SMC Corporation (SMC-HOSE stock code) reports the results of the early buyback of SMCH2124001 bonds.

Accordingly, SMC announced that on February 2, it repurchased all 200 billion dong of SMCH2124001 bonds, reducing the outstanding balance of these bonds to zero dong.

It is known that SMCH2124001 bonds were issued on August 2, 2021, and mature on August 2, 2024. Therefore, SMC has completed the early buyback of all bonds.

In terms of business results in 2023, SMC recorded a fourth-quarter revenue of 3,212.26 billion dong, a 23.6% decrease compared to the same period (4,203 billion dong), a post-tax loss of 333.349 billion dong, and a post-tax loss of 329.87 billion dong for the parent company (compared to a loss of 514.99 billion dong in the same period).

For the full year 2023, SMC reported a revenue of 13,786.3 billion dong, a 40.5% decrease compared to the same period (23,181 billion dong), a post-tax loss of 919 billion dong (compared to a loss of 652 billion dong in the same period), and a post-tax loss of 879.3 billion dong for the parent company, an increase of over 300 billion dong compared to the same period (-578.99 billion dong).

In 2023, SMC set a business plan with a revenue of 20,350 billion dong, a 12.2% decrease compared to the same period, and an expected post-tax profit of 150 billion dong, compared to a loss of 651.8 billion dong in the same period.

Therefore, at the end of 2023, SMC recorded a much larger loss than the profit plan for 2023.

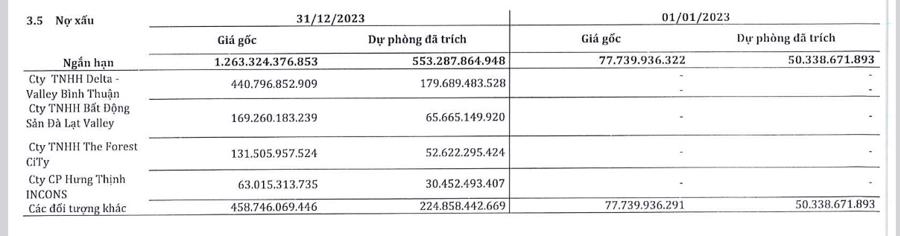

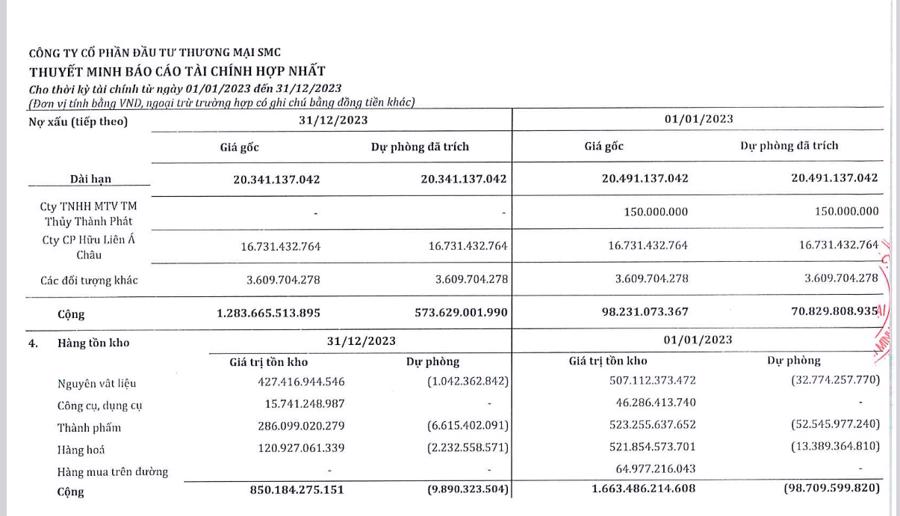

Notably, SMC still has bad debts of nearly 1,284 billion dong, of which Novaland, a related partner, tops the list with over 700 billion dong. As of December 31, 2023, SMC has set aside over 574 billion dong for this bad debt portfolio.

Also as of December 31, 2023, the company recorded a cumulative loss of 162.9 billion dong, while at the beginning of the year, the company reported a cumulative profit of 343.6 billion dong; equity reached 803.7 billion dong.

According to the company’s explanation, the post-tax profit for the fourth quarter and the whole year being a loss is due to the significant decline in steel demand, especially in the context of the frozen real estate market, which has made real estate businesses in general and construction companies face prolonged difficulties, a sharp decrease in revenue and cash flow, which in turn led to the slow turnover of the company’s debts to large customers.

In addition, financial costs remain high due to interest payments and unfavorable exchange rates for the company. By the end of 2023, the company had to increase provisions for receivables, resulting in a loss of 919.3 billion dong.