As of the morning of December 2nd, the price of Bitcoin fluctuated at $38,700, up more than 2% compared to the previous week. The second-largest cryptocurrency, Ethereum, remained almost flat at $2,090.

Other cryptocurrencies in the top 10 had mixed movements, with Dogecoin increasing nearly 7%, Solana advancing 2%, while BNB (the cryptocurrency of Binance) decreased by 2.5%, and Ripple fell nearly 2%.

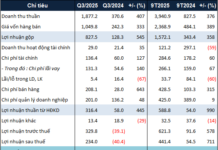

Cryptocurrency performance of the top 10

Source: COinMarketCap

|

Aiming for the $40,000 mark

After a continuous increase over the past few months, the price of Bitcoin has increased by about 130% compared to the beginning of the year, reversing the strong selling wave in 2022 and bringing significantly higher profits compared to traditional investment channels such as stocks or gold. The S&P 500 index of the US stock market has increased by 18.5% this year, while the price of gold has increased by 12%.

Now speculators are dreaming of the $40,000 mark for Bitcoin as they enter the last month of 2023.

The expectation that the US Federal Reserve (Fed) will cut interest rates next year and the possibility that US authorities will approve the first Bitcoin exchange-traded funds (ETFs) for immediate delivery are catalysts driving the recent increase in the price of Bitcoin.

The upward trend of Bitcoin continues even as the US conducts a crackdown on the cryptocurrency industry, leading to Sam Bankman-Fried being jailed for fraudulent activities at the FTX cryptocurrency exchange, and Binance founder Changpeng Zhao pleading guilty to authorities for irresponsible actions in anti-money laundering efforts.

For those with an optimistic view, the US’s efforts to clean up the cryptocurrency industry and the submission of Bitcoin ETF applications by a series of financial institutions are signs that the cryptocurrency industry is maturing and the prospects for widespread application of cryptocurrencies are growing.

“To reach a price of $40,000 for Bitcoin, approval is needed for the establishment of Bitcoin ETFs,” senior analyst Fiona Cincotta of City Index told Bloomberg.

The recent increase in Bitcoin is somewhat weakened, partly due to the recovery in the stock market and the volatility of exchange rates that attract the attention of investors, according to Fiona Cincotta.

Bloomberg predicts a series of applications for the establishment of Bitcoin ETFs will be approved by the US Securities and Exchange Commission (SEC) from now until January 2024. If there is a change in expectations for the Fed’s interest rates or an unexpected change related to the approval of Bitcoin ETFs, the price of Bitcoin could reverse. However, at present, the sentiment of cryptocurrency investors is optimistic.

Last month, MicroStrategy Inc. – a publicly traded company that holds the most Bitcoin – purchased an additional $593 million worth of Bitcoin, bringing its total holdings to $6.5 billion. On Wednesday this week, Michael Novogratz, founder of Galaxy Digital Holdings Ltd., predicted that within a year, the price of Bitcoin could reach a record level of $69,000, set in 2021.

According to Bloomberg, the weekly relative strength index (RSI) – a measure of momentum – of Bitcoin closed at a level above 75 points last week. A level above 70 of this index is considered a sign of being overbought, but the picture is not as simple as that. In the past decade, the price of Bitcoin has increased on average by 15% in the month after the weekly RSI exceeded 75 points. With such an increase, the price of Bitcoin will easily surpass the $40,000 mark.

“I really believe that there is a good chance for Bitcoin to surpass $40,000, which could be a statement allowing the approval of Bitcoin ETFs, or the psychology of high risk appetite towards the end of the year,” said analyst Tony Sycamore of IG Australia Pty.