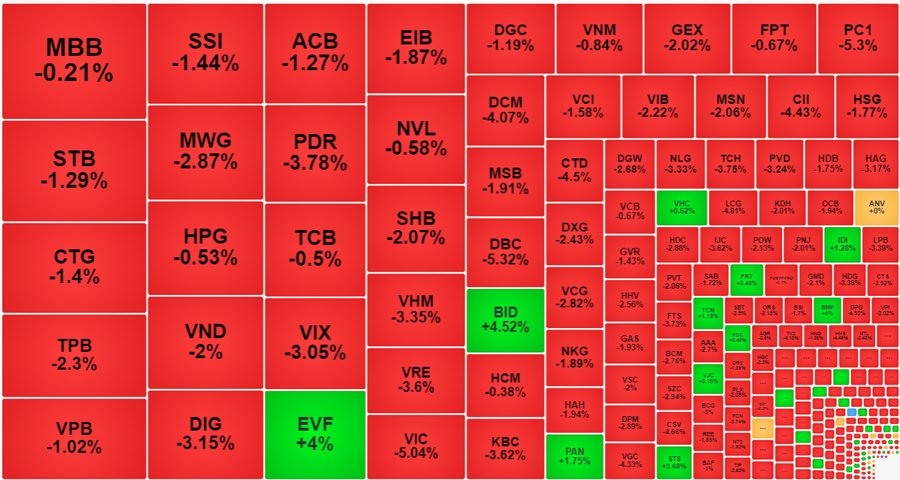

The market suddenly experienced a horrifying sell-off in the afternoon session, with trading volume reaching over 20.4 trillion dong on both exchanges. Overall, total trading volume on all three exchanges reached over 35.1 trillion dong, the highest in 6 months. The VN-Index lost 1.25% (-15.31 points), with the number of declining stocks outnumbering the advancing stocks by more than 4 times, and foreign investors net sold over 780 billion dong.

The highlight today is the trading volume, which is unusually high. Looking at the matched orders alone, total trading volume on both exchanges reached 32.2 trillion dong, the highest since September 22, 2023. Unfortunately, this high trading volume coincided with a sharp decline in stock prices. The VN-Index closed with 98 stocks up and 414 stocks down.

On HOSE, there are 136 stocks that declined more than 2%, a significant drop. Moreover, this group accounted for 49% of the total trading volume on the exchange, confirming the strong selling pressure.

The market didn’t “find” any information that could explain today’s unexpected volatility. Before falling sharply, VN-Index increased by 1.1% or nearly 14 points in the first 15 minutes of the afternoon session. In this short period of time, the index dropped by -2.32% in just over 1 hour.

Leading the decline are the same stocks that led the market recently: VIC decreased by 5.04%, VHM decreased by 3.35%, GAS decreased by 1.93%, CTG decreased by 1.4%… The only stock in the banking sector, BID, increased by 4.52%, preventing the index from falling further. The VN30-Index decreased by 1.14% with 2 stocks up and 28 stocks down, 11 of which declined by more than 2% and 9 other stocks declined from 1% to 2% compared to the reference price.

The VN30 basket also witnessed a sudden increase in trading volume, almost doubling compared to yesterday, reaching 13,731 billion dong, the highest level since late November 2021. Huge selling pressure appeared in stocks like STB with 1,045.5 billion dong, a decrease of 1.29%; CTG with 932.5 billion dong, a decrease of 1.4%; TPB with 858.7 billion dong, a decrease of 2.3%; VPB with 837.4 billion dong, a decrease of 1.02%; SSI with 832.4 billion dong, a decrease of 1.44%; MWG with 785.5 billion dong, a decrease of 2.87%… It can be seen that the banking sector is experiencing intense selling pressure. The total trading value of banking stocks on HOSE reached an unprecedented 9,840 billion dong, and only 4 out of 27 stocks in this sector ended the day in the green.

In addition to BID, all other large-cap stocks also decreased. VJC is the only stock that increased in the VN30 basket, but it ranks 23rd in the VN-Index. Therefore, the pillars that have been leading the market have collapsed today, and it is not surprising that the index lost a significant number of points. This development has a strong impact on market sentiment: At 13:15, there were still 238 advancing stocks and 234 declining stocks, but by around 14:05, when the VN-Index turned red, there were only 156 advancing stocks and 327 declining stocks. The closing session was a disaster for the VN-Index with 98 stocks up and 414 stocks down.

This reality shows that the ability to maintain differentiation in stocks depends heavily on the ability to support the index. If the VN-Index declines significantly – possibly due to the impact of the pillars – sentiment weakens rapidly and triggers panic selling. The midcap index also decreased by 1.81%, while the smallcap index decreased by 1.72%. Very few stocks can go against this pressure.

HOSE ended the session with 37 stocks up more than 1%, most of which had insignificant trading volume. Notable stocks include BMP, up 5% with 55.9 billion dong matched; BID, up 4.52% with 363.1 billion dong; EVF, up 4% with 643.3 billion dong; ST8, up 3.68% with 88.3 billion dong; FRT, up 3.48% with 80.7 billion dong; PAN, up 1.75% with 191.2 billion dong; IDI, up 1.28% with 99 billion dong; TCM, up 1.18% with 73.5 billion dong.

On the downside, there were too many stocks. HOSE recorded 65 stocks with trading volume above 100 billion dong today, of which 61 were in the red, with 37 stocks declining by more than 2%. DBC, PC1, VIC, LCG, CTD, CII… are the stocks that experienced a sharp decline with high trading volume.

Foreign investors continued to “add fuel to the fire” with a net selling volume of over 767 billion dong on HOSE today. The stocks that were heavily sold off include VPB with a net selling volume of 195.5 billion dong, MWG with a net selling volume of 183.1 billion dong, VIX with a net selling volume of 140.9 billion dong, TPB with a net selling volume of 77.9 billion dong, MSN with a net selling volume of 76.2 billion dong, SSI with a net selling volume of 64.9 billion dong, HDB with a net selling volume of 50.3 billion dong… On the buying side, there were DGC with a net buying volume of 119 billion dong, EVF with a net buying volume of 95 billion dong, VRE with a net buying volume of 49.5 billion dong, VNM with a net buying volume of 36.5 billion dong.

This is the second consecutive session of net selling, following the net selling volume of 920 billion dong yesterday. This completely reversed the net buying position in January 2024, with even more selling pressure.

The magnitude of today’s decline in the VN-Index is the largest since November 23 of last year. This development occurred at a time when the index was approaching its highest level in 2023, an important resistance level. The narrow breadth indicates that profit-taking is widespread and investors are reacting despite the fact that the VN-Index has not yet retested its previous high.