Tổng Giám đốc TPBank – ông Nguyễn Hưng.

Amidst the New Year atmosphere of Giap Thin 2024, Mr. Nguyen Hung, the CEO of TPBank, shared about the remarkable highlights of the bank in the past year and its future direction.

Sir, TPBank surpassed the milestone of 12 million customers, just after 15 years of establishment. What has helped TPBank achieve this success?

The figure of 12 million customers is a natural achievement in the period of TPBank’s rapid growth. In 2023 alone, the bank acquired an additional 3.5 million new accounts, a total of 8.6 million new accounts in 3 years, which is twice the total number of customers accumulated in the previous 12 years. TPBank also recorded remarkable growth in the number and value of transactions on digital channels in 2023, with the total number of transactions doubling compared to the previous year and transaction value increasing by 50%.

Post-pandemic can be seen as the booming period of TPBank, as people started to change their financial service habits and technology became an important bridge in communication between customers and the bank. TPBank is the leading financial institution in digital transformation, applying technology to provide customers with modern and convenient experiences.

TPBank has combined flexibility and adaptability in its business strategy with modern technology infrastructure and diverse ecosystem to bring the best benefits to customers. As a result, the bank has gained the trust of millions of hearts.

Pioneering the application of eKYC in opening accounts on LiveBank 24/7 or App TPBank is a revolutionary step of TPBank, changing the financial market in Vietnam and the customer experience for financial services. Features like ChatPay, VoicePay… on the TPBank app are also bringing a new breeze to the way of communicating with digital banking applications. All of these things contribute to the attractiveness of TPBank.

How does TPBank evaluate the young customer group? How does the bank target this customer group?

Youth customers have always been the target group of TPBank. TPBank is also a young bank with 15 years of age, finding resonance with young people, the future generations of the country.

Youth is the demographic group that is easy to access new technology, preferring different, trendy experiences. Therefore, they will easily convert and use TPBank’s high-tech products – a bank focusing on technology to create solutions.

In addition to diversely designed products for young people’s needs, in recent years, TPBank has also implemented youthful, trending and unique communication campaigns. Most recently, the communication campaign with the message “Choose Experience, Choose TPBank” made a mark as the Top 1 outstanding event on social media, Top 7 remarkable campaigns, and Top 5 Trendy Brands on reputable social media rankings.

The “Full Experience – 2in1 Concert” music festival was a great success, with over 10 million views on channels and platforms, along with 50,000 live viewers, hundreds of millions of views and viral hashtags on social media, proving the success of the trendy and unique branding path that TPBank has pursued over the years.

In the future, TPBank will continue on the path it has taken, building trust and attracting young customers to use the bank’s services.

The CEO of TPBank said that currently, 98% of TPBank customers’ transactions are conducted through digital channels.

TPBank is considered a typical bank in Vietnam in the digital transformation wave. Can you share more about TPBank’s digital transformation results? What percentage of TPBank’s operations have been digitized?

Since its restructuring, TPBank has identified technology as a lever for breakthroughs. In recent years, the bank has continuously invested in experienced technology staff, mastered resources and digital processes, and implemented Agile, DevOps combined with Design Thinking. Thanks to that, TPBank has always had technology self-reliance, proactively launching new projects quickly and effectively.

Currently, 98% of TPBank customers’ transactions are conducted through digital channels. This is the result after the bank has built infrastructure, technology solutions, and continuous digital transformation processes. Currently, over 90% of the bank’s activities have been digitized, minimizing files, paper documents, hard copies in business processes. This allows all processes and transactions to be carried out faster, much safer, and ensures data integrity. As a result, the bank saves 40% in operating costs and 60% in average transaction time at customer counters.

For example, LiveBank 24/7, the digital conversion symbol of TPBank, like the banking industry, can serve 90% of customer transaction needs with operating costs only 1/10 compared to a branch/transaction office.

By shifting activities to digital channels, risk management is also improved through data analysis in detecting abnormal activities and monitoring flows.

How does TPBank see its differentiation on the current market? Is the “Technology for Human Life” orientation for sustainable development one of those points?

One thing that probably does not need to be affirmed, as has been proven throughout this time – TPBank is a pioneering bank in digital transformation, digitizing financial services. It can be said that TPBank is a leading symbol, inspiring digital transformation not only in the banking industry but also in the broad digital economy in Vietnam.

