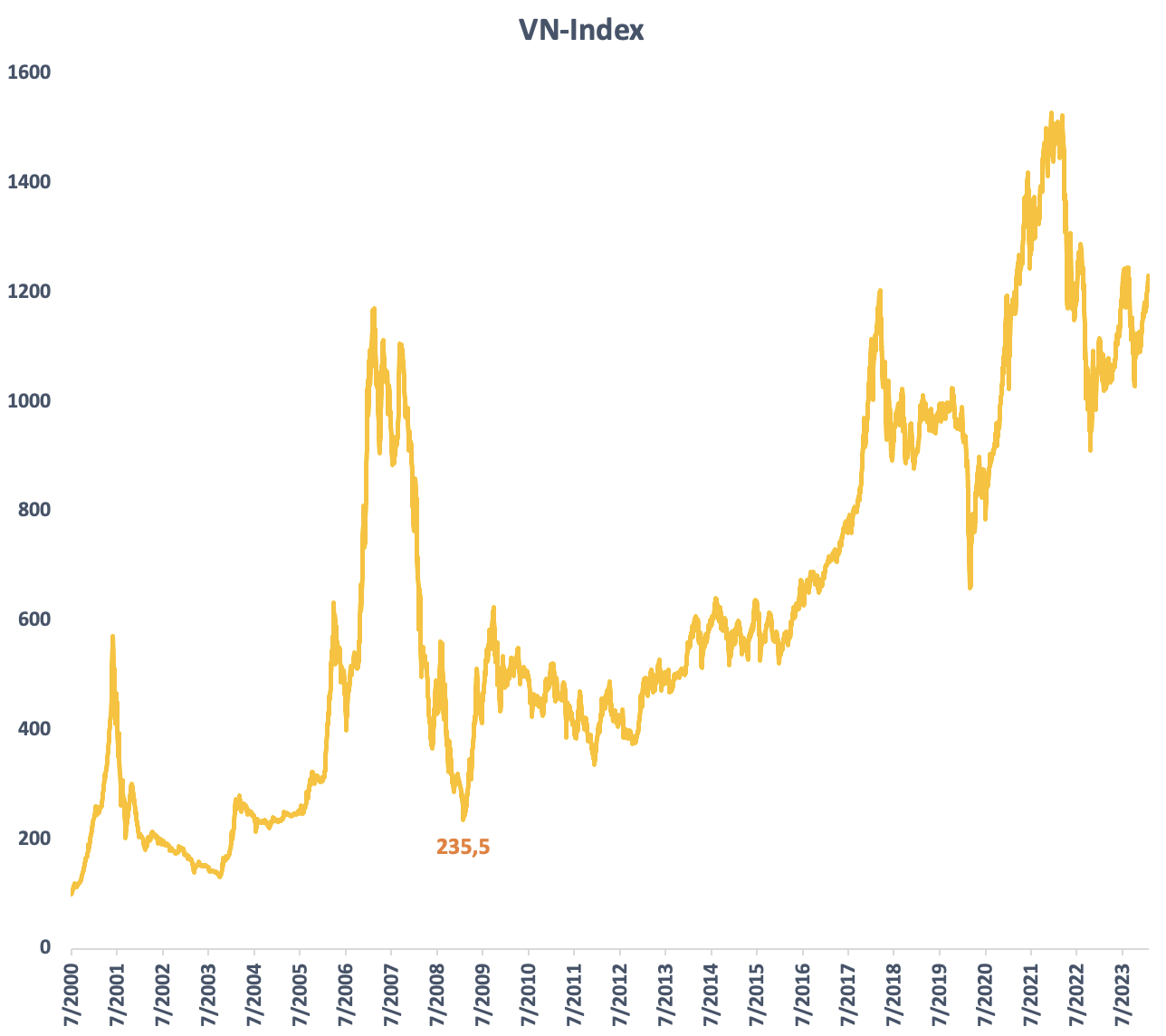

Fifteen years ago, on February 24, 2009, the Vietnamese stock market marked a historic milestone as the VN-Index dropped to 235.5 points, the lowest since the end of February 2005. This was the culmination of a free fall from the peak of nearly 1,200 at the beginning of 2007. In just over 2 years, the VN-Index had divided by 5, wiping out all the gains from the 2006-07 boom.

