On February 21, 2024, the State Treasury called for bids for a total of 10,750 billion dong of Government bonds with maturities of 5 years (2,000 billion), 10 years (4,500 billion), 15 years (3,750 billion), and 30 years (500 billion).

The winning bid rates for the 5-year, 10-year, and 15-year maturities all increased by 1 basis point, to 1.41%, 2.30%, and 2.5% respectively, compared to the previous session, but still remained in a decreasing trend compared to the end of last year.

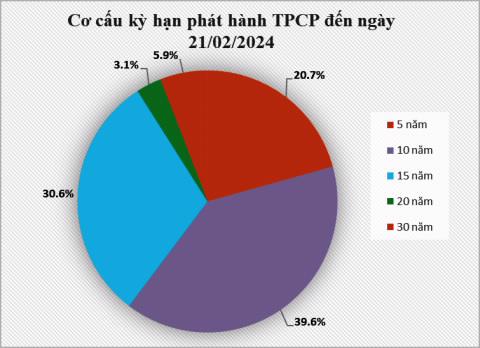

Therefore, the information from the State Treasury shows that the total amount raised from the beginning of the year until February 21, 2024, reached 37,429 billion dong, approximately 29.5% of the planned issuance of 127,000 billion dong in the first quarter of 2024. The average maturity of the Government bond issuance is 11.99 years; the average issuance interest rate is 2.19% per annum.

The 10-year and 15-year bonds were the most issued with values of 14,828 billion dong and 11,466 billion dong respectively, accounting for approximately 70.2% of the total value since the beginning of the year. The 5-year bond ranked third with a value of 7,750 billion dong.

The State Treasury stated that in 2024, it is assigned the plan to raise capital through the issuance of Government bonds of 400,000 billion dong, including the issuance volume for the Social Insurance of Vietnam.

The entire State Treasury system closely adheres to the assigned plan, actively builds a bond issuance schedule, grasps the situation of revenue, expenditure, and debt repayment plan of the central budget, as well as the market situation to timely advise the Ministry of Finance on appropriate Government bond issuance solutions, ensuring the capital mobilization volume meets the demand of the central budget and maintains the stability of the Government bond market.

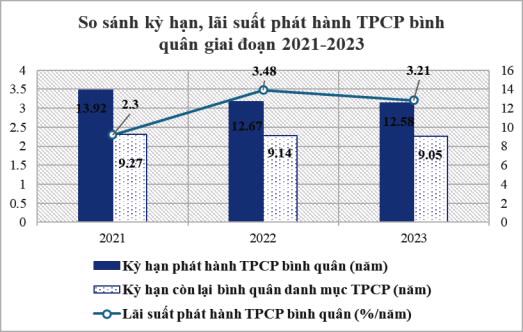

At the same time, the capital mobilization continues to be conducted by the State Treasury, focusing on long-term maturities from 5 years and above, meeting the average maturity target of Government bond issuance from 9 to 11 years as set out in Resolution No. 23/2021/QH15 of the National Assembly. This helps to further restructure the Government bond portfolio towards longer maturities, reducing short-term debt repayment pressure and borrowing costs, contributing to the safe and sustainable restructuring of public debt.

In addition to the issuance task, the State Treasury has coordinated with related units to fully and timely pay the principal and interest of Government bonds to investors, contributing to ensuring the credibility of the Government.

The State Treasury also focuses on managing the cash fund to fully meet the regular expenditure needs of the state budget and the transaction units (both in VND and foreign currency) when there are regular expenditure needs, basic construction investment needs, and high external debt repayment at the end of the year and the time for settling the annual state budget accounts in 2023; managing risks in cash fund management activities.

Prior to that, in 2023, the State Treasury raised 298,476 billion dong, reaching 98% of the adjusted plan assigned by the Ministry of Finance to the State Treasury (305,000 billion dong).

The average maturity of Government bond issuance in 2023 is 12.58 years; the remaining maturity from the average portfolio of Government bonds is 9.05 years. The average issuance interest rate of Government bonds in 2023 is 3.21% per annum. The total volume of principal and interest payments for Government bonds in 2023 is 184,588 billion dong, of which the principal is 100,966 billion dong and the interest is 83,622 billion dong.