Main content:

- Grab post-tax profit of 11 million USD in Q4/2023 while still incurring a loss of 391 million USD in the same period. In 2023, Grab still incurred a loss of 485 million USD, significantly narrowing the loss compared to the loss of over 1.7 billion USD in 2022.

- The delivery segment has shown good growth and has an advantage over the transportation service segment.

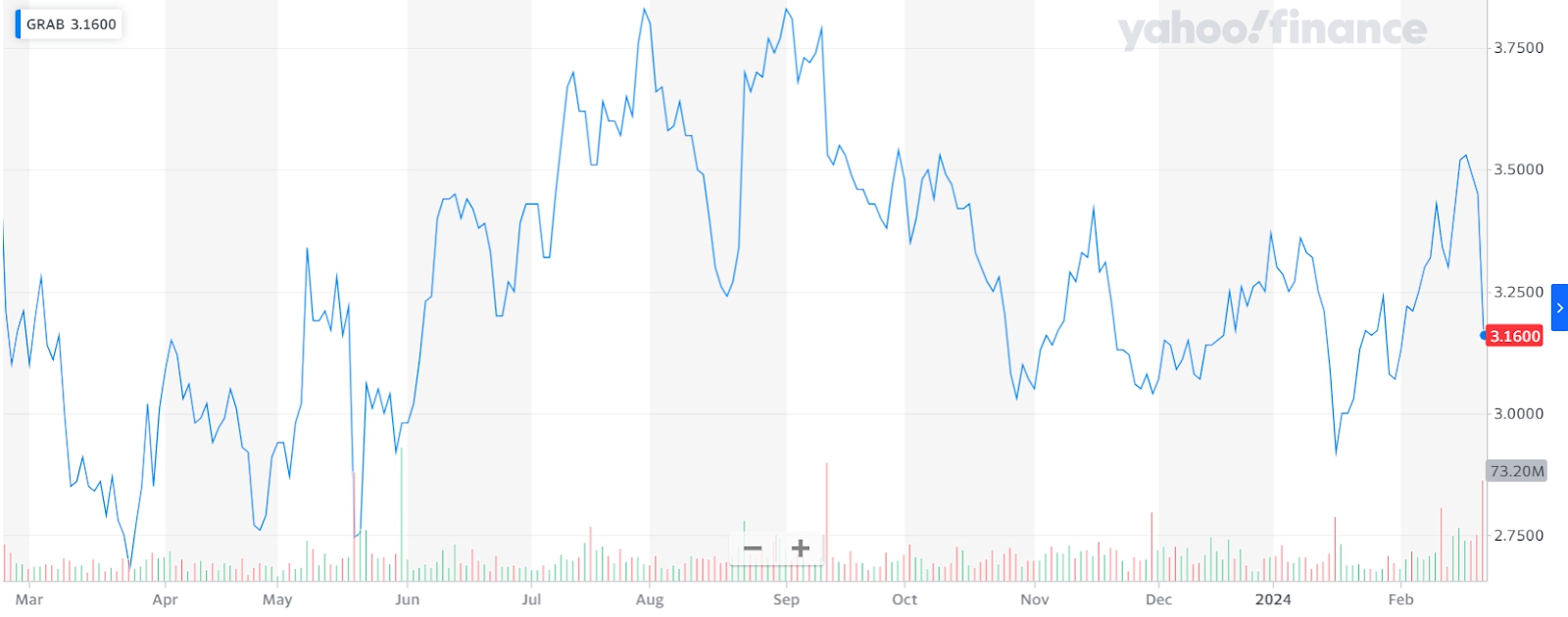

- Grab’s stock price declined after the positive profit results.

Grab, the technology unicorn, has announced its business results for Q4/2023 with a post-tax profit of 11 million USD. This is the first quarter that the company has made a profit in over 10 years of operation. In the same period of 2022, Grab still incurred a post-tax loss of 391 million USD.

Previously, in Q3/2023, Grab has achieved breakeven with EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) profit of 29 million USD, although still incurring a post-tax loss of 99 million USD.

EBITDA is seen as a practical indicator of a company’s business efficiency, excluding the effects of taxes, interest, and depreciation. For startups, the breakeven point is measured by positive EBITDA.

In terms of business results, a company may still continue to incur losses after deducting tax, interest, and depreciation costs, even when it has reached breakeven. The company’s EBITDA can still be positive by eliminating the impact of these costs.

Making a profit in Q4 helps Grab narrow its loss for the whole year of 2023 to 485 million USD, compared to the loss of over 1.7 billion USD in 2022.

Specifically, in Q4/2023 alone, Grab achieved 653 million USD in revenue, a 30% increase compared to the same period in 2022. The company incurred an operating loss of 46 million USD after covering expenses during the period. However, thanks to financial revenue of 42 million USD, Grab made a profit of 11 million USD in Q4/2023.

As of the end of 2023, Grab had nearly 800 million USD in debt, while the cash and cash equivalents of the company at the same time were over 3.1 billion USD, more than double the amount in the previous year.

Accumulated in the whole year, Grab achieved 2.4 billion USD in revenue, a 65% increase compared to 2022. In 2023, Grab has significantly reduced operating costs, helping to reduce the total year loss to 485 million USD. In 2022, Grab incurred a loss of 1.7 billion USD.

As of the end of 2023, Grab has incurred a total loss of nearly 16.8 billion USD.

Delivery is the main growth driver

In 2023, the delivery segment became the main growth driver for Grab, with revenue reaching nearly 1.2 billion USD, accounting for 51% of the company’s total revenue. In 2022, the delivery segment accounted for 46% of Grab’s revenue. This was also a fast-growing business segment in the past year (increasing by 80% in one year).

Meanwhile, Grab’s transportation services have decreased in proportion from 48% to 37% in a year.

Grab’s delivery segment includes delivery activities such as food delivery, on-demand delivery… The revenue for this segment comes from discounts from drivers and brands using the service. To sell products and use Grab’s services, both restaurants and drivers have to allocate revenue (sales revenue and delivery fees) to Grab.

In a report on Vietnamese delivery trends in 2022 released by Grab, the company stated that the total number of orders delivered through the Grab app increased by 24% in 2022. Grab has not yet published the 2023 delivery trend report, but it can be anticipated that the number and value of orders continued to grow in the past year.

Grab’s delivery segment GMV (Gross Merchandise Value) reached nearly 10.2 billion USD, only a 4% increase in 2023. The revenue for this segment increased significantly thanks to Grab’s revenue structure on each order.

In Vietnam, GrabFood (on-demand food delivery service, counted in the delivery segment) is dominating the food delivery market, especially after Baemin officially withdrew from the market. Currently, GrabFood and ShopeeFood are dominating this segment with respective proportions of 47% and 45% in 2023, according to Momentum Works’ Southeast Asia food delivery report.

Stocks react “calmly”

After announcing positive business results in Q4/2023, Grab’s stock price dropped by 8.4%, to 3.16 USD per share. This price is even lower than the price of the company a year earlier (3.21 USD per share).

Stock fluctuations of Grab in one year (Source: Yahoo Finance)

Every fluctuation of Grab’s stock directly affects its old “rival” on the other side of the hemisphere, Uber, which is now a major shareholder holding nearly 14% of Grab’s shares.

In 2023, Uber recorded a profit of 80 million USD thanks to its investment in Grab. Previously, this investment had brought a loss of 2.1 billion USD for Uber.

Uber started to make a profit in 2023 – reaching 2.2 billion USD. However, this technology giant still has accumulated losses of over 30 billion USD until the end of 2023 – according to the newly published audited financial report.