Hoa Sen Corporation (HOSE: HSG)

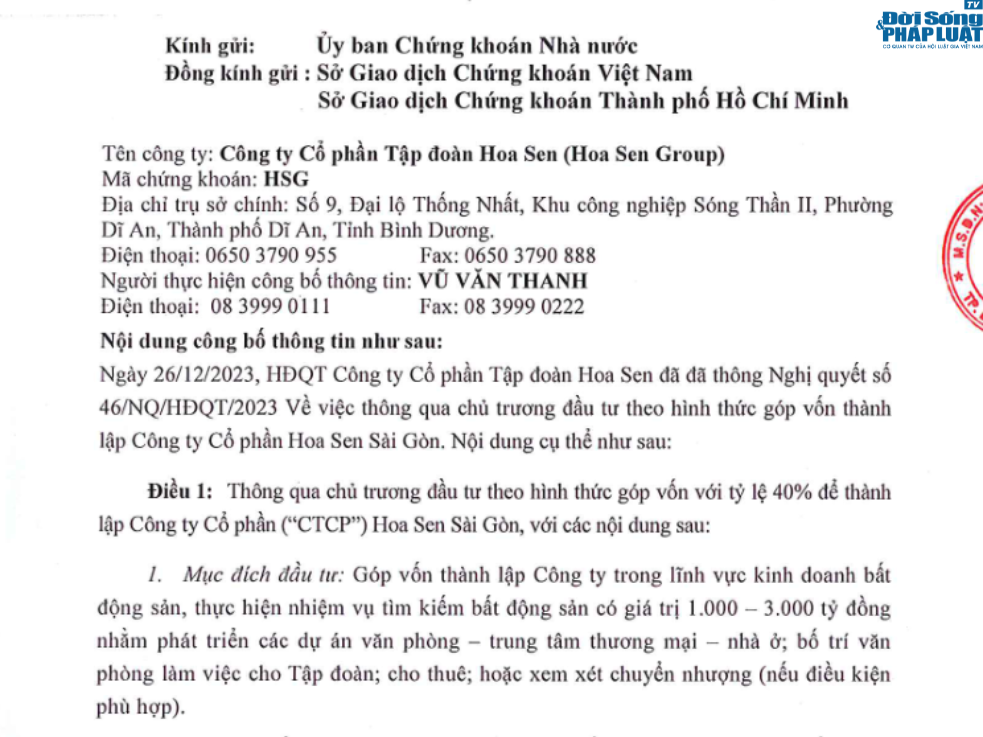

Most notably, Hoa Sen Corporation (HOSE: HSG) has decided to invest in the establishment of a real estate company. In late December 2023, Hoa Sen Corporation (MCK: HSG, HoSE) approved the plan to contribute 40% of the capital to establish Hoa Sen Saigon Joint Stock Company.

Once established, this unit will operate in the real estate business, carrying out the mission of seeking real estate worth 1,000 to 3,000 billion VND to develop office – commercial center – residential projects; arrange office space for Hoa Sen Corporation; lease; or consider transferring.

In late December 2023, Hoa Sen Corporation approved the plan to contribute 40% of the capital to establish Hoa Sen Saigon Joint Stock Company

The company stated that the investment form is the contribution of capital for establishment. In case the market situation changes or Hoa Sen has the need to withdraw capital, the corporation will transfer the contributed capital to existing shareholders of Hoa Sen Saigon Joint Stock Company. The investment deployment is expected to take place in January 2024.

This is not the first time Hoa Sen has invested in real estate. Hoa Sen has ventured into this industry since 2009, but the investment journey has been rocky and has not brought many achievements.

In 2009, Hoa Sen Corporation planned to invest in 5 projects but only 2 years later, the company transferred and withdrew capital from all 4 projects.

In 2016, Hoa Sen Corporation continued to establish 4 Companies in the real estate industry, including Hoa Sen Yen Bai Joint Stock Company, Hoa Sen Hoi Van Joint Stock Company, Hoa Sen Van Hoi Joint Stock Company, and Hoa Sen Quy Nhon Joint Stock Company.

