Since the beginning of the year, Bitcoin has risen more than 160% and the market capitalization has increased by an additional 530 billion USD (estimated based on the market price multiplied by the amount of circulating cryptocurrencies).

The rise of Bitcoin has also led to the surge of other smaller cryptocurrencies, from Solana to Dogecoin and Pepecoin (a meme coin featuring a green frog) in the context of investors accepting more risks. If you invest $100,000 in Solana at the beginning of 2023, you will “pocket” a gain of over $800,000.

Expectations from Bitcoin ETFs

Further supporting the cryptocurrency boom is the expectation that Bitcoin ETFs will soon be approved in the United States. These ETFs allow direct investment in Bitcoin. On January 10, 2024, regulators in the US will consider approving these Bitcoin ETFs.

“Approving Bitcoin ETFs will be a huge catalyst and create a shock in demand,” according to Michael Saylor, co-founder of MicroStrategy – a major player in the Bitcoin market. Investors will have a channel to invest in the largest cryptocurrency in the world.

Despite the excitement, there are still criticisms of cryptocurrencies. Some believe that cryptocurrencies fundamentally have no value and are a channel for criminal exploitation. In November 2023, Binance, the world’s largest cryptocurrency exchange, agreed to pay a fine of $4.3 billion for violating anti-money laundering regulations, and CEO Changpeng Zhao resigned. Sam Bankman-Fried was arrested for fraud at the FTX exchange.

|

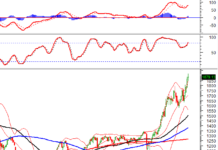

Bitcoin’s performance compared to other assets

|

|

Bitcoin Halving is an event that occurs approximately every 4 years or after about 210,000 blocks are mined. It is a mechanism to reduce the block rewards for miners for each block mined. Halving is an important part of the Bitcoin system as it controls the supply of new Bitcoins entering the market. By reducing the rewards for mining, halving slows down the rate of new Bitcoin creation. |

In 2023, Bitcoin has outperformed stocks and gold. Crypto enthusiasts believe that the halving event in 2024 will further reduce the growth of Bitcoin supply, thereby boosting its price.

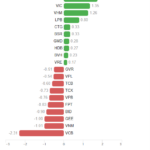

Shares of Bitcoin mining companies Marathon Digital Holdings Inc. and Riot Platforms Inc., cryptocurrency exchange Coinbase Global, and Bitcoin investment company MicroStrategy have all surged as the crypto market recovers. In particular, Coinbase’s stock has increased nearly 400%.

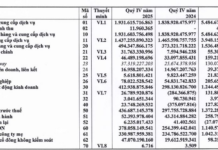

Derivatives products based on Bitcoin have also been active in 2023. The open interest of Bitcoin options contracts on Deribit, the largest crypto options exchange, exceeded $16 billion for the first time in December 2023, according to CCData. The open interest of Bitcoin futures contracts also reached a new high on CME Group.

|

Demand for Bitcoin options

|

The decentralized finance (DeFi) sector has yet to recover from the collapse of the TerraUSD stablecoin project in 2022.

The weekly trading volume of NFTs has also recovered from a low of around $50 million in October 2023, reaching $180 million this month, according to data from Nansen. However, this figure is still much lower than the peak of $1.8 billion recorded in 2022, indicating that there is still much work to be done to revive investor interest in this sector.

Despite Bitcoin’s strong performance this year, the crypto market is still haunted by the scars of the FTX exchange collapse in November 2022. This incident caused a sharp decline in liquidity in the crypto market.