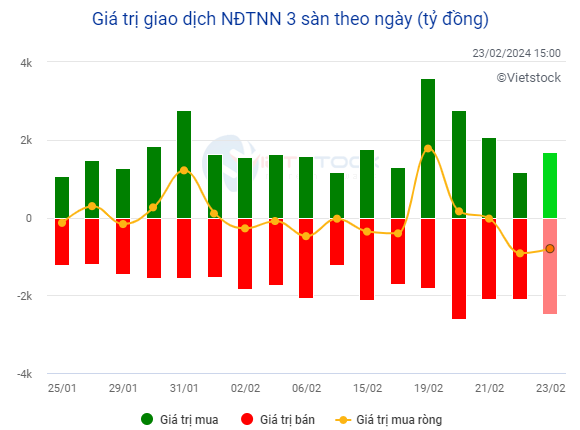

In terms of foreign trading, this group continued to be net sellers with over VND 779 billion on HOSE, focusing on stocks such as VPB (VND 195.87 billion), MWG (VND 183.4 billion), VIX (VND 140.9 billion), and TPB (VND 78.05 billion). On HNX, foreign investors net sold nearly VND 22 billion, focusing on stocks such as PVS (VND 43.08 billion), SHS (VND 18.87 billion), and CEO (VND 12.18 billion).

Source: Vietstock Finance

|

Morning Session: Strong cash flow, VN-Index surges

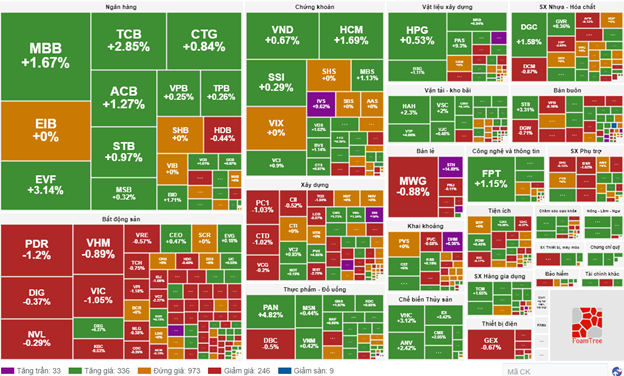

The market ended the morning session with positive movements in the main indexes, temporarily closing the session, VN-Index increased by 9.51 points, reaching 1,236.82 points; HNX-Index increased by 0.1 points, reaching 234.1 points. The market breadth leaned towards buyers with 331 stocks gaining and 300 stocks declining. The VN30 basket had more blue stocks with 18 gaining stocks, 7 losing stocks, and 5 unchanged stocks.

The trading volume of VN-Index recorded in the morning session reached over 494 million units, with a value of nearly VND 11 trillion. HNX-Index recorded a trading volume of nearly 50 million units, with a trading value of over VND 816 billion. With the morning statistics showing that liquidity will continue to increase in the afternoon session.

Source: VietstockFinance

|

In terms of industry groups, the seafood group is the most prominent with a strong growth when consistently leading in the morning session. Stocks in this group all had very positive growth like VHC, ANV, FMC, IDI, CMX, ACL,…

This is followed by the banking sector, which is breaking out in the morning session. Most of the stocks in this group are covered in green. The largest contributions must be mentioned such as VCB (+1.34%), CTG (+1.82%), VPB (+1.52%), TCB (+4.34%), MBB (+2.3%), ACB (+1.63%), STB (+1.13%), TPB (+1.79%), MSB (+1.27%). The stock BID came close to the upper limit with a 5.53% increase.

The construction materials sector also had a quite positive trend, contributing to the morning trading session with stocks such as HPG (+0.7%), HSG (+0.44%), NKG (+0.63%), HT1 (+0.38%),…

Interim performance of industry groups at the end of the morning session on February 23rd. Source: Vietstock Finance

|

At the end of the morning session, the red color temporarily dominated when looking at the overall picture of the industry. The seafood group had the strongest increase with a growth rate of 2.31%. On the other hand, the other financial sector was at the bottom with a quite negative decrease of 1.04%.

10:30 AM: Not ready to break out

Investor sentiment is still quite hesitant, causing the main indexes to fluctuate around the reference level. As of 10:30 AM, VN-Index increased by more than 5 points, trading around 1,232 points. HNX-Index decreased by 0.36 points, trading around 234 points.

Most stocks in the VN30 basket were slightly up and buying pressure still dominated. Specifically, TCB, ACB, FPT, and MBB contributed 2.74 points, 1.20 points, 1.16 points, and 1.13 points respectively to the overall index. On the other hand, VIC, MWG, VHM, and HDB were facing selling pressure, but the decrease was not too significant.

Source: VietstockFinance

|

The banking sector is showing quite impressive growth in the market. In which, BID increased by 1.51%, TCB increased by 3.1%, MBB increased by 1.67%, and ACB increased by 1.08%… As of 10:30 AM, more than VND 2,022 billion had been poured into this sector and the trading volume reached over 85 million units.

In addition, the securities sector is also attracting attention with IVS soaring, SSI increasing by 0.43%, VND increasing by 0.67%, BVS increasing by 1.14%, and HCM increasing by 2.07%… The rest of the sector has unchanged stocks and only TVB stock is still in red.

Compared to the opening, buyers are still dominating. The number of increasing stocks is 369 (33 stocks hitting the upper limit) and the number of decreasing stocks is 255 (9 stocks hitting the lower limit). The total trading volume on all three exchanges reached over 371 million units, equivalent to over VND 7.9 trillion.

Source: VietstockFinance

|

Market Opening: Seafood group leads the uptrend

VN-Index opened this morning in positive territory. The largest contribution came from the seafood group.

VHC unexpectedly increased by over 3.27%, followed by ANV and IDI with respective increases of 2.58% and 3.85%. In addition, FMC increased by 2.84%, CMX increased by nearly 2.73%, ACL increased by 2.44%,… also made significant contributions to the upward momentum of the index.

The information technology group also contributed to the growth of the index at the beginning of the morning session. Stocks such as FPT (+1.24%), CTR (+0.4%), SGT (+5.79%),…

On the other hand, the retail group did not open on a positive note. MWG decreased slightly by 0.66%, PNJ decreased by 1.23%, only FRT increased slightly by 0.24%.

Lý Hỏa