Illustrative image

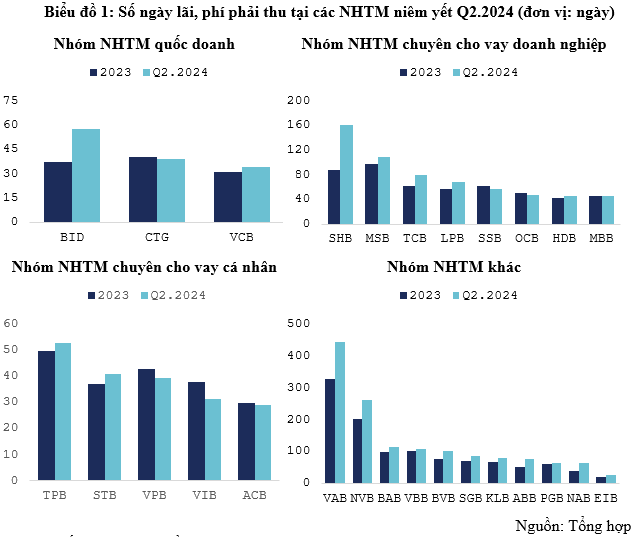

Interest rates at HDBank’s counter for individual customers in February 2024

According to the latest survey, Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) is implementing interest rates from 0.5% per annum to 8.1% per annum for customers depositing money at the counter and receiving end-of-term interest.

Specifically, the lowest interest rate of 0.5% per annum is applicable to short-term periods under 1 month: 1 day, 1 week, 2 weeks, 3 weeks. Savings interest rates for periods from 1 to 5 months are all at 2.45% per annum. The 6-month period has an interest rate of 4.5% per annum. Deposits with terms of 7 – 11 months have the same interest rate of 4.3% per annum

Customers depositing money for a 12-month term will enjoy an interest rate of 4.7% per annum, and for a 13-month term, the interest rate is 4.9% per annum.

The 15-month term has an interest rate of 5.5% per annum, and the 18-month term has an interest rate of 5.6% per annum.

The 24-month and 36-month terms both have a deposit interest rate of 5.4% per annum.

It is worth noting that for deposits of 300 billion VND or more, HDBank will apply an interest rate of 7.7% per annum for the 12-month term and 8.1% per annum for the 13-month term.

In addition to the end-of-term interest payment method, HDBank is still deploying various flexible interest payment methods, including: Early interest payment (applicable interest rate range of 2.35% – 5% per annum); Monthly interest payment (applicable interest rate range of 2.35% – 5.3% per annum); Quarterly interest payment (applicable interest rate range of 4.2% – 5.3% per annum); Semi-annual interest payment (applicable interest rate range of 4.6% – 5.4% per annum); Annual interest payment (applicable interest rate range of 5.2% – 5.3% per annum).

Deposit interest rate table for customers depositing money at HDBank’s counter in February 2024

Source: HDBank.

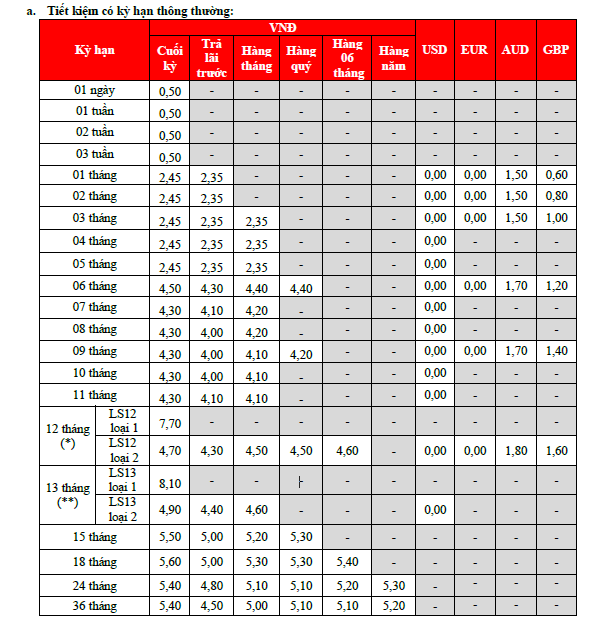

Online savings interest rates at HDBank in February 2024

In February, the range of interest rates for online deposits at HDBank varies from 0.5% per annum to 5.7% per annum.

Specifically, deposit accounts with terms under 1 month have an interest rate of 0.5% per annum;

Online deposit terms from 1 to 5 months have an interest rate of 2.95% per annum, 6 months have an interest rate of 4.6% per annum, 7 – 11 months have an interest rate of 4.4% per annum, the 12-month term has an interest rate of 4.8% per annum, the 13-month term has an interest rate of 5.0% per annum, and the 15-month term has an interest rate of 5.6% per annum.

The highest preferential rate for online deposits is 5.7% per annum, applicable to the 18-month term. The 24-month and 36-month terms have the same interest rate of 5.5% per annum.

Online deposit interest rate table at HDBank in February 2024

Source: HDBank.