In the updated stock outlook report just released, SSI Research expects the business results of securities companies in 2024 to continue the recovery momentum of 2023.

With a base scenario of an 8% increase in average daily trading value in 2024, the business results from the brokerage and margin lending activities of securities companies will continue to improve.

Furthermore, favorable policies to stimulate the capital market are expected to be implemented, with the possibility of Vietnam being upgraded to the FTSE Russell’s developed market by the end of 2024 or 2025. However, the current valuation of securities companies has already reflected significant expectations of capital inflows into the market in the low interest rate environment of 2024, while the industry still faces risks associated with asset quality or legal issues.

Vietnam enters 2024 with a much more positive macroeconomic environment compared to 2023. SSI believes that the economic cycle is still in the early stages of recovery and the stock market cycle usually leads and has further growth potential in the medium term.

However, during the initial stage of the recovery cycle, many risks still exist and the stock market will experience strong fluctuations. In positive terms, fluctuations in a rising market will still attract capital inflows into the stock market.

Therefore, with the above-mentioned liquidity scenario and the correlation between stock prices and market liquidity, there will continue to be positive developments.

Another important question is whether foreign capital will return to the Vietnamese stock market in 2024. In reality, foreign investors have been strong net sellers of Vietnamese stocks in 2023, especially in the second half of the year, following a similar trend in the ASEAN region.

In the short term, the attractiveness of other options such as US Treasury bonds makes it difficult for foreign capital to flow back to the Vietnamese stock market. However, this trend may reverse when the Fed takes steps to cut interest rates. Looking at the past, money tends to flow into the ASEAN stock market when the Fed cuts interest rates.

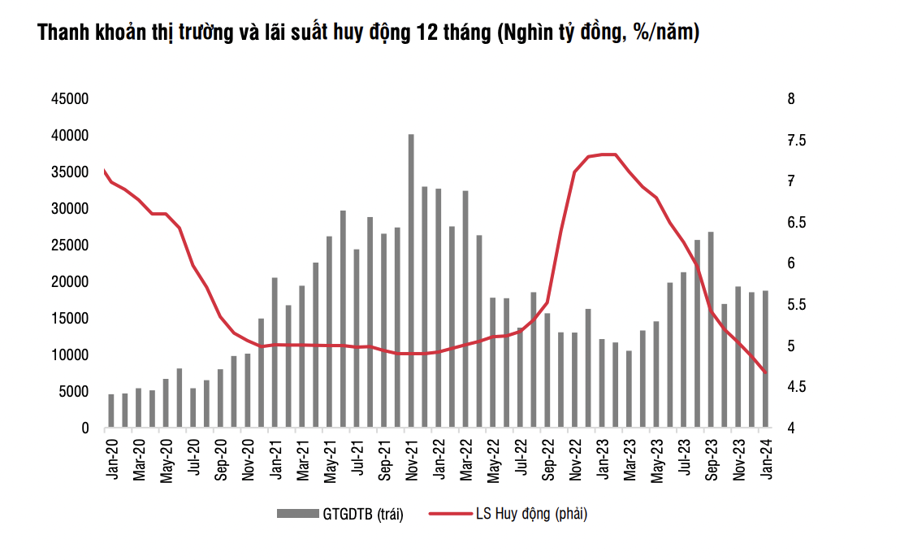

According to SSI, the low interest rate environment is a key factor that helps domestic individual capital continue to flow into the stock market and supports the business results of securities companies.

After the Covid-19 period, the Vietnamese stock market has seen a surge in the number of domestic investors participating. For 2024, an extended period of low interest rates will encourage individual capital inflows, especially in the context of a lack of attractive investment alternatives in Vietnam.

However, SSI provides a relatively cautious market liquidity scenario, with a 8% increase in 2024, lower than about 25% compared to the 2021 level, due to unresolved issues in the real estate and corporate bond markets, which will affect investor sentiment.

For securities companies, the brokerage, margin lending, and proprietary trading business accounts for the largest proportion of operating revenue, and improving the fundamental factors will contribute to the continued expansion of securities companies’ business results in 2024. Pre-tax profit of securities companies bottomed out in Q4/2022 and has seen strong growth in line with the liquidity trend of the market.

In terms of the upgrade process, the Ministry of Finance plans to amend relevant legal documents in 2024 to implement the NPS model. FTSE Russell will rely on feedback from investors to evaluate the effectiveness of the NPS model, and the decision to classify Vietnam into the FTSE Russell’s Emerging Market may take place in September 2024 (positive scenario) or March 2025 (base scenario) and will take effect 6 months later.

With the free float market capitalization of the Vietnamese market at around USD 35 trillion – about a quarter of Indonesia and Thailand – and therefore an estimated weight of around 0.7% – 1.0% in the FTSE EM index and 0.1% in the FTSE Global. This could immediately attract around USD 1.7 – 2.5 billion when the upgrade decision takes effect.