Over 11 years ago, TPBank’s leaders determined that technology was the path to proactively lead in the banking sector. Once the smallest unit in the “turnaround” process, TPBank has now risen to become one of the top 5 most valuable brands in Vietnam with an asset scale surpassing 356 trillion VND, the strongest and most sustainable financial platform among domestic banks, according to the strict and prestigious evaluation standards of The Asian Banker.

The current success, position, and advantages of TPBank are the result of a decade of digital transformation along with the business philosophy of focusing on customers that has spread to every TPBank employee.

As a technology bank, TPBank clearly defines a different path with its own philosophy – Technology for Human Life. In that philosophy, digitalization and technology do not come from computer chips, but from the heart of humans. The digital transformation journey starts from questions: How do customers live? What are the social needs? What will the sustainable future of people be like?

Understanding customers, TPBank starts from the needs of customers to create unique products, providing convenient, modern, and fast experiences to customers. We use technology to solve market problems, serve users, and place sustainability and greening factors as the center of every business activity. That is TPBank’s special essence.

In the coming years, what is TPBank’s strategy to increase competitiveness, especially in the context of many banks proactively participating in the digital race?

With the leading advantage in the digital transformation revolution, TPBank will continue to leverage its existing strengths and build human resources and technology infrastructure. The challenge of investment costs is not small. Therefore, once deployed, TPBank affirms the need to lead in technology. We are committed to continuous improvement to find the most effective and optimal digitalization methods, bring new experiences, and enhance the value of every customer accompanying us.

According to Mr. Nguyen Hung, TPBank is committed to continuous improvement to find the most effective and optimal digitalization methods, bring new experiences, and enhance the value of customers.

A series of outstanding digital service products has been and is being exploited by the bank based on leading technologies such as AI, Big Data, Machine Learning… applied strongly and extensively to all core banking services: payments, credits, deposits… With a diverse ecosystem, connecting with many services, the bank brings seamless experiences and benefits to users in the digital space. The connection between TPBank’s digital financial solutions and comprehensive digital ecosystems in other areas of life brings excellent experiences to customers in the future digital society.

The trend of greening in financial activities is expanding. In this wave, TPBank is also at the forefront, prominent with sustainable development projects according to ESG standards. Can you share more about this direction?

In mid-August 2023, TPBank announced plans to implement a Comprehensive ESG Project within 12 months, with three main components: Building Sustainable Development Reports; Building ESG Governance Frameworks; Building Green Credit Frameworks and Strategies. This is a proactive step in line with global trends, not only in Vietnam but also worldwide, as environmental and social issues are increasingly concerned.

We are confident that TPBank’s team can accept the technology transfer to implement good governance according to international ESG standards, ensuring green, healthy, and sustainable development with responsibility to the community, society, and the environment.

The bank also sets a business direction for green credit flows and community-oriented loan products. TPBank and the Asian Development Bank (ADB) have together provided significant support through practical loans to enterprises led by women.

In reality, TPBank and its employees have implemented measures towards sustainable development and greening even before that, such as limiting paper documents (paperless), participating in green projects, afforestation, and waste collection… participating in community activities. Understanding customers, we want to join hands in building a green economy, a green society, preserving and protecting core values for future generations.

WeChoice Award, Better Choice Award… and many other awards from community votes are the most evident evidence for TPBank’s actions.

What does TPBank expect when entering 2024?

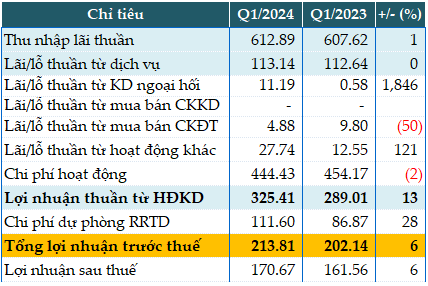

In 2023, TPBank flexibly adapted to the “limitless” spirit, unity, and unanimous effort to overcome difficulties and achieve certain successes, marking its 15th anniversary. With enthusiasm and steadfast belief, TPBank enters 2024 with a proactive mindset, leveling challenges, conquering new heights. We understand that the market still has many difficult developments, so TPBank will continue to promote loan growth, ensure risk management, control loan quality, while expanding non-interest income, contributing to business results. The bank will continue to accompany interest reduction, support customers, and constantly increase the volume of technology to serve customers, aiming to develop a green bank on a comprehensive digital platform.

Thank you!