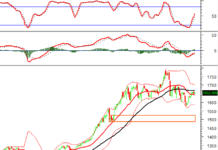

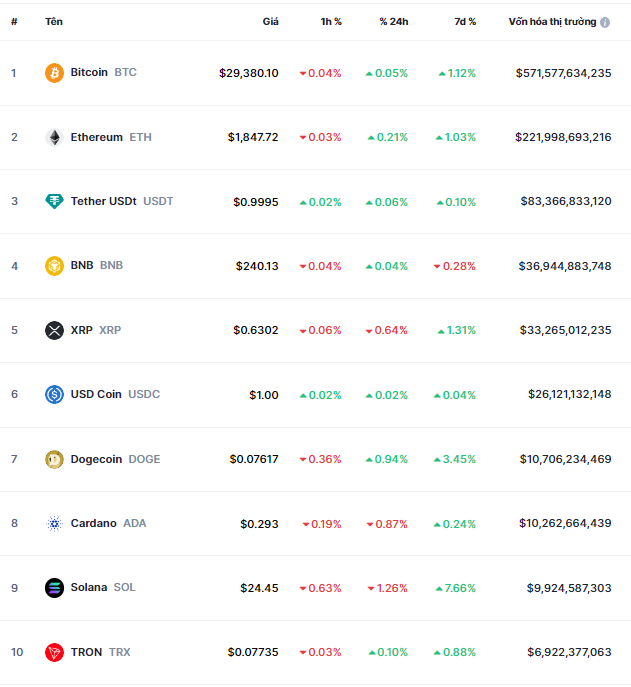

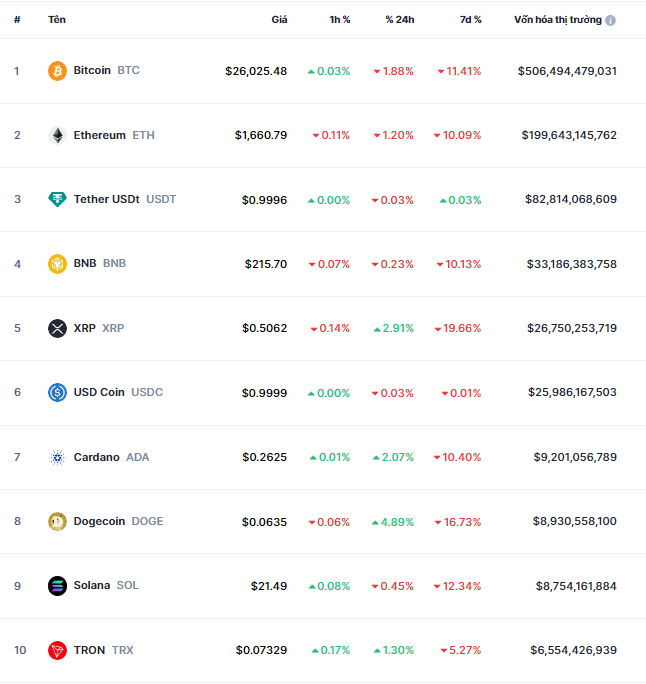

As of the morning of August 19th, Bitcoin plummeted to $26,000, down more than 11% from the previous week. The second-largest cryptocurrency, Ethereum, also dropped 10% to $1,660.

Other top 10 cryptocurrencies also had a downturn, with Dogecoin falling 17%, Solana dropping 13%, Cardano and BNB declining 10%.

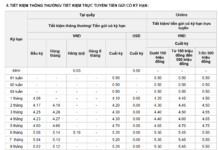

Top 10 cryptocurrencies:

Source: CoinMarketCap

|

Why is Bitcoin plummeting?

The price of Bitcoin recorded the sharpest decline in two months after news broke that Chinese real estate giant, Country Garden, filed for bankruptcy protection under Chapter 15 in the US. Additionally, according to the Wall Street Journal, Elon Musk’s SpaceX revalued its holdings of Bitcoin to $373 million in 2022 and 2021 and sold some Bitcoin.

“This is one of the most brutal sell-offs we have seen in Bitcoin’s history,” Ryan Rasmussen, a researcher at Bitwise Asset Management, shared with CNBC. “The current speculation is a sell-off caused by Elon Musk/SpaceX.”

In 2022, Elon Musk’s electric car company, Tesla, announced that it had sold about 75% of its Bitcoin holdings. Musk had previously been a strong supporter of cryptocurrencies.

According to CoinDesk, professional traders believe that market structure and liquidations are the cause of Bitcoin’s sudden decline. Additionally, the market has been relatively illiquid and sideways in the past, which is an ideal condition for abrupt fluctuations.

Prior to this, Bitcoin faced pressure after the Federal Reserve (Fed) released minutes from its July policy meeting.

Fed: The fight against inflation will last for a while

At the July 2023 meeting, Fed officials raised interest rates by 25 basis points to 5.25%-5.5%, and the market expected this to be the final rate hike of this cycle.

However, internal discussions among Fed members indicate that the majority of them are concerned that the anti-inflation fight will last longer and may require further tightening in the future.

“With inflation still well above the Committee’s longer-run objective and labor markets still tightening, nearly all participants saw appreciable downside risks to the inflation outlook, and some raised the concern that inflation risks might compel the Committee to tighten policy further,” the minutes from the July 2023 meeting of the Fed quoted.

Fed policy planners noted inflation pressures across various sectors and emphasized that future interest rate decisions will depend on upcoming data.

“With respect to the policy outlook, participants viewed it as important to maintain a monetary policy stance that was sufficient to bring inflation back to the 2 percent objective over time,” the minutes stated.

In addition, Fed officials expressed concerns about the commercial real estate market.

They mentioned “risks associated with the potential for a sharp decline in the pricing of commercial real estate, which could have adverse effects on some banks and other financial institutions, such as insurance companies, that have exposure to this market.”

Regarding future policy, members highlighted risks from both sides: excessive easing runs the risk of pushing inflation higher, while excessive tightening could push the economy into a recession.