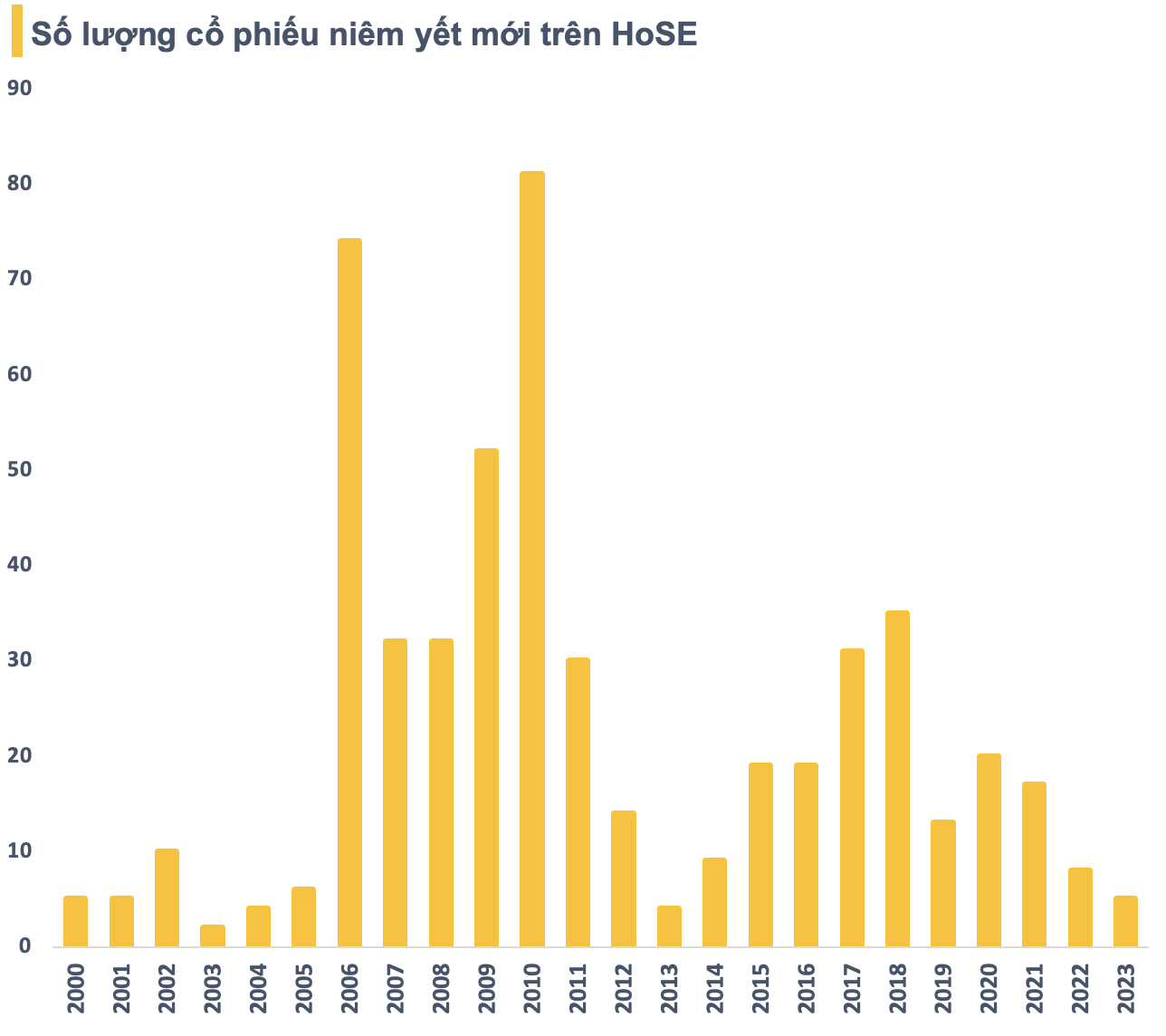

At that time, the hype from Vietnam’s accession to the WTO and the wave of businesses “flooding” the stock market pushed the market to continuously increase, even to the point of being overheated. In just 2 years, HoSE welcomed over 100 new stocks, including a series of “big names” such as Vingroup (VIC), FPT, Nhua Binh Minh (BMP), PV Drilling (PVD), Bao Viet Securities (BVS), Binh Dinh Minerals (BMC), Sudico (SJS), Hau Giang Pharmacy (DHG), Sacombank (STB), SSI, etc.

However, the global financial crisis in 2008 shattered the “feast” of the Vietnam stock market. The unimaginable valuation with a P/E ratio of up to 4 times the peak level made the situation more serious. By the time it dropped to 235.5 points, the VN-Index’s P/E ratio was still around 15 times, much higher than the current level. However, the 80% discount from the peak along with the economic stimulus package at that time attracted capital inflows.

This period also witnessed many “big players” listed, such as Masan (MSN), Bao Viet (BVH), PetroVietnam Construction (PVX)… or a series of banks such as Vietcombank (VCB), VietinBank (CTG), SHB, Eximbank (EIB). In 2010, a record number of listed companies were recorded.

Although there are no longer explosive waves of new listed stocks as before, the market still has positive changes in both quantity and quality over the years. Investment products are increasingly diverse, and improved legal mechanisms have contributed to the healthy development of the stock market. Since the historical low 15 years ago, VN-Index has never returned to that point. Despite ups and downs, the overall trend is still upward.

VN-Index even reached over 1,500 points in the late 2021 – early 2022 period. Although it is no longer at its peak, the index is still around 1,200 points, more than 5 times higher after 15 years. HoSE’s market capitalization reached approximately 5 million billion VND, more than 39 times the historical low 15 years ago.

Generally, the possibility of VN-Index returning to 235.5 points is very low, although anything is possible. Particularly, the prospects of the Vietnam stock market are still highly regarded thanks to stable macro conditions, the growth potential of listed companies, the remaining room for new investors, and the upgrading story.

According to Dragon Capital, the 12-month deposit interest rate at banks is only around 4.7%, which is not attractive compared to the 10.9% profit from the stock market. Other investment channels such as real estate have certain limitations such as large capital scale, low liquidity, especially when investors are still cautious about the legal progress of projects. Therefore, large capital inflows may turn to the stock market.

In addition, the story of upgrading the market to the emerging level is expected to be an important factor in attracting foreign capital. With Vietnam’s free float market capitalization of about 35 billion USD, SSI Research estimates the proportion of Vietnam in the FTSE EM index at about 0.7-1% and in FTSE Global at 0.1%. This could immediately help Vietnam’s stock market attract about 1.7-2.5 billion USD when the FTSE Russel’s upgrade decision takes effect.