Illustrative Image

Deposit interest rates at MSB bank in February 2024

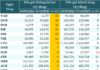

According to the latest interest rate chart posted by MSB, savings deposit interest rates at the counter range from 3 – 4% per annum.

Specifically, the interest rates for 1 to 5-month fixed-term deposits are currently 3% per annum, while the rates for 6 to 11-month terms are 3.6% per annum. The highest interest rate of 4% per annum is applied to deposits with terms of 12 to 36 months.

Note that for new savings accounts or accounts opened from January 1, 2018, with automatic renewal and a 12-month term and a deposit of 500 billion VND, MSB applies an interest rate of 7% per annum, and for a 13-month term, an interest rate of 8% per annum.

Highest interest rate product at MSB bank in February 2024

|

Unit |

Highest interest rate |

|

|

Counter deposit |

Online deposit |

|

|

Pre-maturity withdrawal |

0 |

0.5 |

|

01 month |

3 |

3.5 |

|

02 months |

3 |

3.5 |

|

03 months |

3 |

3.5 |

|

04 months |

3 |

3.5 |

|

05 months |

3 |

3.5 |

|

06 months |

3.6 |

3.9 |

|

07 months |

3.6 |

3.9 |

|

08 months |

3.6 |

3.9 |

|

09 months |

3.6 |

3.9 |

|

10 months |

3.6 |

3.9 |

|

11 months |

3.6 |

3.9 |

|

12 months |

4 |

4.3 |

|

13 months |

4 |

4.3 |

|

15 months |

4 |

4.3 |

|

18 months |

4 |

4.3 |

|

24 months |

4 |

4.3 |

|

36 months |

4 |

4.3 |

Source: MSB

Online deposit interest rates at MSB bank in February 2024

In addition to counter deposits, MSB also offers online deposit options with interest rates ranging from 3.5% to 4.3% per annum. Compared to the counter deposit rates, the rates for online savings are higher by 0.3% to 0.5% per annum, depending on the term.

Specifically, customers depositing money through the online application for terms from 1 to 5 months will enjoy an interest rate of 3.5% per annum. The rates for 6 to 11-month terms are 3.9% per annum. Currently, the highest interest rate for online deposits at MSB is 4.3% per annum, applicable to deposits with 12 to 36-month terms.

Note that for the “Special Interest Rate” product, customers will enjoy interest rates ranging from 4.4% to 4.6%. However, this deposit product is only available for new customers with a maximum deposit of 5 billion VND, and they can only deposit for 6, 12, 15, or 24 months. The interest rate for a 12, 15, or 24-month deposit is 4.6% per annum.

Special Interest Rate product chart at MSB bank in February 2024

|

Term |

Interest Rate |

|

6 months |

4.4 |

|

12 months |

4.6 |

|

15 months |

4.6 |

|

24 months |

4.6 |

Source: MSB

MSB bank is currently also offering various other deposit products in February, such as Immediate Interest Payment, Partial Withdrawal, Deposit Contract, Fixed-rate Earnings, Young Bamboo Shoots, and Golden Bee.

Interest rates for other capital mobilization products at MSB bank

|

Unit |

Partial Withdrawal |

Immediate Interest Payment |

||

|

Counter deposit |

Online deposit |

Counter deposit |

Online deposit |

|

|

Pre-maturity withdrawal |

0 |

0 |

0 |

0 |

|

01 month |

3 |

3.5 |

2.3 |

2.75 |

|

02 months |

3 |

3.5 |

2.3 |

2.75 |

|

03 months |

3 |

3.5 |

2.5 |

2.75 |

|

04 months |

3 |

3.5 |

2.5 |

2.75 |

|

05 months |

3 |

3.5 |

2.5 |

2.75 |

|

06 months |

3.6 |

3.9 |

2.85 |

2.85 |

|

07 months |

3.6 |

3.9 |

2.85 |

2.85 |

|

08 months |

3.6 |

3.9 |

2.85 |

2.85 |

|

09 months |

3.6 |

3.9 |

2.85 |

2.85 |

|

10 months |

3.6 |

3.9 |

2.85 |

2.85 |

|

11 months |

3.6 |

3.9 |

2.85 |

2.85 |

|

12 months |

4 |

4.3 |

2.55 |

3.4 |

|

13 months |

4 |

4.3 |

2.55 |

3.4 |

|

15 months |

4 |

4.3 |

2.55 |

3.4 |

|

18 months |

4 |

4.3 |

2.55 |

3.4 |

|

24 months |

4 |

4.3 |

2.55 |

3.4 |

|

36 months |

4 |

4.3 |

2.55 |

3.4 |

|

04 – 15 years |

– |

– |

– |

– |

Source: MSB