Currently, Hoa Sen Corporation has only 1 unit operating in the real estate sector, which is Hoa Sen Yen Bai Joint Stock Company (established in 2016). Hoa Sen Corporation has increased its capital in this company in February 2023, raising the charter capital from 340 billion VND to 421 billion VND.

Minh Phu Seafood Corporation (UpCOM: MPC)

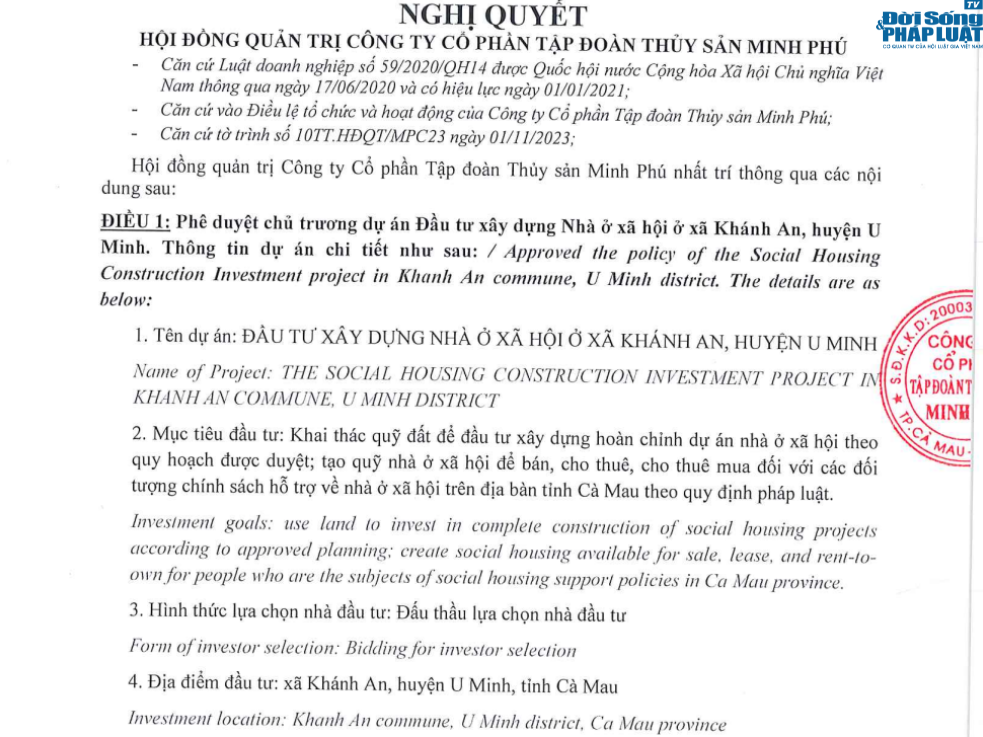

Minh Phu Seafood Corporation surprised many when it announced its expansion into the real estate field. At an extraordinary General Meeting of Shareholders held in late December 2023, MPC added the field of “real estate business, land use rights under ownership, management or lease” to its list of business lines.

Previously, on November 23, MPC announced the resolution of its Board of Directors to approve a social housing project in An Khanh commune, U Minh district, Ca Mau province.

According to the announcement, this is a social housing project invested and built by MPC with a total capital of nearly 633 billion VND, including over 619 billion VND for project implementation costs, and the remaining 13.5 billion VND for compensation, support, resettlement and clearance.

Minh Phu Seafood Corporation surprised many when it announced its expansion into the real estate field

MPC stated that the investment objective is to exploit land funds to invest in the construction of complete social housing projects according to approved plans; create additional social housing funds for sale, lease, leasing with repurchase for subjects supported by social housing policies in Ca Mau province as prescribed by law.

TCO Holdings Joint Stock Company (HOSE: TCO)

TCO Holdings Joint Stock Company is a transportation enterprise that is implementing a plan to expand into the real estate market. Specifically, at an extraordinary General Meeting of Shareholders on November 18, 2023, TCO approved a comprehensive restructuring plan, including name changes and business redirection. From there, the company will focus on developing 3 sectors: transportation, logistics; agriculture, food, and related industries; especially real estate and investment.

