Bitcoin has crossed the $30,000 mark twice on October 20th, before settling at around $29,500 for most of the day. This is the first time Bitcoin has returned to this level since mid-August 2023.

Over the past week, the world’s largest cryptocurrency has gained 10%, the largest weekly increase since the week ending June 23rd.

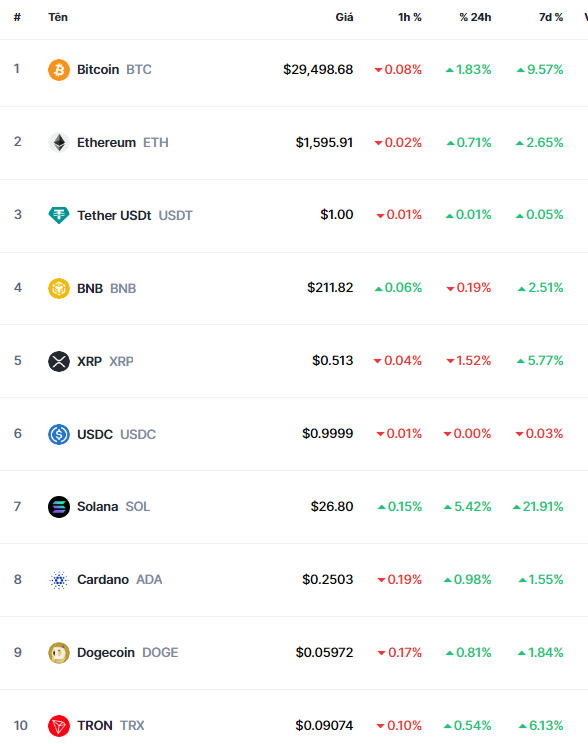

The world’s second-largest cryptocurrency, Ethereum, also rose 2.65% to nearly $1,600 on October 20th.

Other top 10 cryptocurrencies also performed well, notably with Solana up 22%, Ripple up 6%, and TRON up 6%.

|

Top 10 cryptocurrencies

Source: CoinMarketCap

|

SEC may approve Bitcoin ETF

Most cryptocurrencies saw an uptrend on October 20th, thanks to news of the first-ever Bitcoin ETF approval in the US.

Prior to that, JP Morgan said the Securities and Exchange Commission (SEC) could approve ETFs in the coming months. Four members of the House Financial Services Committee urged the SEC to listen to the court and abandon its effort to block bitcoin ETFs in a letter to SEC Chairman Gary Gensler.

Some companies have also adjusted their filings to address concerns from the SEC, signaling positive signals from regulators.

Positive news about Bitcoin ETFs has buoyed the crypto market despite the 10-year US Treasury bond yield reaching 5% for the first time in 16 years. Typically, higher yields would have a negative impact on Bitcoin, but the digital asset is clearly being propelled by a stronger catalyst.

Noelle Acheson, economist and author of the “Crypto is Macro Now” newsletter, said: “Concerns about escalating conflicts in the Middle East, worries about the US banking system, and overall market tensions are pushing both the price of BTC and gold higher.”

In a related development, alternative cryptocurrencies also rose after the SEC dropped its demand for compensation from Ripple Labs’ CEO Brad Garlinghouse and co-founder Chris Larsen in a lawsuit alleging securities law violations.

Ripple’s XRP rose 6%. Litecoin rose nearly 4%. Ethereum competitors Solana and Polygon increased by 7% and 4% respectively.

Challenges ahead

However, risk assets like cryptocurrencies still face many challenges, especially as the Fed has shown no signs of changing monetary policy.

Chairman Powell said: “Inflation is still too high, and positive data over the past few months is just the beginning of building confidence that prices are sustainably falling in line with our target. We also don’t know how long the cooling will last or where inflation will return to in the coming quarters.”

Powell implied that the labor market and economic growth need to slow down for the Fed to achieve its inflation target. “History shows that to sustainably bring inflation back to our 2% target, we may need a period of below-trend growth and the labor market may need to weaken further,” he said.