Shorting orders were triggered en masse in the market during the afternoon session, causing the index to plummet more than 15 points at the end of the week, dropping to a price level of 1,212 points. The market breadth was terrible with 414 stocks declining, four times the number of advancing stocks, and almost no sectors maintaining their green color except for seafood with a slight increase of 0.6%. Instead, the entire market was engulfed in flames.

In particular, real estate was hit the hardest, falling by 3.15%; Oil and gas decreased by 2.36%; Securities dropped by 1.75%; Construction decreased by 2.63%; Food and beverage decreased by 1.18%; Construction materials decreased by 0.74%; Banks decreased by 0.26%.

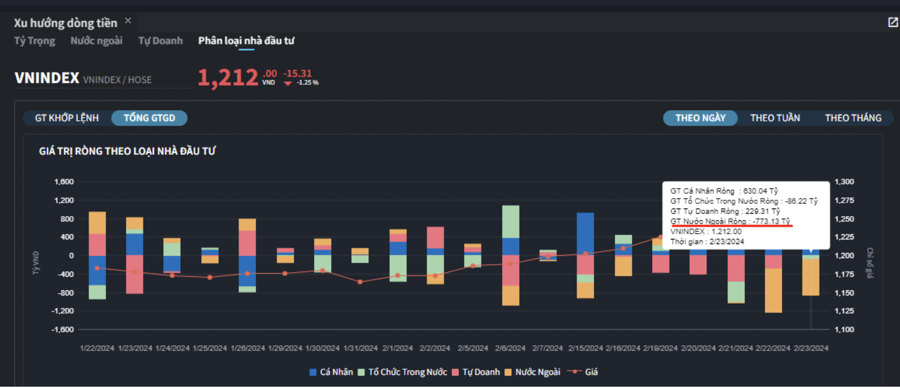

Strong profit-taking pressures sent the liquidity of the three exchanges to a record high in a short period of time, with a trading value of 35 trillion VND, of which foreign investors still net sold 795.6 billion VND, and in terms of matched orders, they net sold 796.5 billion VND.

The main net buying groups in matched orders by foreign investors were in the Chemicals and Basic Resources sectors. The top net buying stocks by foreign investors included DGC, EVF, VRE, VNM, PAN, CTG, HPG, VHC, FRT, HAH.

The main net selling group in matched orders by foreign investors was in the Banking sector. The top net selling stocks by foreign investors included VPB, MWG, VIX, TPB, MSN, HDB, DCM, VCG, BID.

Individual investors net bought 630.0 billion VND, of which they net bought 621.9 billion VND in matched orders. In terms of matched orders, they net bought 14 out of 18 sectors, mainly in the banking sector. The top net buying stocks by individual investors included VPB, VIX, ACB, PC1, EIB, MSN, FPT, TPB, MWG, SSI.

The main net selling group in matched orders was in the Chemicals and Basic Resources sectors. The top net selling stocks included EVF, DGC, STB, HPG, VNM, CTG, HCM, SHB, HAH.

Proprietary trading net bought 229.3 billion VND, of which they net bought 204.8 billion VND in matched orders. In terms of matched orders, proprietary trading net bought stocks in 8 out of 18 sectors. The strongest net buying group was in Financial Services and Basic Resources. The top net buying stocks in matched orders by proprietary trading today included EVF, FUEVFVND, BID, HCM, SSI, HPG, VPB, GEX, DIG, VCB.

The top net selling group was in the Construction and Materials sectors. The top net selling stocks included PC1, EIB, FPT, NVL, ACB, VRE, VND, PNJ, TCB, IJC.

Domestic institutional investors net sold 86.2 billion VND, of which they net sold 30.2 billion VND in matched orders. In terms of matched orders, domestic institutional investors net sold stocks in 12 out of 18 sectors, with the largest value in the Financial Services sector. The top net selling stocks included ACB, FUEVFVND, VRE, SSI, FPT, VGC, EIB, NKG, E1VFVN30, HSG.

The largest net buying value was in the Retail sector. The top net buying stocks included MWG, DCM, STB, VCB, SHB, TPB, SAB, CTG, FUESSVFL, SZC.

Block trading reached 2,048.7 billion VND, an increase of +52.5% compared to the previous session and contributing to 5.8% of the total trading value. Some stocks involved in large block trades include TCB, VIC, EIB, MBB, FPT.

The allocation of capital flows increased in the Banking, Securities, Chemicals, Information Technology, and Logistics & Maintenance sectors, while it decreased in the Real Estate, Construction, Steel, Agriculture & Seafood, Retail, Food, and Oil & Gas sectors. In terms of matched orders, the proportion of trading value in the large-cap VN30 group increased, while it decreased in the mid-cap VNMID and small-cap VNSML groups.