On the weekend trading session (23/2), the domestic stock market recorded two contrasting states in the morning and afternoon sessions. By the end of the morning session, VN-Index increased nearly 10 points, but during the lunch break, a large amount of selling unexpectedly appeared, causing the main index to plummet. Despite the attempt to recover towards the reference level, before the ATC session, VN-Index once again reversed, closing down by 15 points.

Heavy selling pressure pushed liquidity to a high level, with trading value on HoSE reaching nearly 32,000 billion VND. Domestic and foreign capital both saw strong net selling, with net selling value of nearly 800 billion VND. The selling pressure focused on VPB, MWG, VIX, TPB, MSN…

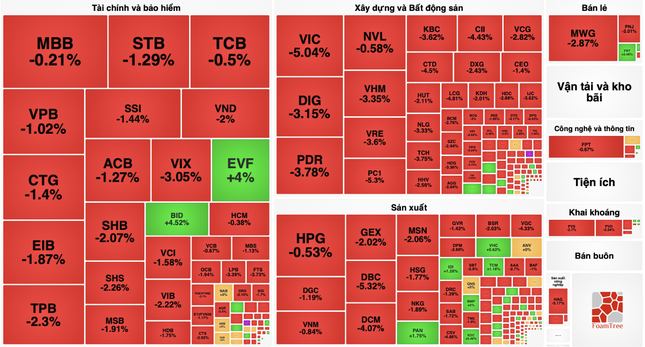

Red dominates the whole market.

The negative trading of large-cap stocks is the reason why VN-Index suffered the most points loss. VIC decreased 5%, causing VN-Index to drop more than 2 points. VHM, GAS, VCB, CTG, VRE, MSN… also added pressure. VN30 basket recorded 27/30 stocks declining.

Big groups of stocks with high liquidity such as banks, real estate, securities, construction materials… were all immersed in red. Stocks with huge trading value like MBB, STB, CTG, TPB, VPB also decreased in price.

Selling pressure poured into bank stocks, however, the market price did not decrease deeply, thanks to the buying side intervention in supporting the price. The top liquidity stock MBB changed hands with more than 49 million shares, equivalent to a value of 1,192 billion VND, and closed with a slight 0.21% decrease. Most bank stocks also decreased below 1-2%.

BID surprisingly led the banking group by increasing 4.5%. Only BID contributed more than 3 points, but it was not sufficient to offset the selling pressure from other stocks. The banking group attracted the most cash flow in the session, with more than 9,328 billion VND, significantly higher than the second group, real estate, with nearly 6,360 billion VND.

Major real estate stocks with large transactions such as DIG, PDR, NVL, GEX, KBC, CII… all fell. In the real estate group, before the sharp decline today, Dragon Capital just sold the holdings of DXG and GEX stocks.

At the end of the trading session, VN-Index decreased by 15.31 points (1.25%) to 1,212 points. HNX-Index decreased by 2.93 points (1.25%) to 231.08 points. UPCoM-Index decreased by 0.42 points (0.45%) to 90.16 points.