Strong recovery in Q4/2023 profits but not enough to offset the full-year results. 2023 post-tax profits for the entire market decreased by -6.7% compared to the previous year and even larger than the decline in 2020 when the Covid-19 pandemic broke out, according to statistics from FiinGroup.

This is a worse result than the plan set by businesses at the beginning of the year, which expected a decrease of only -3%. Specifically, for the Financial group, post-tax profits in 2023 increased by +5.6%, much lower than the plan (+14.7%), mainly due to a slower growth rate in the Banking sector, which increased by only 3.5% compared to the planned +13.6%.

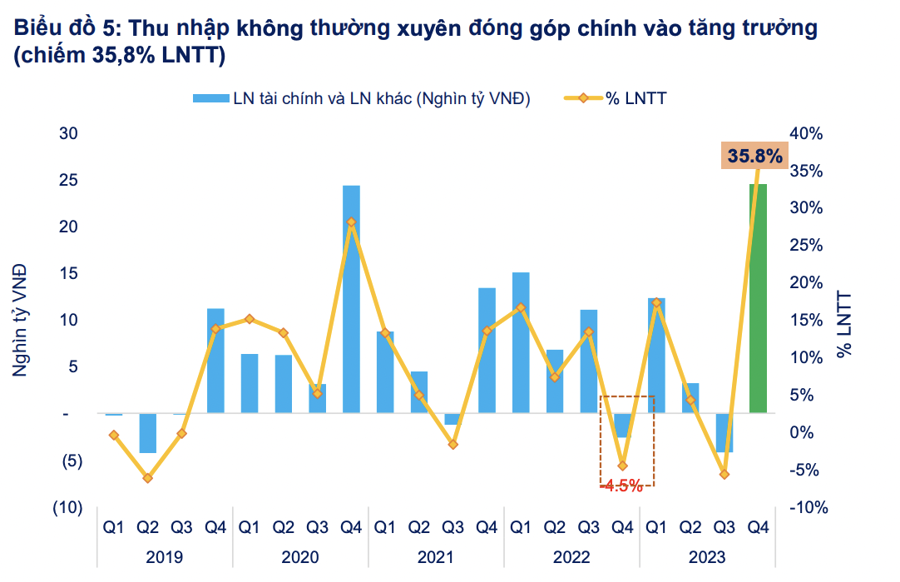

For the Non-Financial group, 2023 post-tax profits decreased by -18.9%, which is more optimistic than the planned -20.6% decrease. This result was achieved thanks to the significant contribution of non-recurring incomes, accounting for 38% of the total pre-tax profits in 2023, mainly from the Real Estate group and some leading industry enterprises.

More details on the Non-Financial group: Q4/2023 growth quality declined, mainly due to the impact of the Real Estate group. Q4/2023 post-tax profits of the Non-Financial group increased significantly compared to the same period, up 93%, but net revenue increased very slightly (+1.1% YoY) and EBIT margin decreased by -1.6 percentage points in the context of weak consumer demand that limited the ability to increase selling prices to compensate for increased input costs.

Non-recurring income, including financial income and other income, accounted for 35.8% of the total pre-tax profits in Q4/2023, contributing significantly to the breakthrough growth in post-tax profits compared to the same period. It is worth noting that this non-recurring income was recorded in many leading industry enterprises, where nearly 80% belonged to the Real Estate group (VIC, VHM, NVL, PDR) and the remaining 20% were some other leading industry enterprises such as Aviation (VJC), Fertilizer (DHB), Agriculture (HAG).

If adjusted for these non-recurring incomes, Q4/2023 post-tax profits of the Non-Financial group respectively decreased by -28.4% compared to the same period in 2022 and -49.2% compared to Q3/2023.

The core profits of the Non-Financial group are calculated by pre-tax and interest expenses (EBIT), which decreased significantly by -29.5% compared to the same period, mainly due to the impact of the Real Estate sector. It comprised nearly 13% of the total post-tax profits of the market, but real estate enterprises currently have somewhat unique revenue recognition cycles. They only recognize revenue after project handover, resulting in a certain delay compared to actual sales (which can take several years).

The calculations of profit growth and growth quality do not play a decisive role in the selection of real estate stocks for investment; instead, it is the financial capacity and sales speed of each project.

The prepayment ratio/Inventory and changes in average days of inventory are among several indicators used to assess a company’s sales progress. In Q4/2023, the inventory of real estate businesses increased again with positive signals from the amount of prepayment, indicating that sales activities are gradually recovering.

FiinGroup believes that the trend of recovery in after-tax profits in the coming quarters depends on revenue growth. The Growth group: Information Technology, Telecommunications, Tourism and Entertainment, Construction and Materials, Basic Resources are groups with after-tax profits maintaining a recovery trend in the past 2 quarters and strong growth in Q4, though the EBIT margins of these groups are gradually narrowing or remaining steady. Therefore, revenue growth will be the main factor affecting the trend of after-tax profit growth in the next quarters.

The Recovery group: Food, Chemicals, and Personal Goods show signs of recovery in after-tax profits with an expanding EBIT margin continuing to support after-tax profit growth amid very low or even declining revenue. The recovery momentum will continue if revenue returns to good growth in the coming quarters.

The Bottoming group: Retail, Utilities, Industrial Goods & Services are groups at the bottom of the cycle, with EBIT margins at their lowest points in 5 quarters, while revenue is slowly declining or slightly increasing as consumer demand remains weak.