Mr. Pham Binh Phuong – an analyst at Mirae Asset Securities – stated that the domestic stock market ended last week with a “black Friday,” as the VN-Index lost most of its gains. Starting the trading week with a 15-point increase, it seemed like the VN-Index would have a favorable week, but unexpected developments emerged at the last minute. After two optimistic sessions, the VN-Index quickly closed at 1,230 points, and selling pressure began to appear at this level in the sessions from February 20th to 22nd.

The final session of the week saw significant volatility as the index surged in the morning session, reaching 1,243, but then unexpectedly plummeted in the afternoon session to close the week at 1,212, a slight increase of 2.3 points (0.19%) compared to the previous week’s session. The banking group only has two positions in the top 10 stocks that affect the VN-Index this week, BID and TCB. In the descending session, the top 3 are two other banking stocks, VCB and VPB.

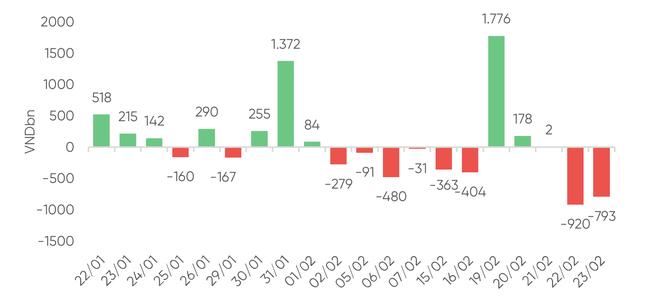

Foreign investors maintained a second consecutive week of net selling with a value of 1,456 billion dong. Topping the net selling list this week is MWG, which was sold for nearly 531 billion dong, followed by VPB and GEX at 545 billion dong and 244 billion dong, respectively.

Foreign investors continued to be net sellers for a second week in a row (data: VPBankS).

“The VN-Index unexpectedly dropped sharply in the final session, but before that, it had a streak of 7 consecutive increases from 1,172 to 1,230. Therefore, market correction is a necessary development to attract outside capital. Buying power has also participated strongly when the market dropped in the session on February 23rd, pushing liquidity to over 30 thousand billion dong, the highest since August 18th, 2023,” Mr. Phuong said and believed that a sharp drop with improved liquidity is not a bad trend in the upward movement. The support level of 1,200 will be crucial in the short term.

SHS Securities’ analysis group believes that the volume of more than 1.3 billion shares traded in the final session demonstrates strong short-term distribution pressure on many stocks/stock groups when the VN-Index is in the price range of 1,235 – 1,240 points.

Banks are a group of stocks that have a strong impact on the market this week with a high level of differentiation, sudden liquidity attracts short-term capital inflows and increased trading volume, and many stocks continued to increase strongly, surpassing previous peaks such as BID, VAB, and TCB. Meanwhile, most bank stocks declined, such as LPB, HDB, OCB, and EIB.

Last week, the market received many news related to the banking group, such as: Credit growth by the end of January 2024 decreased by 0.6% compared to the beginning of 2023; the State Bank of Vietnam will continue to maintain the current interest rate levels at least in the first half of 2024. Notable international news includes the minutes of the January meeting released on February 21st by the Federal Reserve. The minutes emphasized that it is still too early to cut interest rates and that the current rates are the highest in 23 years, ranging from 5.25% to 5.5%.

VPBankS Securities believes that the recent sharp decline in the market accompanied by high liquidity will make investors cautious about new investment strategies. The short-term resistance level at 1,230-1,250 points has been effective, especially when the relative strength index (RSI) reached the overbought territory, issuing a warning signal earlier. However, a pure profit-taking session does not affect the market’s upward trend. This correction will help cool down the market and create opportunities for sustainable capital inflows. The VN-Index could approach the support level of 1,200 – 1,210 points.