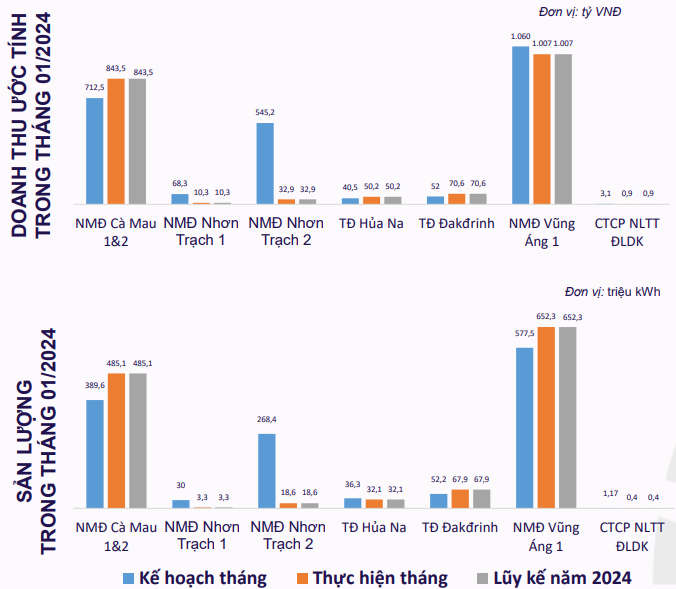

PV Power (POW), a subsidiary of Vietnam Oil and Gas Corporation, announced its estimated business results for January 2024 with revenue reaching VND 2,015 billion, fulfilling 82% of the monthly target. Notably, Vung Ang 1 power plant contributed VND 1,007 billion in revenue, while Ca Mau 1&2 power plant contributed VND 843.5 billion.

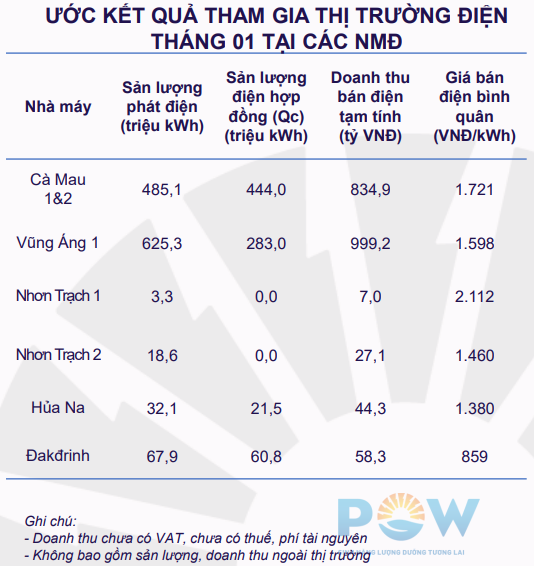

Electricity sales revenue in January reached VND 1,971 billion, up 15% compared to the same period last year. The estimated electricity generation output reached 1,232 million kWh. According to PV Power, January is the dry season in the North and the South, and the transition from the rainy season to the dry season in the Central region. The full market price of FMP electricity is expected to be around VND 1,450/kWh.

Regarding the operations of power plants, at Ca Mau 1 and 2 power plants, the actual gas supply capacity of PV GAS currently meets operational requirements (average 4.5 million Sm3/day). Due to lower market prices compared to conversion costs, Ca Mau 1 and 2 power plants offer operational prices closely following Qc to achieve optimal efficiency.

In a more positive note, thanks to the market price increase compared to coal conversion costs, Vung Ang 1 power plant offers a well-balanced and efficient operational price with relatively high production output, reaching over 625 million kWh.

Nhon Trach 1 power plant has already completed maintenance work on January 3. Since the market price is lower than the conversion cost, the power plant mainly operates for testing purposes after maintenance. Meanwhile, Nhon Trach 2 power plant actively offers operational prices at high market prices and operates as required by A0.

At Dakdrinh power plant, A0 has assigned a significantly increased Qc (up to 60.8 million kWh). This has had an impact on the profit efficiency of the power plant. Due to high market prices compared to contract prices (Pc) and the current high water level at the reservoir, Dakdrinh power plant balances the operational price to meet the assigned Qc and prioritizes large-scale production during periods of high market prices.

The decreased water inflow into Hua Na hydropower reservoir in January has prompted Hua Na power plant to offer a balanced operational price to optimize profit and reserve water for the hot and dry season with high market prices.

Regarding new investment projects, PV Power stated that as of now, the overall progress of the EPC for Nhon Trach 3 and Nhon Trach 4 power plants has reached about 65.6% of the plan (9.5% behind schedule). The company will continue to work on capital arrangements, negotiate gas purchase contracts, and power purchase contracts for the project in accordance with the schedule.

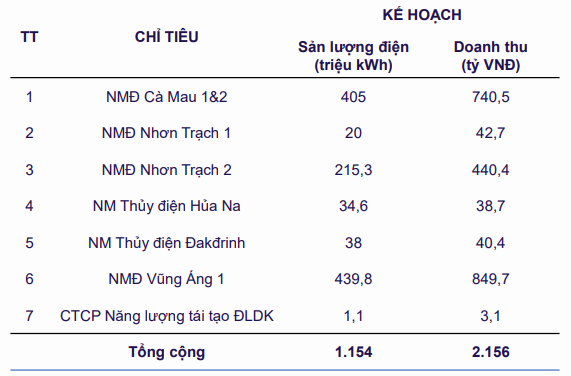

Entering February, PV Power targets a revenue of VND 2,156 billion, with an expected electricity output of 1,154 million kWh.

Previously, the company announced its business plan for the whole year of 2024, with a total revenue of VND 23,960 billion and after-tax profit of VND 929 billion. Both figures are down 22% compared to the performance in 2023. The target total electricity generation output for the year is 16.7 billion kWh.