For the real estate and investment sector, the company plans to expand into industrial real estate and agriculture real estate development and carry out potential M&A deals.

Subsequently, on December 6, 2023, the Board of Directors of TCO decided to establish 3 subsidiaries with a 99.95% ownership ratio, namely TCO Agri Joint Stock Company (charter capital of 101.71 billion VND) specializing in wholesale trading of rice and agricultural products; TCO Real Estate Joint Stock Company (charter capital of 98.72 billion VND) specializing in real estate business; TCO Logistics Joint Stock Company (charter capital of 116.72 billion VND) specializing in logistics.

HVC Investment and Technology Joint Stock Company (HOSE: HVH)

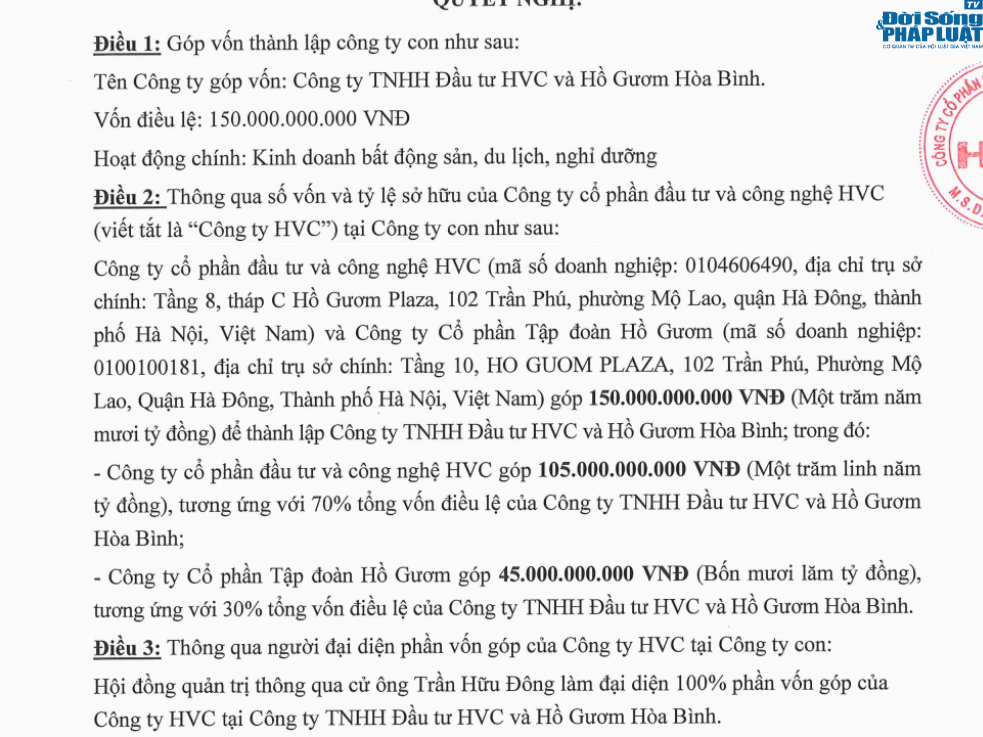

Some construction and installation companies also want to take advantage of their strength to shift their business to real estate, tourism, and resorts. A typical example among them is HVC Investment and Technology Joint Stock Company. In late November 2023, this company announced that it would contribute capital to establish HVC Investment Limited Liability Company and Ho Guom Hoa Binh Limited Liability Company.

In late November 2023, HVC Investment and Technology Joint Stock Company announced that it would contribute capital to establish HVC Investment Limited Liability Company and Ho Guom Hoa Binh Limited Liability Company

The new company has a charter capital of 150 billion VND. In which, HVH contributes 105 billion VND, accounting for 70%; the remaining capital belongs to Ho Guom Corporation. The main business areas of the new company are real estate, tourism, and resorts.