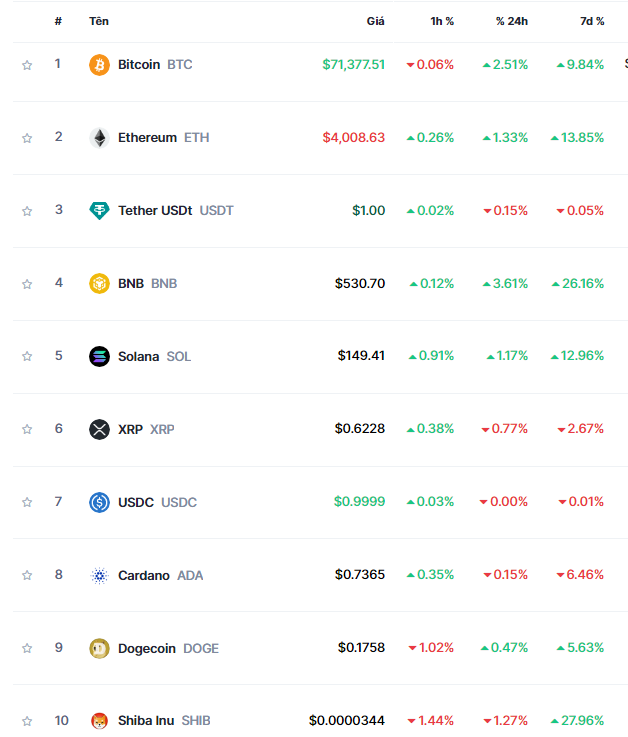

The world’s largest cryptocurrency prices have risen more than 4% to nearly $43,800 USD, as excitement about the Bitcoin ETF engulfed the market. At one point, Bitcoin rose to $44,903 USD, the highest since April 7, 2022.

The surge in Bitcoin has pushed its year-to-date increase to 160% in 2023. Meanwhile, Ethereum is up 1.6% to $2,263 USD, an 88% increase since the beginning of the year.

Bitcoin has been reaching new highs for the past few weeks. Last weekend, the cryptocurrency broke the $40,000 USD mark for the first time since April 2022, after starting November 2023 at $34,000 USD.

The excitement about the possibility of a Bitcoin ETF in the US is the main driving force behind Bitcoin’s relentless climb, which began in the summer. Initially, this news did not have much impact, but as more applications were filed and feedback was received from the Securities and Exchange Commission (SEC), investors became more excited and more confident in the ETF’s approval.

“The biggest driving force behind the Bitcoin price increase could be the expected approval of the Bitcoin Futures ETF registration applications by the SEC,” said Yiannis Giokas, a senior executive at Moody’s Analytics, in an email. “The race is heating up, with large fund management organizations beginning to look at Bitcoin.”

The cryptocurrency industry is eagerly awaiting the registration result of BlackRock’s Bitcoin Futures ETF. Bloomberg Intelligence expects SEC approval of Bitcoin ETFs to be granted in January 2024.

Smaller cryptocurrencies like Ethereum and Dogecoin are also climbing. Bitcoin Cash surged 9% and a top 100 coin index added 4%.

In addition, the resolution between Binance and the US Department of Justice in late November 2023 is seen as positive news and removes the last hurdle in the aftermath of the FTX incident.

“Bitcoin continues to rely on the optimism surrounding the ETF and the possibility of the Fed lowering interest rates in 2024,” said Tony Sycamore, a market analyst at IG Australia, in a report. Technical patterns indicate that the next milestone to watch is $42,330 USD, he added.

Many ups and downs in the first 11 months of the year

Bitcoin has overcome a series of challenges in the cryptocurrency market to recover. Sam Bankman-Fried faces the risk of 100 years in prison for fraudulent behavior at the FTX cryptocurrency exchange. Meanwhile, Changpeng Zhao, the founder of Binance, has pleaded guilty to authorities for failing to assume responsibility for anti-money laundering efforts.

Optimists believe that the crypto crackdown campaign and the slew of ETF registration applications could expand the investor base in the cryptocurrency market.

Many industry executives have already begun discussing a new bull run, believing that the price of Bitcoin could surpass $100,000 USD this year.

“It appears that 2023 is preparing for a new bitcoin bull market. Investor sentiment towards 2024 and 2025 is very optimistic,” said Pascal Gauthier, CEO of Ledger.

From an optimistic standpoint, many cryptocurrency industry leaders believe that the tough crackdown on wrongdoing has made the cryptocurrency industry healthier.

“I think once the speculative frenzy is removed, the real builders in the crypto industry will focus on the technology and the problems they can solve in the world, rather than just having this massive digital casino that people come to play,” shared David Marcus, CEO of Lightspark. Marcus is currently developing technology to drive Bitcoin payments.

Vu Hao (source: CNBC, Bloomberg)